Lesson 5 - Crude Oil Logistics & Value Chain

Lesson 5 Introduction

Overview

The term “logistics” has become more and more popular to define the process whereby goods move from the point of manufacturing and production to the point of sale and consumption. UPS® and FedEx® are no longer just in the package shipping business. They now provide a full range of services, from receiving parcels to transporting them via truck, rail, and plane, to storing them in warehouses, and, ultimately, distributing them to their final destinations. All the while, they are tracking packages throughout the entire process, which can also be done by their customers.

The delivery system for energy commodities is no different, as products—either from the wellhead, plant, or refinery—are transported using various methods, stored, and ultimately distributed to places of final consumption. As we explore the ways and methods in which energy commodities are delivered to market, you will see this same basic theme consistently applied.

Additionally, we will learn the “value chain” for energy commodities. That is, what are the costs and revenues along this delivery path?

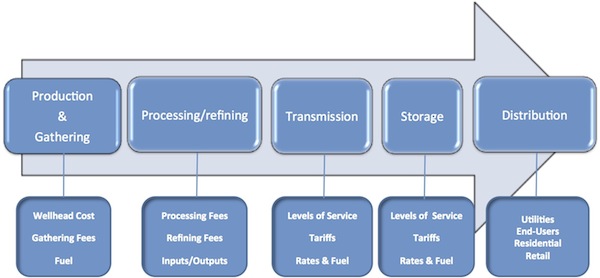

Flow chart in the shape of an arrow.

Production & Gathering (Wellhead Cost, Gathering Fees, Fuel)

Leads to

Processing/Refining (processing fees, refining fees, inputs/outputs)

Leads to

Transmission (levels of service, tariffs, rates & fuel)

Leads to

Storage (levels of service, tariffs, rates of fuel)

Leads to

Distribution (utilities, end-users, residential, retail)

This graphic illustrates the various steps in the "wellhead-to-burnertip" logistical path for oil and natural gas: aggregation (gathering), the "cleaning" of the raw stream and production of valuable natural gas liquids (NGLs) and, the steps for getting crude oil and natural gas from the wells all the way to market. As you can see, there is processing of natural gas or refining of crude, the transportation and storage and, finally, the distribution and retail delivery to the various end-users. As you will see, each step along this "path" will have some costs associated with it, and most will represent an opportunity for generating revenue. These will add to the total profit that can be derived from the initial wellhead production.

Over the years, many industries have been regulated by the federal government. But one by one, they became "deregulated" over time. The banking and airline industries were once heavily regulated, as was the telephone business. In exchange for federally-approved rates of service and a set return on investment, companies were given exclusive franchises, or service territories. Today, the deregulation of formerly regulated businesses has spurred on competition and stimulated new products and services. The natural gas and crude oil businesses followed behind, but eventually became deregulated as well. The chain of events leading up to that, and the current regulatory status of these industries, is presented in this lesson.

Learning Outcomes

At the successful completion of this lesson, students should be able to:

- define the steps in the movement of crude oil from the wellhead to the end-user (“pump-to-pump” path);

- recognize the “value chain” along the path;

- explain the general methods of transporting crude oil from well to refinery;

- trucks

- pipeline

- rail

- barge

- tanker

- outline the crude refining processes and their refined products.

What is due for this lesson?

This lesson will take us one week to complete. The following items will be due Sunday, 11:59 p.m. Eastern Time.

- Lesson 5 Quiz

- Lesson 5 activities as assigned in Canvas

Questions?

If you have any questions, please post them to our General Course Questions discussion forum (not email), located under Modules in Canvas. The TA and I will check that discussion forum daily to respond. While you are there, feel free to post your own responses if you, too, are able to help out a classmate.

Reading Assignment: Lesson 5

The refining of crude oil is a complex process. In preparation for this topic, please complete the reading assignment below. My lecture will closely follow the steps in refining as outlined here.

Reading Assignment:

Crude Oil Refining Process

Go to "How Oil Refining Works" [2] and read pages 1 through 6 in preparation for the mini-lecture on Crude Oil Refining. As you read the sections, keep these questions in mind:

- What is meant by “crude” oil?

- What are the two main refining processes?

- What are the various products derived from raw crude oil?

- How does “distillation” work?

- What is “cracking”?

- What is “reforming”?

- What is “alkylation”?

Also, see "A Brief History of Energy Regulations" [3] and read the "Overview" and "Oil Market Policies."

Optional Reading and Videos

Readings

- Review the crude oil basics from Lesson 2 Reading Assignment [4].

- Petroleum History [5]

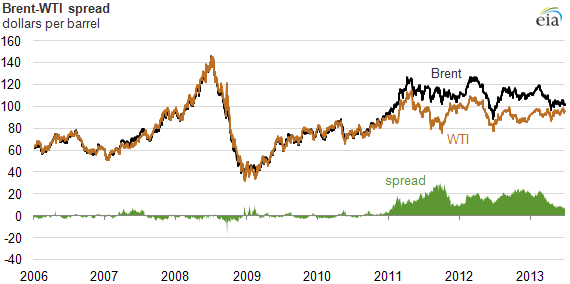

- Price difference between Brent and WTI crude oil narrowing? [6]

- Where Are Liquids Pipelines Located? [7]

- Oil tanker sizes range from general purpose to ultra-large [8]

- PADD regions [9]

Video: The Importance of Cushing Oklahoma (1:21 minutes)

Click for a transcript of the Importance of Cushing Oklahoma video

Cushing, Oklahoma is the delivery location for the NYMEX benchmark light sweet crude oil futures contract. The light sweet crude oil futures contract specifies delivery of a common stream of light sweet crude US oil grades, which are referred to as WTI or domestic sweet crude oil.

The Cushing physical delivery mechanism is a network of nearly two dozen pipelines and 15 storage terminals, several with major pipeline manifolds. Cushing is called the pipeline crossroads of the world. This vibrant hub has 90 million barrels of storage capacity, where commercial companies are active participants in the market.

The storage capacity has grown dramatically over the past few years and now accounts for 13% of total US oil storage. Crude oil inventory levels reached a record high of 69 million barrels in storage in early 2017. Cushing's inbound and outbound pipeline capacity is well over 6.5 million barrels daily. It is interconnected to multiple pipelines, each capable of transporting hundreds of thousands of barrels of oil daily. Significant investments in infrastructure, along with increased US oil production and the repeal of the oil export ban have strengthened the role of WTI as the leading global benchmark.

Video: Petroleum Refining Basics (10:00 minutes)

Click for a transcript of the Petroleum Refining Basics video.

For crude oil to be used effectively by modern industry, it has to be separated into its component parts and have impurities like sulfur removed. The most common method of refining crude is the process of fractional distillation. This involves heating crude oil to about 350 degrees Celsius, to turn it into a mixture of gases. These are piped into a tall cylinder, known as a fractional tower.

Inside the tower, the very long carbon chain liquids, such as bitumen and paraffin wax, are piped away to be broken down elsewhere. The hydrocarbon gases rise up inside the tower, passing through a series of horizontal trays and baffles called bubble caps. The temperature at each tray is controlled so as to be at the exact temperature that a particular hydrocarbon will condense into a liquid. The distillation process is based on this fact.

Different hydrocarbons condense out of the gas cloud when the temperature drops below their specific boiling point. The higher the gas rises in the tower, the lower the temperature becomes. The precise details are different at every refinery and depend on the type of crude oil being distilled. But at around 260 degrees, diesel condenses out of the gas. At around 180 degrees, kerosene condenses out. Petrol, or gasoline, condenses out at around 110 degrees, while petroleum gas is drawn off at the top.

The distilled liquid from each level contains a mixture of alkanes, alkenes, and aromatic hydrocarbons with similar properties, and requires further refinement and processing to select specific molecules.

The quantities of the fractions initially produced in an oil refinery don't match up with what is needed by consumers. There is not much demand for the longer chain, high molecular weight hydrocarbons, but a large demand for those of lower molecular weight-- for example, petrol. A process called cracking is used to produce more of the lower molecular weight hydrocarbons. This process breaks up the longer chains into smaller ones.

There are many different industrial versions of cracking, but all rely on heating. When heated, the particles move much more quickly, and their rapid movement causes carbon-carbon bonds to break. The major forms of cracking are thermal cracking, catalytic, or cat cracking, steam cracking, and hydrocracking.

Because they differ in reaction conditions, the products of each type of cracking will vary. Most produce a mixture of saturated and unsaturated hydrocarbons. Thermal cracking is the simplest and oldest process. The mixture is heated to around 750 to 900 degrees Celsius, at a pressure of 700 kilopascals That is, around seven times atmospheric pressure. This process produces alkenes, such as ethene and propene, and leaves a heavy residue.

The most effective process in creating lighter alkanes is called catalytic cracking. The long carbon bonds are broken by being heated to around 500 degrees Celsius in an oxygen-free environment, in the presence of zeolite. This crystalline substance, made of aluminum, silicon, and oxygen, acts as a catalyst. A catalyst is a substance that speeds up a reaction or allows it to proceed at a lower temperature than would normally be required.

During the process, the catalyst, usually in the form of a powder, is treated and reused over and over again. Catalytic cracking is the major source of hydrocarbons, with 5 to 10 carbon atoms in the chain. The molecules most formed are the smaller alkanes used in petrol, such as propane, butane, pentane, hexane, heptane, and octane, the components of liquid petroleum gas.

In hydrocracking, crude oil is heated at very high pressure, usually around 5,000 kilopascals, in the presence of hydrogen, with a metallic catalyst such as platinum, nickel, or palladium. This process tends to produce saturated hydrocarbons, such as shorter carbon chain alkanes because it adds a hydrogen atom to alkanes and aromatic hydrocarbons. It is a major source of kerosene jet fuel, gasoline components, and LPG.

In one method, thermal steam cracking, the hydrocarbon is diluted with steam and then briefly heated in a very hot furnace, around 850 degrees Celsius, without oxygen. The reaction is only allowed to take place very briefly.

Light hydrocarbons break down to the lighter alkenes, including ethene, propene, and butene, which are useful for plastics manufacturing. Heavier hydrocarbons break down to some of these, but also give products rich in aromatic hydrocarbons and hydrocarbons suitable for inclusion in petrol or diesel. Higher cracking temperature favors the production of ethene and benzene.

In the coking unit, bitumen is heated and broken down into petrol alkanes and diesel fuel, leaving behind coke, a fused combination of carbon and ash. Coke can be used as a smokeless fuel.

Reforming involves the breaking of straight chain alkanes into branched alkanes. The branched chain alkanes in the 6 to 10 carbon atom range are preferred as car fuel. These alkanes vaporize easily in the engine's combustion chamber, without forming droplets and are less prone to premature ignition, which affects the engine's operation. Smaller hydrocarbons can also be treated to form longer carbon chain molecules in the refinery. This is done through the process of catalytic reforming, When heat is applied in the presence of a platinum catalyst, short carbon chain hydrocarbons can bind to form aromatics, used in making chemicals. A byproduct of the reaction is hydrogen gas, which can be used for hydrocracking.

Hydrocarbons have an important function in modern society, as fuel, as solvents, and as the building blocks of plastics. Crude oil is distilled into its basic components. The longer carbon chain hydrocarbons may be cracked to become more valuable, shorter chain hydrocarbons, and short chain molecules can bind to form useful longer chain molecules.

Crude Oil Logistics

The following mini-lecture traces the flow of crude oil from the wellhead to the refinery using various forms of transportation. We also discuss the two global standards for crude oil, West Texas Intermediate, and Brent North Sea. The major supply/demand districts in the US are presented, as well as supply and demand statistics.

The history of regulation for crude oil and liquids pipelines goes back to the first regulation of the railroads in the 1800s. A fear of a monopoly by the few railroads in existence prompted the US government to form the Interstate Commerce Commission. The body was later given jurisdiction over interstate crude oil pipelines based upon the same monopoly fears. Today, that responsibility lies with the Federal Energy Regulatory Commission (FERC).

Under federal regulations, pipelines must file “just and reasonable” rates and provide access to any shipper requesting space, if available.

Key Learning Points for the Mini-Lecture: Crude Oil Logistics & Refining

While watching the mini-lecture, keep in mind the following key points and questions:

- What are the steps in the crude oil value chain?

- What are the costs and revenue opportunities on the value chain?

- What are the crude oil standards? “West Texas Intermediate” crude oil vs. “Brent North Sea” oil

- How is crude oil transported?

- What is the role of pipeline in crude oil transportation?

- What entity regulates crude oil pipelines?

- How does The Federal Energy Regulatory Commission (FERC) regulates the crude oil pipelines?

- FERC replaced the Interstate Commerce Commission as the regulatory body for crude oil pipelines.

- “Common carrier” status

- Non-utility vs. natural gas pipeline utility status

- Explain the rate schedules – “tariffs”.

- What are “PADDs”?

- Which PADDs have the highest crude oil Supply & Demand?

The following lecture is split into two parts.

The first video is 11 minutes long.

In this lesson, we're going to talk about crude oil, the actual logistical path getting it from the pump at the wellhead to the pump, basically, at the retail gasoline station. And then, we'll talk about the value chain. Crude oil itself has no real value. It's what the refiners can turn it into is where the value actually lies.

Here, again, is this schematic of the value chain for both natural gas and for crude oil. But if you look at the crude oil parts, basically we go from the wellhead where there is the cost to lift the crude oil. Then, we've got the refining, and then, there's fees associated with that. Then, we're going to have to get it, the crude, to the refineries via various methods that we'll talk about.

Then, we also have to take away the refined products to market itself. You can store crude oil. You can also store the refined products. And, ultimately, you get to a distribution point where you're at the retail level. Or, in the case of crude oil, you're also manufacturing some petrochemical feedstocks.

So, we're talking, again, about crude oil logistics from pump to pump. Here's an old wooden derrick, crude oil, probably back from the time of the first discoveries in Titusville, Pennsylvania. West Texas Intermediate Crude Oil is going to be the standard we talked about. We did talk about that in a previous lesson when we talked about the contracts with the New York Mercantile Exchange.

But it's the North American standard. It is known as low-sulfur sweet crude, traded in international currency as the US dollar. It is priced free on board in Cushing, Oklahoma. And again, as we talked about in a previous lesson, it is traded on the New York Mercantile Exchange as a financial derivative, which does allow for hedging.

And then, Brent crude is the North Sea global standard. It is traded on ICE Futures Europe in London, which is formerly the International Petroleum Exchange in London. There are financial derivative instruments over there that are similar to the NYMEX crude contract. A lot of traders take the price opportunity or arbitrage between the London contracts and the NYMEX contracts in New York City.

Currently, still due to some supply bottlenecks, US Gulf Coast refiners are paying higher prices since imports are priced off of the Brent crude price. Now, we can't get enough of the surplus domestic supply that we have to the Gulf Coast refiners at the present time.

Here is, basically, what the EIA shows to be the growth in crude oil production over the last year or so, going back actually two years to 2013, a four-week average on each plot point, and then showing the 2014 to 2015 period, again, four-week averages on each plot point. So, you can see, there's been a significant increase in US domestic crude production. And then, imports-- as you would guess-- imports have declined steadily over the same two-year period and will continue to do so.

The pipeline infrastructure, of course, is critical to balancing the supply and demand for energy across the United States. And the same holds true for crude oil and petroleum product pipelines. Here is a very simplified schematic of the grid across the US.

Crude oil and petroleum pipeline product lines are supplied to major demand centers in the United States by over 200,000 miles of pipelines, representing about a $31 billion investment. Pipelines transport over 38 million barrels of crude oil, feedstocks, and petroleum products each day. 17% of the nation's freight is transported via pipelines for only 2% of the nation's cost.

The infrastructure now for crude oil in terms of various pipelines, you've got pipelines to transport the crude oil from major producing basins and various ports, import ports, to various refining centers and/or supply hubs. Other pipelines transport refined petroleum products, including gasoline, diesel, jet fuel, and LPGs, which are liquefied petroleum gases, from refineries and ports to end-user markets. Other liquids, energy-related petrochemical feedstocks are transported between supply chain points, perhaps from the tailgate of a refinery to the inlet side of a petrochemical processing plant.

Various modes for crude oil delivery, the primary one is the pipeline. You've got, in essence, it's a wellhead to transmission pipeline to the refineries themselves. You have pump systems along the way. And they can batch process the crude, put it in different volumes at different times, and separate them with a batch separator.

The interstate grid in the United States transports about 2/3 of all the oil. The pipelines are subject to the Federal Energy Regulatory Commission and the former Interstate Commerce Commission. They are labeled as common carriers. They do not have utility status, which natural gas pipelines do get.

The US network of petroleum and petroleum product pipelines is the largest in the world. It's also the cheapest method on a cost-per-barrel basis to move crude around. We also truck crude oil, mostly from wellhead tanks to refineries or from the wellhead tank batteries to rail terminals where it's loaded onto rail cars. It is the most costly method, you can imagine. It's the smallest amount that can be transported. It's the least volume capacity, approximately 200 barrels per tank, per truck tank, or 8,400 gallons.

Other modes of transportation, rail cars, they're very large capacity, 2,000-barrel tank cars, relatively cheap cost. The problem is there is limited access. Railroads obviously aren't everywhere.

Tankers, we're mostly familiar with those. Generally, for import purposes, they are very large capacity. Of course, they vary from standard tankers to what they call VLCCs, which are the very large crude tankers, so-called supertankers. Now, these are water-bound. We also can barge crude oil intra-country. These are large capacity tanks also. But they are strictly water-bound as well.

Here's just a schematic, kind of a simplistic map, of petroleum refined product transportation infrastructure across the US. What you see here on the map is pipeline, rail, barge, and tanker locations around the US.

Just a quick couple of thoughts on the actual regulation of crude oil. We've talked about regulated and non-regulated industries before. And pipelines have been regulated going way far back. You can see here, in 1887, the Interstate Commerce Act placed pipelines under the regulation of the ICC, the Interstate Commerce Commission, because railroads had been regulated. And now, there was a concern about potential monopolistic power for those who owned the pipelines.

This then, in 1906, pipelines where placed under what was known as the Hepburn Act. And then the Interstate Commerce Act of 1887 set some ground rules which still apply to the pipelines today. Rates that they can charge have to be just and reasonable. They have to disclose their terms of service, in other words, the rules and regulations under which they will transport the crude oil.

They have to have form and content of tariffs. That means they have to have some documentation in terms of how they are going to conduct operation, the rules for you to be a shipper to move crude oil, on there. And then, tariffs are the rates that they're going to charge. Accounting methodologies, all reporting requirements, and then disclosure of shipper information, all of these things are requirements for pipelines to operate and, again, come out of this Interstate Commerce Act from 1887.

And today, the Federal Energy Regulatory Commission, or FERC as its most widely known, has jurisdiction over the crude oil pipelines. Congress abolished the Interstate Commerce Commission in 1995. Again, they have common carrier status. That means they need to be able to carry or ship crude oil for just about everyone. They don't have utility status. Natural gas pipelines received utility status under the Natural Gas Act, or the NGA, of 1938. So, they don't have franchises, in other words.

Crude oil pipelines don't have protected territories. They also have no right of eminent domain. The right of eminent domain, especially for those of you who are familiar with land law, allows the entity to come in and condemn the property if the property owner protests the building of the pipeline. But again, these pipelines still have to provide just and reasonable rates and have the reporting requirements that I mentioned above.

Here's just a sample crude pipeline tariff. This is from Shell Pipeline Company. They have a pipeline and a crude line in the Houston, Texas area. And if you look at the top, the issuer is Shell Pipeline. The regulator in the state of Texas is the Texas Railroad Commission.

And we have, in essence, the originating point or the input points to the pipeline for the crude oil. And then the destination is East Houston, which is more than likely the very large Houston ship channel, which is the world's largest petrochemical refining corridor. That is the US Gulf Coast. They're shipping petroleum. You can see that the date of this particular contract agreement was June 1st of 2012.

The unit measuring, they're going to be paying so many cents per barrel. And if you get all the way down to the bottom here, you can see that the actual tariff rate for volumes of 0 to 65 million barrels, they're going to be paying $0.16 per barrel. If they ship a greater amount than 65, almost 66, million barrels, they will only be paying $0.08. So this would be a typical crude oil pipeline tariff. If you were interested in being a shipper, you would be issued one of these by the operator of the pipeline.

The second video explains the PADDs and crude oil supply and demand from these regions. This video is 6:07 minutes long.

Here's just a shot, actually just a partial shot, of what is the Houston Ship Channel Complex east of Houston. It's a huge crude refining and petrochemical refining complex.

Back during World War II, there was concern about the amount of crude and refined products that we would have for the war effort. And so, the Department of Defense came up with what they call the Petroleum Administrative Defense Districts. And this is the way that they could keep tabs on the supply, the demand, and at times of rationing, set the rationing limits for the various districts across the United States. Well, these have remained in place today, and we talk about the various PADDs, the supply, the demand, the pricing and those types of things.

Now, PADD 1, it's the highest petroleum consumption rate in the United States. And you can see, I mean, it's running from Maine down to Florida. So several very, very large metropolitan areas. They are highly dependent on imports for both crude oil and refined products. 100% of the crude oil, traditionally, has been imported. But now, they do have access to some of the oil coming from the shales, such as the Marcellus and the Utica.

There's also crude oil coming from the Bakken by rail. But in this case, they mean imports as in importing crude oil from other PADD regions. 25% of the refined products in the Northeast, they do, in fact, import. They are the largest recipient of supplies from the other PADD districts.

The south Atlantic region is experiencing higher population growth rates and the slower growth in New England. So, again, demand is expected to expand in the southeast part of the United States. It's also the largest concentration of oil-heated homes. There's still a considerable amount of heating oil used in the Northeast. It's used to create hot water, as well as for space heating purposes.

And when we had our discussion about the supply-demand fundamentals that impact crude oil, we talked extensively about the idea that the Northeastern part of the United States is the world's largest consumer of heating oil and fuel oil.

PADD 2, as you can see, it runs all way down to Oklahoma, and Tennessee and all the way then up to the Canadian border in what we generally call the Midwest region. They're dependent on crude oil imports, mostly from Canada. Except now, we do have the Bakken oil, which can help supply the region as well, coming from North Dakota.

Second highest crude oil demand region in the United States. Again, several major metropolitan areas, including Cleveland, Detroit, Chicago, Kansas City, St. Louis, those areas. They are chronically short, the market, due to a combination of demand growth and refinery closures.

So, they don't have a lot of crude being produced in that area, with the exception of the Bakken and, potentially, Utica shale. There is crude oil in Oklahoma. The question is are they getting it to the refineries? And as this indicates, there have been, anyhow, reductions in the refining capacity over the years.

PADD 3, this is the origin of 90% of the crude oil and 80% of the refined products shipped among the various other PADD regions. It's the largest crude oil and refined product supply region in the US. And only two OPEC nations, that is Saudi Arabia and Iran, have a higher crude oil production rate than PADD 3.

So, you can look and every one of these is an oil-producing state. And then, no foreign nation has a higher refined product output than PADD 3. Again, the Gulf Coast petroleum refining and petrochemical manufacturing corridor is the largest in the world.

PADD 4, which is sensibly the Rocky Mountain region. PADD 2 and 3 have historically supplied the market to augment local production. It's a small, but growing, market. There's minimum demand for specialty products. The infrastructure's not developed due to long distances, limited markets, and high costs.

The Rocky Mountains are running right through this region. And so, it makes it tough to, basically, transport, have an interchange, so to speak, of crude and refined products. There is a large refinery in the Denver area.

And then, PADD 5 is the entire west coast plus Alaska. And West Coast is traditionally isolated from other US supply regions, again, due to the Rocky Mountains. Growing population continues to increase demand for products. Alaska North Slope crude oil is an important source of supply for West coast refineries. North Slope Crude oil has been around for decades. And it is piped. And in some cases, they do use large tanker ships to bring it down to the lower 48.

The California Air Resources board rules, they kind of isolate the market, which limits supply options. In other words, I think a lot of you've seen the fuel standards for California, from an emission standpoint, are much more restrictive than the rest of the country. And so refiners in that region or refiners wanting to sell to that region have to meet those standards.

Just an overview of supply and demand. Over 50% of all the US crude oil demand exists in the Gulf Coast. The demand, yes, because when we talk about crude oil demand itself, we're talking about refinery demand. Production from the Gulf Coast region supplies the majority of the Midwest and East Coast refined product deficit.

New England regions becoming increasingly dependent on foreign imports as the South Atlantic region continues to grow. The Midwest deficit is expected to grow as regional refineries struggle to keep up with demand. And the West Coast and Rocky regions are fairly well-balanced between regional refined products, supply, and demand.

Figure 2 displays the price difference between Brent and WTI crude oil. As you can see in this graph, there has always been a price difference between WTI and Brent. Before 2011, this difference was very small with Brent being slightly cheaper than WTI. In 2011, increased domestic light crude oil production, along with pipeline and transportation limitations, caused the WTI to be traded at a lower price with a larger gap compared to Brent. Recently, infrastructure limitations are decreasing and the difference is once again becoming smaller; and WTI can be supplied to the Gulf of Mexico. The green area in this graph indicates the price difference. More recent charts and data can be found here [10].

Please review Figure 1 and Figure 2 in Lesson 2 [11] to see the upward trend in oil production and the downward trend in oil imports for the same time period.

Crude oil transportation

The following links provide good resources for the U.S. pipeline infrastructure:

- U.S. Energy Mapping System [12]

- American Petroleum Institute (API) [13]

- The National Pipeline Mapping System [14]

Please go to this map on Pipeline 101.org [7] and find Cushing, OK.

More information about tankers can be found on this article, "Oil tanker sizes range from general purpose to ultra-large crude carriers on AFRA scale [8]", on the EIA website.

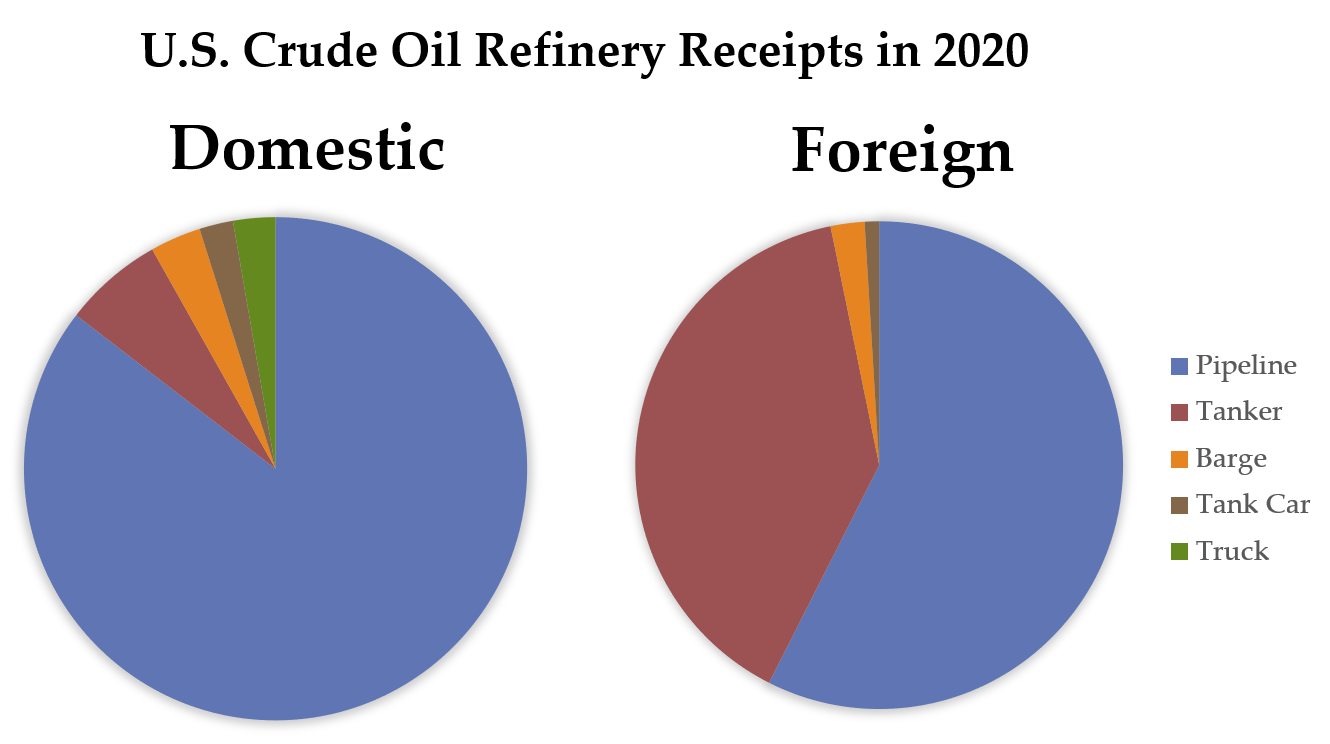

Figure 3 is drawn from the EIA data for the U.S. Crude Oil Refinery Receipts by mode of transportation in 2020. As you can see, pipelines transport the largest portion of domestic crude oil, and tankers transport the largest portion of foreign crude oil to the refineries.

| Percent of Receipts | Domestic | Foreign |

|---|---|---|

| Pipeline | 85% | 56% |

| Tanker | 6% | 39% |

| Barge | 4% | 2% |

| Tank Car | 2% | 1% |

| Truck | 3% | 0% |

Crude Oil Refining

The following mini-lecture presents each phase of the crude oil refining process and the various products that are extracted from each barrel of oil.

Key Learning Points for the Mini-Lecture: Crude Oil Refining

While watching the mini-lecture, think about the following:

- products made from a barrel of crude oil

- refining process

- distillation

- conversion = “cracking,” reforming, alkylation, “coking”

- types of refined products

In the previous lesson, we talked about the actual logistics of getting crude oil to the refineries. And again, keep in mind, crude oil itself is not where the value lies, it's once the refiners turned it into various refined products and also petrochemical feedstocks.

Here's a picture of a petroleum refining complex down in Port Arthur, Texas, which is again, part of that huge refining petrochemical corridor along the US Gulf Coast. A map of where the current refineries are located, and this one is shaded in to show the petroleum administration defense districts, or the various PADDs, that we discussed in the prior lesson. Just a simple illustration of how the process might work. You can see these are seafloor gathering systems for crude oil, bringing through onshore, then you got offshore drilling and production platforms there. You can also see some tankers that are offloading and more than likely imported crude oil directly to the refineries.

The refining process itself, these are the types of products that you can extract from a simple barrel of crude oil. You can see gasoline being the largest, and then diesel being the second largest percentage. So, we have, again, basically, the largest component being motor fuels. Now the distillation process, it's the same as distilling anything. You're going to heat up the crude oil, and then naturally there's going to be some vapors, and some other moisture, or some other condensation, and they're all going to represent products that are derived from raw crude oil. So, you're going to separate heavier and lighter components by heating raw crude oil, feeding it into a distillation tower where the cooling occurs.

The lighter fractions rise to the top while heavier fractions remain on the bottom layers according to weight and boiling points. Again, we're talking about fractions, in other words, the hydrocarbon fractions that can be removed from the complex hydrocarbon molecule that is crude oil. The primary fractions come out of this first process of distillation but things like liquefied petroleum gases, or LPGs, naphtha, kerosene, diesel, heavy oils, and residual oil. And now, we have some other processes that all these will go through, processes like reforming, alkylation, cracking, and coking to make additional products that we might need.

And here's just illustration of the distillation column, and you can see off to the right the products that come out simply by heating up the crude oil in this first phase. One of the next phases, then, is conversion, and this is where they're going to crack the remaining heavy hydrocarbons into lighter once. You've got thermal cracking where heat or steam is actually used to break down larger hydrocarbons into smaller ones, or chemical cracking where a specific catalyst is used to speed up the cracking process. The result of the cracking process is to create additional gasoline, to create jet fuel and diesel fuel. Now, again, the overall process of a refinery is to take complex hydrocarbon molecules break them down, and then reform them into the products that the refinery chooses to market at any one time.

Again, the next phase in what we call the conversion process is the reformer. This is where you have heat, pressure, and catalysts that take these smaller molecules and combine them back into larger ones. For instance, naphtha, which is a product of the distillation phase, can be turned into gasoline. Another conversion process is that of alkylation. You take some of the lower weight molecules, and they're combined using a catalyst to form high-octane hydrocarbons for gasoline blending. This are the so-called anti-knocking compounds that are added to gasoline.

And then last, but not least, we have coking, which is another conversion process. Coking is where the residual oil, the heaviest stuff that comes from the distillation process, is going to be heated, and it's broken down into heavy oil, gasoline, and naphtha as well. The remaining product then is known as coke. It is used as a fuel source, it's used as iron ore smelting, and this is what is inside of dry cell batteries.

And then you have all-in-one the refining process. You can see here, you start off with the raw crude oil, you have the distillation column, the LPGs come off the top, you can see here, the naphtha can be sent to the reformer to create gasoline, then we have the cracking, the alkylation unit and last, but not least, the coking. So, all of these together combined form the refining process, which then gives us these various products that are going to be sold in places like retail, gasoline outlets, but then, also, there's going to be some of these that are used as feedstocks for the actual production of petrochemicals.

Optional Viewing

Petroleum Refining Basics video (10 minutes)

For crude oil to be used effectively by modern industry, it has to be separated into its component parts and have impurities like sulfur removed. The most common method of refining crude is the process of fractional distillation. This involves heating crude oil to about 350 degrees Celsius, to turn it into a mixture of gases. These are piped into a tall cylinder, known as a fractional tower.

Inside the tower, the very long carbon chain liquids, such as bitumen and paraffin wax, are piped away to be broken down elsewhere. The hydrocarbon gases rise up inside the tower, passing through a series of horizontal trays and baffles called bubble caps. The temperature at each tray is controlled so as to be at the exact temperature that a particular hydrocarbon will condense into a liquid. The distillation process is based on this fact.

Different hydrocarbons condense out of the gas cloud when the temperature drops below their specific boiling point. The higher the gas rises in the tower, the lower the temperature becomes. The precise details are different at every refinery and depend on the type of crude oil being distilled. But at around 260 degrees, diesel condenses out of the gas. At around 180 degrees, kerosene condenses out. Petrol, or gasoline, condenses out at around 110 degrees, while petroleum gas is drawn off at the top.

The distilled liquid from each level contains a mixture of alkanes, alkenes, and aromatic hydrocarbons with similar properties, and requires further refinement and processing to select specific molecules.

The quantities of the fractions initially produced in an oil refinery don't match up with what is needed by consumers. There is not much demand for the longer chain, high molecular weight hydrocarbons, but a large demand for those of lower molecular weight-- for example, petrol. A process called cracking is used to produce more of the lower molecular weight hydrocarbons. This process breaks up the longer chains into smaller ones.

There are many different industrial versions of cracking, but all rely on heating. When heated, the particles move much more quickly, and their rapid movement causes carbon-carbon bonds to break. The major forms of cracking are thermal cracking, catalytic, or cat cracking, steam cracking, and hydrocracking.

Because they differ in reaction conditions, the products of each type of cracking will vary. Most produce a mixture of saturated and unsaturated hydrocarbons. Thermal cracking is the simplest and oldest process. The mixture is heated to around 750 to 900 degrees Celsius, at a pressure of 700 kilopascals That is, around seven times atmospheric pressure. This process produces alkenes, such as ethene and propene, and leaves a heavy residue.

The most effective process in creating lighter alkanes is called catalytic cracking. The long carbon bonds are broken by being heated to around 500 degrees Celsius in an oxygen-free environment, in the presence of zeolite. This crystalline substance, made of aluminum, silicon, and oxygen, acts as a catalyst. A catalyst is a substance that speeds up a reaction or allows it to proceed at a lower temperature than would normally be required.

During the process, the catalyst, usually in the form of a powder, is treated and reused over and over again. Catalytic cracking is the major source of hydrocarbons, with 5 to 10 carbon atoms in the chain. The molecules most formed are the smaller alkanes used in petrol, such as propane, butane, pentane, hexane, heptane, and octane, the components of liquid petroleum gas.

In hydrocracking, crude oil is heated at very high pressure, usually around 5,000 kilopascals, in the presence of hydrogen, with a metallic catalyst such as platinum, nickel, or palladium. This process tends to produce saturated hydrocarbons, such as shorter carbon chain alkanes because it adds a hydrogen atom to alkanes and aromatic hydrocarbons. It is a major source of kerosene jet fuel, gasoline components, and LPG.

In one method, thermal steam cracking, the hydrocarbon is diluted with steam and then briefly heated in a very hot furnace, around 850 degrees Celsius, without oxygen. The reaction is only allowed to take place very briefly.

Light hydrocarbons break down to the lighter alkenes, including ethene, propene, and butene, which are useful for plastics manufacturing. Heavier hydrocarbons break down to some of these, but also give products rich in aromatic hydrocarbons and hydrocarbons suitable for inclusion in petrol or diesel. Higher cracking temperature favors the production of ethene and benzene.

In the coking unit, bitumen is heated and broken down into petrol alkanes and diesel fuel, leaving behind coke, a fused combination of carbon and ash. Coke can be used as a smokeless fuel.

Reforming involves the breaking of straight chain alkanes into branched alkanes. The branched chain alkanes in the 6 to 10 carbon atom range are preferred as car fuel. These alkanes vaporize easily in the engine's combustion chamber, without forming droplets and are less prone to premature ignition, which affects the engine's operation. Smaller hydrocarbons can also be treated to form longer carbon chain molecules in the refinery. This is done through the process of catalytic reforming, When heat is applied in the presence of a platinum catalyst, short carbon chain hydrocarbons can bind to form aromatics, used in making chemicals. A byproduct of the reaction is hydrogen gas, which can be used for hydrocracking.

Hydrocarbons have an important function in modern society, as fuel, as solvents, and as the building blocks of plastics. Crude oil is distilled into its basic components. The longer carbon chain hydrocarbons may be cracked to become more valuable, shorter chain hydrocarbons, and short chain molecules can bind to form useful longer chain molecules.

Cushing - NYMEX Crude Oil Hub

As explained in previous lessons, crude oil is one of the energy commodities that are traded on the NYMEX. Its symbol is CL. We refer to this as West Texas Intermediate or WTI crude. It is low sulfur, and so, therefore, is given the nickname sweet crude. The NYMEX contract for crude oil was initiated in 1983. Every contract represents 1,000 barrels, which is the equivalent of 42,000 gallons of oil. Price quotes on the New York Mercantile Exchange are all US dollars and cents per barrel. The minimum price fluctuation, the amount that the price has to move for a trade to take place, is one cent per barrel, or $10 per contract.

The delivery point for crude oil under this contract is what's known as FOB, or free on board, or delivered to the seller's facilities at Cushing, Oklahoma and to any pipeline or storage facility with access to Cushing Storage, TEPPCO, or Equilon pipelines. So, if you buy or sell crude oil contracts on NYMEX for a particular month, you are obligated to either receive the crude oil or deliver the crude oil at Cushing, Oklahoma.

The delivery point for the NYMEX Crude Oil contract is the Cushing Hub in Cushing, OK, USA. It is the world's largest crude oil storage facility and represents 16% of the US capacity. It has been in the news over the last few years as TransCanada seeks approval for its Keystone XL pipeline and, as the excess supply at Cushing looks for new outlets to the Gulf of Mexico refineries.

Key Learning Points for the Mini-Lecture: Cushing - NYMEX Crude Oil Hub

While watching the following mini-lecture, please keep in mind the following key points:

- Cushing, OK is the delivery "hub" for the NYMEX contract for crude oil.

- It has both pipelines and storage capacity.

- It is currently over-supplied.

- Takeaway capacity is constrained.

- Gulf Coast refiners are having to pay higher prices for imported crude as a result.

- Two major pipeline projects have helped move crude south.

- Keystone XL pipeline could bring more Canadian tar sands crude oil to Cushing.

NOTE:

The lecture slides can be found in the Modules under Lesson 3: The New York Mercantile Exchange (NYMEX) & Energy Contracts in Canvas.

In the last lesson, we talked about Cushing as the New York Mercantile Exchange crude oil hub for the buying and selling of physical crude products under the New York Mercantile Exchange contracts. We're going to talk a little bit about this. But I want to spend some time on it only because it's made the news a few times in the past year. There are certainly some issues related to pricing of crude oil, which again impacts the price of unleaded gasoline throughout the United States, involving Cushing and a surplus of crude oil that happens to be there.

Here are some aerial pictures of Cushing itself. It is a pipeline and above ground crude oil storage hub in Oklahoma. It is a pipeline hub. Hub-- we use the term whenever we're really talking about the intersection of multiple pipes where any type of crude, natural gas liquids, natural gas can be exchanged or moved from one pipe to another.

They also have, as the previous picture showed, it's a crude oil storage tank farm as well. It's the world's largest crude oil storage facility. The companies of TEPPCO, Equilon, and TransCanada have crude oil pipelines that run to and away from Cushing.

It has 46 million barrel storage capacity that represents 16% of the total US crude oil storage capacity. It's designed to receive Gulf Coast and Midwest crude, to store it, and then transport it to refineries in Oklahoma and throughout the upper Midwest. Some of the key companies that are participants and owners of facilities of Cushing are Enbridge, BP, SemGroup, ConocoPhillips, Sunoco, Plains All American, and TEPPCO.

Here, in the last couple years, there have been historically high inventory levels. In fact, they're running out of storage capacity for crude. There's no incremental storage capacity at present. In part, this is due to the dramatic increase in domestic production of crude oil from the shale plays.

The most recent ones are the Bakken Shale in North Dakota and the Mississippian Lime play in central or northern Oklahoma. The Canadian imports continue to increase. The Keystone XL pipeline received some press earlier this year. But a lot of people do not know that TransCanada already has a pipeline in place known as the Keystone pipeline. So, there are shipments of Canadian crude oil entering the United States, coming to Cushing as we speak.

One of the biggest issues, though, is that we can't get the surplus crude oil to the Gulf Coast. So, as a result, Gulf Coast refiners-- that's the largest petrochemical refining area in the United States-- are having to pay more for crude oil than the WTI price. They're having to import more.

And so, it's a price that is above WTI. It's not quite the North Sea Brent Crude pricing that occurs in Europe. But it's more than they should have to pay because we can't get this excess supply down to them.

A couple of solutions to this problem, this bottleneck or this glut of supply, is to reverse the Seaway pipeline. The Seaway pipeline has been in existence for several decades. It originally was a crude oil pipeline that brought crude that was offloaded from tankers near Houston in the Ship Channel and Beaumont-Port Arthur areas of eastern Texas, right there on the Gulf. And the pipeline shipped it up to Cushing from there. In the late '80s, early '90s, it was actually a natural gas pipeline, taking natural gas from the mid-continent down to the Houston Ship Channel petrochemical and refining corridor, and was later converted back to crude oil. And it currently would bring crude oil to Cushing.

However, the demand is actually in the Gulf of Mexico. So, Enbridge and Enterprise bought this pipeline from ConocoPhillips. It's 500 miles, runs from Freeport, Texas, up to Cushing, Oklahoma. And they have already reversed the flow, currently by, in essence, redirecting the pumps along the pipeline. They're able to push 150,000 barrels a day of crude oil from Cushing down towards the Gulf Coast refiners. They're working on a project to expand the pipeline. And hopefully, by next year, they'll be able to ship 400,000 barrels a day southbound to the Gulf Coast refineries.

The Keystone XL project is the one that has received some press in this past year. It's TransCanada Pipeline Company's proposed two-phase crude oil pipeline. The objective is to move tar sands, crude oil, from Canada's Alberta province all the way down to Texas.

Phase one would run from Alberta, Canada, to Cushing, Oklahoma, approximately 1,180 miles. Phase two would run from Cushing, Oklahoma, to Nederland, Texas, on the Gulf Coast. And that segment is about 435 miles.

This is a picture of the Seaway pipeline, as you can see running from Cushing all the way down to Freeport, Texas. And in fact, the flow on this has been reversed. And here's the Keystone XL project, the yellowish dotted lines, and, the existing Keystone pipeline, is in orange. And so, you can see that TransCanada plans phase one to hook up with a portion of the existing Keystone pipeline. But phase two would run from Cushing on down to both the Houston Ship Channel and Port Arthur, Texas.

Some of the project issue's, as I've already mentioned, Seaway pipeline. It's already reversed their pump stations. And it's flowing southward again already as we speak.

Keystone XL, phase one, requires a presidential permit for the international border crossing. Back in February, this was delayed by the US State Department because the pipeline route was going to go through a sensitive environmental area known as Sandhills in Nebraska. The TransCanada Keystone project's parent is investigating alternate routes, and in fact, I believe has refiled for the permit to get the international border crossing.

Phase two, the section from Cushing, Oklahoma, down to Texas, is going to proceed. TransCanada has already received most of the regulatory approvals that they need. As a crude oil pipeline, they can only receive common carrier status. They are not a utility. And so they will have to negotiate with landowners the entire way.

There is a new project that ONEOK, out of Tulsa, Oklahoma, has announced. They're going to build a crude oil pipeline, which will run from the Bakken Shale area in North Dakota all the way to Cushing. It's estimated to be somewhere between $1.5 to $1.8 billion and 1,300 miles of pipeline. And they hope to have it in service in approximately three years' time.

Summary and Final Tasks

Key Learning Points: Lesson 5

- There are various methods used to transport crude oil from the wellhead to the refinery.

- truck

- rail

- pipeline

- barge

- tanker

- Brent is the “global standard” crude oil stream, while WTI is the North American standard and is also the standard for futures trading in crude oil.

- PADDs are regional districts for supply and distribution of crude oil.

- The US still relies heavily on imported crude, but domestic supplies are increasing.

- The refining process consists of distillation and conversion and produces several products used in transportation and as petrochemical feedstocks.

Reminder - Complete all of the lesson tasks!

You have reached the end of this lesson, Double-check the list of requirements on the first page of this lesson to make sure you have completed all of the activities listed there before beginning the next lesson.