Uniform Price Auctions

Virtually all RTO markets are operated as “uniform price auctions.” Under the uniform price auction, generators submit supply offers to the RTO, and the RTO chooses the lowest-cost supply offers until supply is equal to the RTO’s demand. This process is called “clearing the market.” The last generator dispatched is called the “marginal unit” and sets the market price. Any generator whose supply offer is below the market-clearing price is said to have “cleared the market,” and is paid the market-clearing price for the amount of supply that cleared the market. Generators with marginal operating costs below the market-clearing price will earn profits. In general, if the market is competitive (all suppliers offer at marginal operating cost) the marginal unit does not earn any profit.

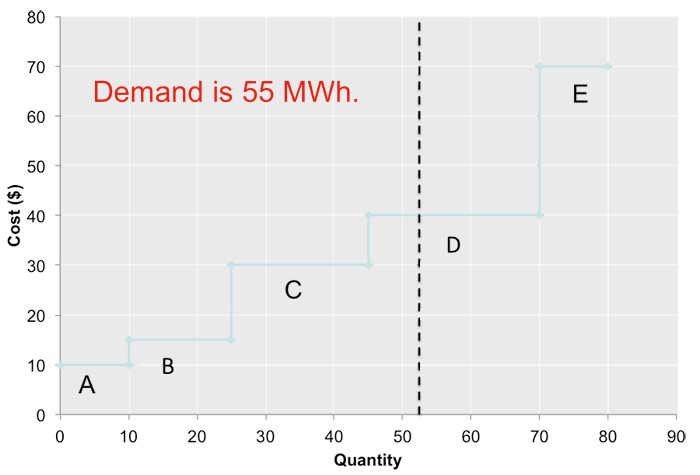

As a reminder of how this system works, the uniform price auction is illustrated in Figure 12.1. There are five suppliers, each of which offers its capacity to the market at a different price. These supply offers are shown in Table 12.1. Here we will assume that supply offers are equal to the marginal costs of each generator, but in the deregulated generation market suppliers are not really obligated to submit offers that are equal to costs. The RTO aggregates these supply offers to form a single market-wide “dispatch stack” or supply curve. Demand is represented by a vertical line (the RTO assumes that demand is fixed, or “perfectly inelastic” with respect to price). In this case, demand is 55 MWh. Generators A, B, C, and D clear the market. Generator E does not clear the market since its supply offer is too high. The market-clearing price, known as the “system marginal price (SMP)” would be $40 per MWh. Generators A, B, C, and D would each be paid $40 per MWh. Generators A, B and C would earn a profit. Generator D is the marginal unit, so it earns zero profit.

| Supplier | Capacity (MW) |

Marginal cost ($/MWh) |

|---|---|---|

| A | 10 | $10 |

| B | 15 | $15 |

| C | 20 | $30 |

| D | 25 | $40 |

| E | 10 | $70 |

Each generator that clears the market (in this case, it would be A, B, C, and D; E does not clear the market) earns the SMP for each unit of electricity they sell. Total hourly profits are thus calculated as:

Profit = Output × (SMP – Marginal Cost).

Since the SMP in our example is equal to $40, hourly profits are calculated as:

Note in particular that Firm D, which is the “marginal unit” setting the SMP of $40/MWh, clears the market but does not earn any profits.