Lesson 8 - Quantitative Methods and Energy Risk Management

Lesson 8 Introduction

Overview

In the previous lesson, we learned about risk management and hedging. In this lesson, we will learn more about the quantitative methods in risk management.

We will review some basic statistics topics, such as variance standard deviation as measures for dispersion, and learn how to apply them to the price data for our risk evaluations.

We will also learn about correlation, which basically explains how two variables are related, how two variables change together, and, if they are highly correlated, how they tend to move together.

Statistics and price analysis

Statistics can help traders evaluate and estimate price changes. Statistics could be used to summarize the data and also provide the accuracy of that summary. It can also be used to explore the relationship between parameters.

Learning Outcomes

At the successful completion of this lesson, students should be able to:

- define, calculate, and interpret the standard deviation of the price;

- define, calculate, and interpret the volatility of the price;

- calculate the moving standard deviation for price data;

- calculate the moving volatility for price data;

- distinguish between high and low volatility in the prices;

- define, calculate, and interpret the correlation for given price data.

What is due for this lesson?

This lesson will take us one week to complete. The following items will be due Sunday, 11:59 p.m. Eastern Time.

- Lesson 8 Quiz

- Lesson 8 activities as assigned in Canvas

Questions?

If you have any questions, please post them to our General Course Questions discussion forum (not email), located under Modules in Canvas. The TA and I will check that discussion forum daily to respond. While you are there, feel free to post your own responses if you, too, are able to help out a classmate.Reading Assignment: Lesson 8

Reading Assignment:

- Measures of Central Tendency and Skewness [1] (from STAT 500, Applied Statistics, Penn State University)

- Measures of Variability [2] (from STAT 500, Applied Statistics, Penn State University)

- Correlation [3] (from STAT 500, Applied Statistics, Penn State University)

Optional Readings

Edwards (textbook) - Section 3.3

Standard Deviation (Volatility)

How Do You Calculate Volatility In Excel?

Variation and Standard Deviation

Variation of a parameter, such as price data, is an important factor in risk management. A commodity with high price variation is considered a high-risk investment. Consequently, variation and measures of dispersion are among the useful information for traders and investors.

As we learned in the previous section, variance and standard deviation (square root of the variance) indicate variation in the data. Standard deviation measures the amount of variability or dispersion around the average. Standard deviation is more useful than variance, because it has the same unit as the parameter that it is representing, which makes it easier to compare and interpret the changes in price.

Standard deviation of the price

Standard deviation can be used as a measure of volatility. Volatility is a term for measuring the dispersion (in the prices, returns, …), which is widely used in the financial arena. Intuitively, when prices are volatile, it means prices have been changing a lot. Volatility is calculated based on the standard deviation. Volatility substantially affects the value of many financial instruments such as options (we will get to this in future lessons).

Note that standard deviation is dependent on the price level; commodities with higher price levels could have a higher standard deviation. So, calculated standard deviations have to be compared appropriately.

Example: The following table includes 10 prices for the NYMEX crude oil February futures contracts in January 2018 extracted from EIA. We are going to calculate the 10-period mean, variance, and standard deviation of these prices:

| Date | Price | 10-period Average |

Difference (distance) |

Squared Difference |

10-period Sample daily Variance |

10-period Sample daily Standard Deviation |

|---|---|---|---|---|---|---|

| Jan 02, 2018 | 60.37 | -2.19 | 4.77 | |||

| Jan 03, 2018 | 61.61 | -0.95 | 0.89 | |||

| Jan 04, 2018 | 61.98 | -0.58 | 0.33 | |||

| Jan 05, 2018 | 61.49 | -1.07 | 1.13 | |||

| Jan 08, 2018 | 61.73 | -0.83 | 0.68 | |||

| Jan 09, 2018 | 62.92 | 0.36 | 0.13 | |||

| Jan 10, 2018 | 63.6 | 1.04 | 1.09 | |||

| Jan 11, 2018 | 63.81 | 1.26 | 1.58 | |||

| Jan 12, 2018 | 64.22 | 1.66 | 2.77 | |||

| Jan 16, 2018 | 63.82 | 62.56 | 1.26 | 1.60 | 1.67 | 1.29 |

Note that the equation to calculate the sample variance is where is the average (10-period moving average) and represents the observations (each price data).

So, in order to calculate the sample variance, we need to calculate the summation of the fifth column and divide the summation by 9 (n-1).

Note that standard deviation is just the square root of the variance (the last column).

Note: Excel functions STDEV() or STDEV.S() can conveniently calculate the standard deviation of a price vector.

Moving Standard Deviation

We can calculate the standard deviation for a moving window of prices. In that case, we include a new price data each time and remove the oldest price data for calculating the new standard deviation. This is called moving [6] (rolling or running) standard deviation.

Example: The following table shows the price data for the NYMEX crude oil February futures contracts in January 2018 extracted from EIA. We are going to calculate the 10-period moving mean, variance, and standard deviation:

Calculating the moving standard deviation, like what we did in the previous example, is not very straightforward. So, we will just use the Excel function STDEV() or STDEV.S() to calculate the 10-period moving standard deviation.

| Date | Price | 10-period Sample daily Standard Deviation |

|---|---|---|

| 2-Jan-18 | 60.37 | |

| 3-Jan-18 | 61.61 | |

| 4-Jan-18 | 61.98 | |

| 5-Jan-18 | 61.49 | |

| 8-Jan-18 | 61.73 | |

| 9-Jan-18 | 62.92 | |

| 10-Jan-18 | 63.6 | |

| 11-Jan-18 | 63.81 | |

| 12-Jan-18 | 64.22 | |

| 16-Jan-18 | 63.82 | 1.29 |

| 17-Jan-18 | 63.92 | 1.10 |

| 18-Jan-18 | 63.96 | 1.04 |

| 19-Jan-18 | 63.38 | 0.95 |

| 22-Jan-18 | 63.66 | 0.72 |

| 23-Jan-18 | 64.45 | 0.43 |

| 24-Jan-18 | 65.69 | 0.65 |

| 25-Jan-18 | 65.62 | 0.79 |

| 26-Jan-18 | 66.27 | 1.00 |

| 29-Jan-18 | 65.71 | 1.06 |

| 30-Jan-18 | 64.64 | 1.02 |

| 31-Jan-18 | 64.82 | 0.98 |

Volatility

There are many parameters to calculate the volatility. One indicator is calculating the moving (rolling) standard deviation for the changes of price rather than the actual price.

A change in price is also called a return in finance. It can be simply calculated as:

Example:

We calculate the price changes (return) in the third column and then calculated the 10-period daily standard deviation for the returns. This is a measure for volatility.

| Feb. Futures crude oil NYMEX | Arithmetic Change | 10-period daily standard deviation | |

|---|---|---|---|

| 2-Jan-18 | 60.37 | ||

| 3-Jan-18 | 61.61 | 2.05% | |

| 4-Jan-18 | 61.98 | 0.60% | |

| 5-Jan-18 | 61.49 | -0.79% | |

| 8-Jan-18 | 61.73 | 0.39% | |

| 9-Jan-18 | 62.92 | 1.93% | |

| 10-Jan-18 | 63.6 | 1.08% | |

| 11-Jan-18 | 63.81 | 0.33% | |

| 12-Jan-18 | 64.22 | 0.64% | |

| 16-Jan-18 | 63.82 | -0.62% | 0.93% |

| 17-Jan-18 | 63.92 | 0.16% | 0.78% |

| 18-Jan-18 | 63.96 | 0.06% | 0.88% |

| 19-Jan-18 | 63.38 | -0.91% | 0.80% |

| 22-Jan-18 | 63.66 | 0.44% | 0.85% |

| 23-Jan-18 | 64.45 | 1.24% | 0.85% |

| 24-Jan-18 | 65.69 | 1.92% | 0.83% |

| 25-Jan-18 | 65.62 | -0.11% | 0.86% |

| 26-Jan-18 | 66.27 | 0.99% | 0.93% |

| 29-Jan-18 | 65.71 | -0.85% | 1.08% |

| 30-Jan-18 | 64.64 | -1.63% | 1.08% |

| 31-Jan-18 | 64.82 | 0.28% | 1.14% |

Note:

Return can be calculated using the mathematical method or using the natural log method. Log change (return) can be calculated using the following equation:

In the following table both methods are used to calculate the price change (return). As you can see, surprisingly, both methods give very similar values. The natural log method might be preferred for computational purposes.

| Feb. Futures crude oil NYMEX | Arithmetic Change | Natural Log Change | |

|---|---|---|---|

| 2-Jan-18 | 60.37 | ||

| 3-Jan-18 | 61.61 | 2.05% | 2.03% |

| 4-Jan-18 | 61.98 | 0.60% | 0.60% |

| 5-Jan-18 | 61.49 | -0.79% | -0.79% |

| 8-Jan-18 | 61.73 | 0.39% | 0.39% |

| 9-Jan-18 | 62.92 | 1.93% | 1.91% |

| 10-Jan-18 | 63.6 | 1.08% | 1.07% |

| 11-Jan-18 | 63.81 | 0.33% | 0.33% |

| 12-Jan-18 | 64.22 | 0.64% | 0.64% |

| 16-Jan-18 | 63.82 | -0.62% | -0.62% |

| 17-Jan-18 | 63.92 | 0.16% | 0.16% |

| 18-Jan-18 | 63.96 | 0.06% | 0.06% |

| 19-Jan-18 | 63.38 | -0.91% | -0.91% |

| 22-Jan-18 | 63.66 | 0.44% | 0.44% |

| 23-Jan-18 | 64.45 | 1.24% | 1.23% |

| 24-Jan-18 | 65.69 | 1.92% | 1.91% |

| 25-Jan-18 | 65.62 | -0.11% | -0.11% |

| 26-Jan-18 | 66.27 | 0.99% | 0.99% |

| 29-Jan-18 | 65.71 | -0.85% | -0.85% |

| 30-Jan-18 | 64.64 | -1.63% | -1.64% |

| 31-Jan-18 | 64.82 | 0.28% | 0.28% |

More on Volatility

Exponentially Weighted Volatility

In calculating the volatility, we may prefer to give higher weights to the more recent data. There are many methods of assigning these weights. Exponentially weighted volatility is a common method that uses a decay factor, λ, to apply higher weights to the recent returns and lower weight to the older returns:

Where w is the weight, t is the time and λ is the decay factor. t=0 for today, t=1 for yesterday, and so on. λ is a constant that is defined by the analysts and usually takes a value between 0.99 and 0.94.

For example: Assuming

Today's weight:

Yesterday's weight:

The day before yesterday's weight:

As you can see, older data will have a lower weight (importance).

The average and standard deviation for exponentially weighted values can be calculated as:

Relative Volatility Index

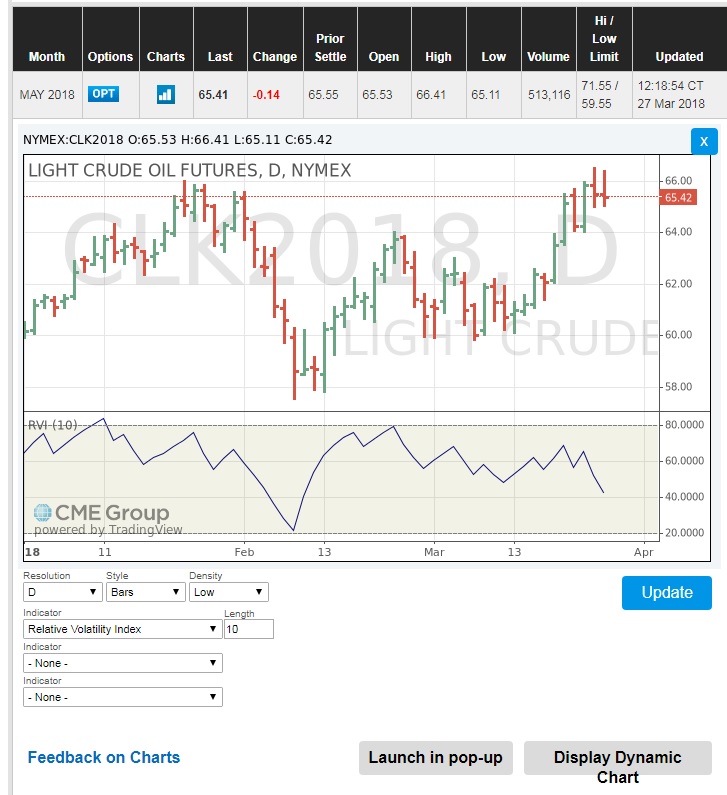

There are many other volatility measures that each give some signals and information about the price movement. Some of these measures might be a bit complicated to calculate. Some of these volatility indicators are provided in the NYMEX chart data, such as the Relative Volatility Index [7] (RVI). Relative Volatility Index gives us an indicator of the direction and magnitude of the volatility.

For example, to see the Relative Volatility Index for the WTI crude oil NYMEX futures contracts:

- Go to the NYMEX Crude Oil Futures Quotes. [8]

- Click on the Chart icon on the left side of the “Last” price.

- Make sure the chart is in the Static mode. If not, click on the “Display Static Chart”.

- From the “Indicator” list, choose the “Relative Volatility Index” and click “Update”.

The lower section of the following graph shows the Relative Volatility Index for May 2018 WTI crude oil NYMEX futures contracts. We will learn more about the RVI in lesson 9.

Correlation

Correlation is a measure of the strength of the linear relationship between two quantitative variables. The equation for the correlation coefficient is:

Correlation coefficient takes a value between -1 and 1. As you can see in the following video, a correlation coefficient of 1 indicates a strong positive linear relationship between two variables and a correlation coefficient of -1 shows a strong negative linear relationship. And if two variables are not related or not linearly related, the correlation coefficient can take a value close to zero.

Strength of linear association

The video shows a graph with the explanatory variable on the x-axis and the response variable on the y-axis. There are many points on the graph. The correlation value is shifted from -1 to 1. What the correlation is -1 the points are in a linear, negatively sloped line. As the correlation value changes until the correlation value reached +1 where the points are now in a linear, positively sloped line.

As we learned in a previous lesson, a high correlation between spot and futures market prices makes the hedging efficient. Note that in the case of backwardation, the correlation between spot and futures would be lower.

Example:

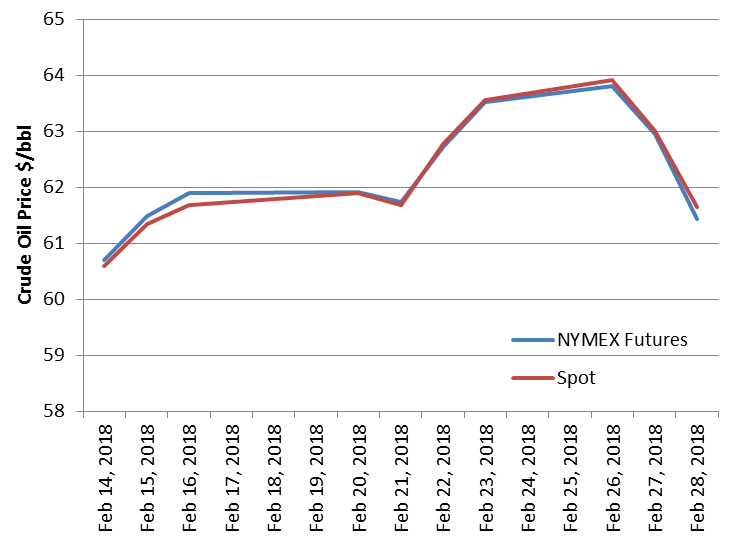

The following chart shows the last 10 prices of February 2018 crude oil spot and futures from EIA.

| Date | NYMEX Futures [9]$/bbl | Spot [10]$/bbl |

|---|---|---|

| Feb 14, 2018 | 60.7 | 60.6 |

| Feb 15, 2018 | 61.48 | 61.34 |

| Feb 16, 2018 | 61.89 | 61.68 |

| Feb 20, 2018 | 61.91 | 61.9 |

| Feb 21, 2018 | 61.73 | 61.68 |

| Feb 22, 2018 | 62.72 | 62.77 |

| Feb 23, 2018 | 63.52 | 63.55 |

| Feb 26, 2018 | 63.81 | 63.91 |

| Feb 27, 2018 | 62.94 | 63.01 |

| Feb 28, 2018 | 61.43 | 61.64 |

The following chart displayed the data and, as you can see, they are closely related.

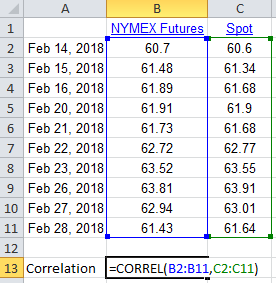

As the following graph shows, we can use the Excel function CORREL() to calculate the correlation between spot and futures for these price data as 0.994, which shows a strong relationship between them.

Note that cross hedging is using futures contracts (for commodity A) in order to hedge the price risk for the commodities (commodity B) that don’t have futures contract market. And cross hedging is possible when the futures price of commodity A are highly correlated with spot prices of commodity B.

Note that we can calculate the correlation of the returns in a similar way to what we did to calculate the volatility (calculating the standard deviation for the returns).

Summary and Final Tasks

Key Learning Points: Lesson 8

- Variation of a parameter such as price data is an important factor in risk management.

- A commodity with high price variation is considered a high risk investment.

- Volatility is a term for measuring the dispersion and variation.

- Standard deviation can be used as a measure of volatility.

- The moving standard deviation is the standard deviation calculated for a moving window of data.

- One measure for calculating volatility is the moving (rolling) standard deviation for the changes of price (return).

- Price change can be calculated using an arithmetic method or using the natural log method (return).

- Exponentially weighted volatility uses a decay factor, λ, to apply higher weights to the more recent data.

- Relative Volatility Index is another measure of volatility.

- Correlation is a measure of the strength of the linear relationship between two quantitative variables.

- A strong correlation between spot and futures market prices makes the hedging efficient.

Over the past few weeks, you have been researching various Fundamental Factors that can be used to aid in making trading decisions. In the next two lessons, we will explore quantitative methods and price analysis. The other type of information, used by "day traders," is Technical Analysis. In the next lesson, we will get an elementary overview of Technical Analysis.

Reminder - Complete all of the lesson tasks!

You have reached the end of this lesson. Double-check the list of requirements on the first page of this lesson to make sure you have completed all of the activities listed there before beginning the next lesson.