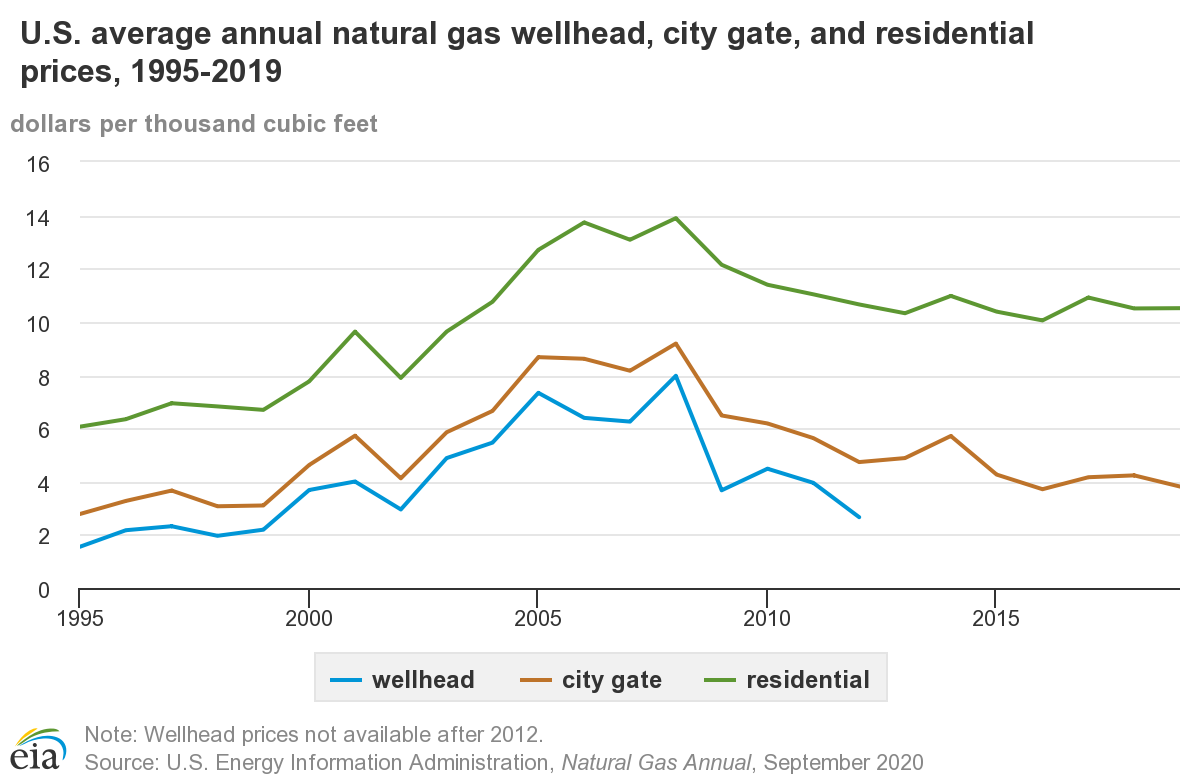

Figure 11 displays the U.S. average annual natural gas wellhead, city gate, and residential prices (1995-2019). Please note the increasing trend before 2008 and decreasing prices after. In order to fully understand these trends, have a look at Figure 7 (U.S. annual natural gas marketed production) and U.S. GDP from 1995-2019.

In contrast to crude oil, natural gas was almost strictly a domestic North American commodity* whose price is more influenced by weather and the health of the US economy. It is gradually becoming a global commodity in recent years due to increasing LNG export capacity. Other factors, such as the level of US natural gas inventory, impact prices on a weekly basis. While US economic indicators, such as the stock market, employment figures, housing and, manufacturing indexes, are deemed to be indicative of demand for natural gas, global economies and the US dollar do not have much effect on pricing in this country.

Among the major factors influencing US natural gas prices are:

- Weather – over 50% of American homes are heated by natural gas; hot weather leads to more electrical generation for air-conditioning loads, and natural gas represents about 25% of that market. Hurricanes in the Gulf of Mexico disrupt supply as platforms are evacuated ahead of the storms, and the hurricanes can also damage the rigs.

- US economy - as with crude oil, fluctuations in the economy translate into an increase or, decrease, in energy consumption.

- Production levels vs. demand indicators - statistics showing flowing natural gas are compared with demand indicators to determine if the market is "short" or "long" supply. Here are some major indicators.

- Weekly Natural Gas Inventory Report (Energy Information Agency) - every Thursday morning, the US government releases data on the amount of natural gas that is in the nation's underground storage facilities. Injections and withdrawals from storage are also indicative of supply and demand dynamics.

- Baker Hughes Drilling Report of active rigs - the field services company reports weekly on the number of drilling rigs actively pursuing oil and/or natural gas. The change in number and type impact the perception of supply in the future.

- Electrical generation “fuel-switching” - besides the impact of overall demand for electricity, a large amount of the country's power plants that are fueled by coal can actually switch to natural gas, but only if prices are competitive. Also, the Nuclear Regulatory Agency publishes a daily status report for all nuclear plants in the US. When plants are down, more electricity is generated by natural gas.

- Global demand – US LNG reaches most regions of the world. Major economies such as Brazil, China, France, India, Japan, Netherlands are purchasing more and more US LNG. The price of LNG is higher than natural gas exported by pipeline due to costs associated with compression, transportation, and decompression. However, it is still profitable given the increasing worldwide demand for clean energy.

The following video goes into greater detail about the factors which can influence natural gas prices. (The lecture notes can be found in module 2 in Canvas. (Lesson 2: Supply/Demand Fundamentals for Natural Gas & Crude Oil.)

As we explore pricing for crude oil and natural gas in a later lesson, we will consider the major influential factors for each and define their individual impact. We will also have a weekly activity about the market prices for crude oil and natural gas and the factors we believe affect them.

Note: When commodity price is expected to go up, the market is called bullish. In this case, an investor will invest in the commodity. On the other hand, if prices are expected to go down, then it’s called a bearish market. In this situation, an investor is expecting the commodity to lose its value. Consequently, the investor sells the financial commodity.

PRESENTER: In this video, I'm going to explain the factors that can influence natural gas price. In contrast to crude oil, natural gas is almost not a global commodity, yet. It can be construed as a domestic commodity in the United States. So things that are happening outside the United States, they don't have a major impact on the natural gas prices.

So we can focus on the factors that are happening in the United States. And two of these major factors are the US economy and weather events. Other factors, such as the level of US natural gas inventory, can also impact the natural gas prices on a weekly basis.

The higher natural gas inventory means high supply or having enough supply for fluctuations in demand. So if there is a high level of inventory, it can translate to not having, not experiencing, not expecting the higher price of natural gas.

US economic indicators such as the stock market, employment, figures housing and manufacturing, they impact the natural gas prices. On the other side, global economy, US dollar exchange rate would not have an impact on the pricing of natural gas.

The first factor is the weather. More than 50% of American homes are heated by natural gas. So any cold or extreme weather could potentially increase the price if there is a shortage of supply. If there is an unexpected demand, it could shift the price to higher prices.

Also, hot weather could cause the price increase, because people will use air conditioning to lower the inside temperature for space cooling. And so increase in demand for electricity could potentially increase the natural gas prices.

The other weather event is hurricanes, same as crude oil, that we explain how a hurricane in the region of Gulf of Mexico can disrupt the supply and damage platforms. Evacuation and recovery after a hurricane can potentially interrupt the supply.

US economy-- similar to crude oil, fluctuations in economy translate into an increase or decrease in energy consumption. North American natural gas is not a truly global commodity, so the global economy does not have an impact on the price of natural gas.

The other factor that could potentially affect the natural gas price is the reports about production levels versus demand indicators. Any statistics, any information about supply or demand of natural gas can potentially affect the price.

EIA, Energy Information Administration from Department of Energy, publishes a weekly report every Thursday at 9:30 AM. This report is about natural gas storage. And it has some pieces of information that I'm going to explain them in the following slides.

So EIA Weekly Natural Gas Storage Report includes pieces of information on natural gas storage. The first piece of information is regional breakdown-- the activity for the EIA-defined regions, which includes the major consuming regions, both east and west, and producing region. The producing region is further broken down into the salt and non-salt storage facilities, with the majority of the salt caverns existing along the Gulf Coast.

Injections, or gas added, and withdrawals, gas removed, by region can be telling about the weather conditions in each area. A good balance is when the consuming regions are withdrawing the same amount of gas as producing region is injecting gas.

The other very important piece of information included in EIA Weekly Natural Gas Storage Report is the total gas in storage. It is the change in historic levels from one week to the next week. It is the first thing that traders and other parties involved in the natural gas market would look to for guidance.

Excess storage, a high level of storage or injection in the report, can be translated to a bearish price signal. That is, the production exceeds demand for the prior week.

The converse is also true for the removal of gas from the storage, or withdrawal in the report, that can indicate demand exceeded the production for the prior week. Prior to the release of the report, analysts have compiled forecasts in the variance of the actual volume to these predictions.

The other piece of information that can be found in EIA Weekly Natural Gas Storage Report is a comparison to a year ago. This data includes the information-- the current inventory level compared to the same period the previous year. In order to truly interpret this comparison correctly, we must consider the weather in this year with the last year, if there was or there is harsh winter we are experiencing or we were experiencing cold days.

The last piece of information in EIA Weekly Natural Gas Report that is important for us is a comparison to the five-year average that can be found in the report.

The other factor that can influence natural gas price is electrical generation fuel switching. A large amount of country's power plants were fueled by coal. And they can switch. They can switch their fuel to natural gas if natural gas prices are competitive or more restrictions are being enforced for the emissions. But this effect is a more long-term effect.

Also, the Nuclear Regulatory Agency publishes a daily status report for all nuclear power plants in the United States. When plants are down, more electricity is generated by natural gas.