Market Deployment of Wind Energy

Market Deployment of Wind Energy

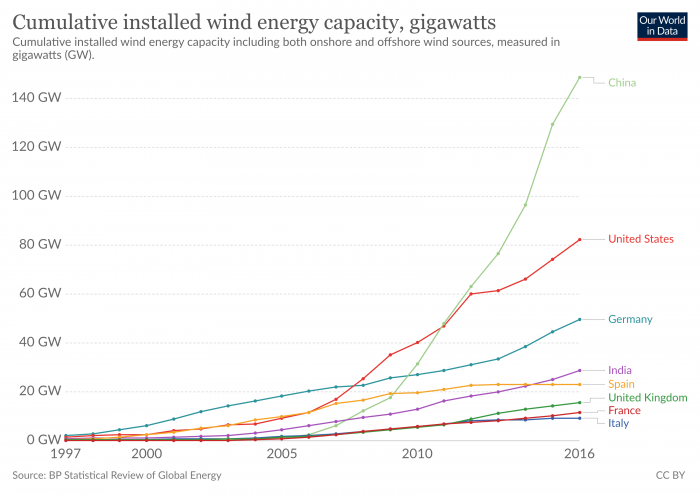

Over the last 20 years, growth in the total installed capacity of wind energy generation across the globe has been growing rapidly. Germany was the first country to lead the development of wind power, but the US and China have dominated the growth since 2010. China is especially impressive in terms of its recent growth.

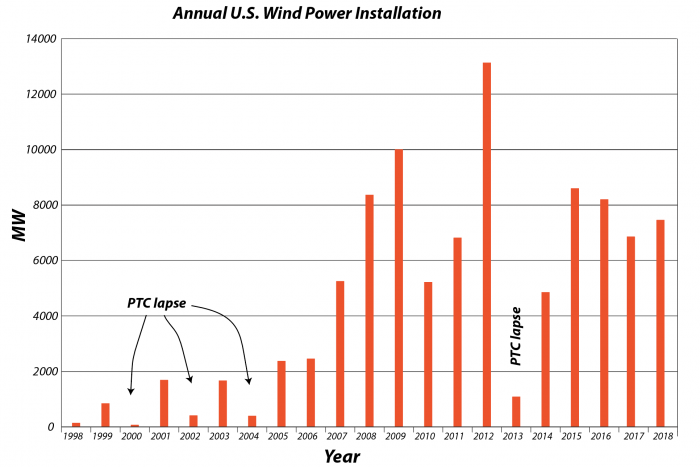

Part of the reason for this growth is the steady decline in the cost of wind energy, as discussed in the previous section on solar energy. But government policies are another important factor. The United States has one of the most volatile markets for wind energy in the world, while those in Europe and China have been among the most stable. This is due in part to differences in how governments in these countries treat wind energy. In many parts of Europe, wind energy (and other renewable generation technologies) enjoy subsidies and incentives known as feed-in tariffs. The feed-in tariff is essentially a long-term guarantee of the ability to sell output from a specific power generation resource to the grid at a specified price (typically higher than the prices received in the market by other generation resources). The United States, on the other hand, has favored a system of tax incentives called the “Production Tax Credit” (PTC) to encourage renewable energy deployment. In theory, a tax incentive should not work much differently than a feed-in tariff (both are just payments based on how many kilowatt-hours are generated). But the PTC has historically needed to be re-authorized frequently by the US Congress – this “on-off” policy strategy has been a major factor in the volatility of wind energy investment in the US as shown in the figure below. It is worth noting that the PTC was recently renewed for 2013, but will lapse again at the end of 2019, so it is difficult to say what impact it will have on wind investment going forward.

This bar graph shows the history of the annual US wind power installation. The heights of the bars represent the amount of new wind energy installed each year. So this goes from 1998 until 2019. And there are a couple of interesting things: One is there is very unsteady growth pattern over time, and the second is that there are four periods here, four years where there are very little in the way of new wind energy installation. And that’s because there was a lapse in this policy device we us in the US that encourages using wind energy called the Production Tax Credit ( PPC). This has to be renewed by Congress on a regular basis and they can’t get their act together all the time to renew this. So if that lapses then there are no incentives for wind power companies to install new turbines to generate more electricity. So what we see here is this kind of erratic history of production because the incentives are not reliable.

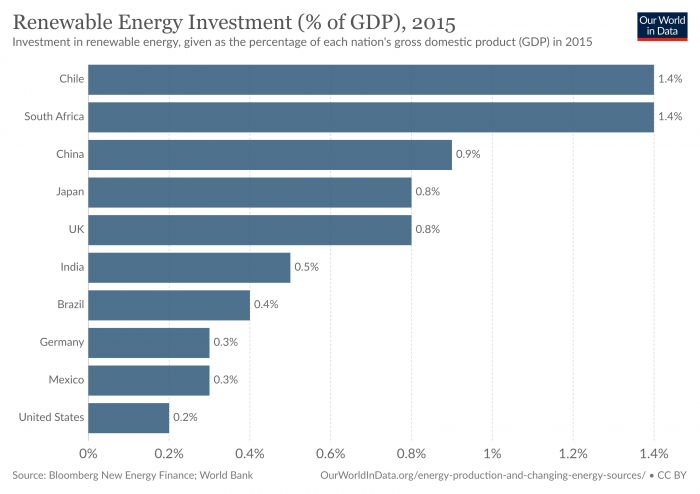

The above makes it clear that government policies are important to the growth of renewable energy production (both wind and solar). In a very real way, you can think about these policies (feed-in tariffs or tax credits) as a form of investment. Governments can also provide investments in the form of funding for basic research related to these technologies. In general, these investments do not add up to a huge amount when seen in the context of a country's gross domestic product (GDP), which is a measure of the size of the economy, as seen in the figure below.