Lessons

Lesson 1 - The Rise of American Oil and the Competitive International Industry

Lesson 1 Introduction

Concepts to Consider for the Lesson

In this Lesson, we see the birth of the modern oil industry. I say “modern” because fossil fuels and hydrocarbons have been in use for thousands of years. We learned that what defines this new era was driven by several factors- the growth of the “business” aspect, the advent of new technologies and efficiencies, and the shift to “rock oil” or oil recovered by drilling as compared to finding seeps and skimming off the surface. In other words, we started digging for it rather than stumbling onto it. Another fact defining the “modern” oil industry was the incredible diversification in uses. We tend to think of fossil fuels as mainly for heating and transportation, but those uses are relatively recent arrivals to the story. The early years were focused on oil as a source of lighting, as a lubricant, and to an extent, for medicinal purposes. In regard to efficiencies, the rapid evolution from horse-drawn carriages carrying barrels to railroads to seafaring tankers completely altered the dynamics and economics of the business.

The textbook frames these aspects as themes- oil as the rise of modern capitalism; oil as a commodity important enough to impact politics and national strategies, and as something that permeates society so thoroughly that we are in what the book calls the age of “Hydrocarbon Man.” This short half-century from the mid to late 1800s saw this industry go from its birth to unseating coal as “king,” and making itself one of the world’s most important commodities even to this day. As we will see as we go further into the textbook, many of the characteristics of the industry back then still exist and occur today. We will also see how we got to be where we are today.

However, the focus of the first few chapters actually highlights another effect altogether of the oil industry and that is how it shaped and molded the business world as a whole and helped define the era of the giants of the industry. The oil industry taught us many things about the general aspects of being successful in business. We learned that it takes an immense risk, confidence in convictions, patience, and tolerance for failure or at best, long delays between successes. Without this mindset, the giants of their day, most exemplified by Rockefeller, would not have been able to create what they did. Unlike typical manufacturing, in the oil industry, you need to go to where it is. You also need to move it great distances to get it from where it is to where it is needed, with the intermediate elements of processing and refining. It is truly amazing then that it was the oil industry and not typical manufacturing, that was the early pioneer of fully integrated and multinational giants.

Learning Objectives

By the end of this lesson, you should be able to:

- Recall course concepts relating to the history and development of the oil industry in America and throughout the world

- Demonstrate an understanding of the role of oil in relation to pivotal events in history

- Discuss the role of oil in business applications, global markets, conflicts, energy security, and various unconventional applications

What is due for Lesson 1?

This lesson will take us one week to complete. Please refer to the Course Syllabus for specific time frames and due dates. Specific directions for the assignment below can be found within this lesson.

| Activity | Location | Submitting Your Work |

|---|---|---|

| Read | The Prize: Chapters 1, 2, & 3 (select sections) | No Submission |

| Discuss | Participate in the Yellowdig discussion | Canvas |

Questions?

Each week an announcement is sent out in which you will have the opportunity to contribute questions about the topics you are learning about in this course. You are encouraged to engage in these discussions. The more we talk about these ideas and share our thoughts, the more we can learn from each other.

The Prize, Chapter 1 Overview

The Prize, Chapter 1 Overview

Even in the earliest days of the business, the pioneers experienced market booms and busts with wild price fluctuations. Some areas that were prolific producing regions quickly dried up. The early days were characterized by an essentially uncontrolled frenzy to find and produce as much as possible. This quickly proved unsustainable, and our oil industry today is much more tempered and organized. Some may see today’s discipline as counter to the entrepreneurial spirit, but in reality, it is necessary to ensure long-term stability.

An interesting point about the early days of the oil industry is the important role that Pennsylvania played. Pennsylvania essentially was the US oil industry. It would only come later, as we shall see in subsequent chapters, that the focus moved to Texas and Oklahoma. And by the time we get to today, the first places people think about in regard to the US oil industry are Texas, Alaska, Oklahoma, Louisiana, and Wyoming. The recent reemergence of Pennsylvania, and the entry of the Dakotas, as oil hubs is due to the advent of hydraulic fracturing, another “necessity driven innovation”.

The Prize

Chapter 1 - Oil on the Brain: The Beginning

Sections to Read

- Introduction

- To "Assuage our Woes"

- Price and Innovation

- The "Colonel"

- "The Light of the Age"

- Boom and Bust

Questions to Guide Your Reading:

- What term describes the transition from whale oil to petroleum?

- What was noted as a key to the advancement of the industry?

- What does Boom/Bust cycle mean?

- What role did Pennsylvania play from 1860-1890?

The Prize, Chapter 2 Overview

The Prize, Chapter 2 Overview

What is even more interesting from a business perspective is how the oil industry created changes and approaches that we see today in nearly all business sectors, for example, the concept of multinational monopolies and the pushback to these monopolies. We also learned about the concept of the integrated company, which contains many or all aspects of the business. We are used to this now with industry, but the idea evolved from the early oil days when they realized being limited to only a few aspects of the lifecycle led to uncertainty, risk, and vulnerability. Rockefeller’s vision was to control all aspects. Ironically, he didn’t go at it from start to finish in terms of the process. Instead, he focused at first on the middle, the refining, and only later added exploration and production, and then marketing. Not surprising in that the highest risk and uncertainty was in the exploration and production, as compared to refining the product once already in hand.

Rockefeller and Standard Oil also catalyzed the concepts of “cash on hand”, leveraging economy of scale, and reducing, or even eliminating competition. We see all of these aspects today. I am sure many of you can see Rockefeller’s Standard Oil in today’s Walmart or Ford Motor Company. The concept of shareholders and trusts that Rockefeller leveraged to maintain his empire effectively are now common in the business world.

Although a keen, and at times ruthless businessman, Rockefeller was also part of the age of philanthropists that gave us Carnegie, DuPont, and others. They came from a mindset of being successful, providing a service to society, and giving back to do good.

The Prize

Chapter 2 - "Our Plan": John D. Rockefeller and the Combination of American Oil

Sections to Read

- Introduction

- "Methodical to an Extreme"

- The Great Game

- "Now Try Our Plan"

- "War or Peace"

- New Threats

- The Trust

- "Buy All We Can Get"

- The Upbuilder

Questions to Guide Your Reading:

- Why was the early oil industry so highly competitive?

- What did Standard Oil (SO) do to emerge as a dominant firm?

- What characteristics made SO as a model of the first modern corporation?

The Prize, Chapter 3 Overview

The Prize, Chapter 3 Overview

With Chapter 3, we see the beginning of true globalization. This doesn’t mean that the rest of the world didn’t use oil, but what happened in the late 1800’s was the connection between countries by way of multinational business approaches. As the industry was essentially private sector and not bound by national borders and government jurisdictions, it was possible for single entities to see the entire world as a marketplace and source of oil. But with this expansionist view, we also now saw the arrival of new competitors. Whereas Standard Oil may have had a monopoly in the US, they encountered formidable challengers on the world stage. They also encountered significantly more challenging conditions. For those who thought exploring for oil in rural Pennsylvania was challenging, it was a rude awakening to encounter the conditions in Southeast Asia and Russia. The topography was challenging, and the distances were truly vast. Moving oil tens or hundreds of miles paled in comparison to moving it thousands of miles and across waterways and over mountains.

The Prize

Chapter 3 - Competitive Commerce

Sections to Read

- Introduction

- "The Walnut Money"

- The Rise of Russian Oil

- The Son of the Shell Merchant

- The Coup of 1892

- Royal Dutch

Questions to Guide Your Reading:

- What led to Standard Oil’s dominance being eroded?

- Why were British traders key to Russian oil and later Dutch East Indies?

- What aspect of oil was noted as critical?

- Why were there recurring attempts to form cartels and monopolies?

Lesson 1 Connection Video

Lesson 1 Connection Video

Review the video titled "The Rise of American Oil and the Competitive International Industry" (3:36)

Lesson 2 - Standard Oil Trust and The Oil Wars

Lesson 2 Introduction

Concepts to Consider for the Lesson

In the short time passage covered from Lesson 1 to Lesson 2 we see the inevitable consequences of the appearance of a new industry sector. Recall in Lesson 1 the diversification of uses for oil, and the meteoric growth of Standard Oil. We saw in Lesson 1 that with this rapid growth came great success. But brewing underneath that success was the focus of the competition and others' suspicion of ulterior motives.

As with Lesson 1, the readings teach us two stories in parallel. The evolution of the oil industry itself, and the oil industry as an example of the evolution of capitalism as a whole. For example, the appearance of competitors, the obsession with “cutting Standard Oil down to size,” and the expansion of markets. There are two ways to succeed in business- get a bigger piece of the pie, but also see what you can do to make the pie bigger! Consider what you read about the early days of the oil industry to what you see today with electronics, social media, and the entertainment industry.

Another significant takeaway from the readings in Lesson 2 is that what may seem like a solid business that will last forever rarely does. In a short time, the oil industry almost disappeared simply because of the invention of electric lighting. It was only by sheer luck that the automobile came along at the same time and innovation found a way to utilize oil products for that market. The key was the ability of the oil industry to see what was happening and find a way to adapt. The oil industry never stopped innovating since then, and today, the uses of crude oil products are staggering. A common misconception by society is that if we can eliminate the automobile, there will no longer be a need to drill for oil and gas. Many people will be quite disappointed if they knew how many day-to-day household necessities come from crude oil products. So even if phased out of transportation or power generation, there will be a lot more innovation needed to phase out its other uses entirely.

With Lesson 2 we will discuss the loss of oil markets with the invention of electric light and the almost simultaneous regaining of new markets with the development of the automobile. It also discusses the decline in the dominance of Standard Oil with the discovery of oil in other parts of America and the subsequent emergence of competitors. But at the same time we will also discuss the growing public hatred against big oil, and the cry for the Federal government to break up Standard Oil as a way of overcoming its monopoly. Concurrent with the desire to break up the monopoly that was Standard Oil, the concept of the major international oil company was born. The rise of Royal Dutch/Shell as a major international oil company and the fall of the Russian oil industry will also be discussed.

Learning Objectives

By the end of this lesson, you should be able to:

- Recall course concepts relating to the Standard Oil Trust and to the “Oil Wars”

- Demonstrate an understanding of the role of oil in relation to pivotal events in history

- Discuss the role of oil in business applications, global markets, conflicts, energy security, and various unconventional applications

What is due for Lesson 2?

This lesson will take us one week to complete. Please refer to the Course Syllabus for specific time frames and due dates. Specific directions for the assignment below can be found within this lesson.

| Activity | Location | Submitting Your Work |

|---|---|---|

| Read | The Prize: Chapters 4, 5, & 6 (select sections), and The Quest: Chapters 2 & 4 (selected sections) | No Submission |

| Discuss | Participate in the Yellowdig discussion | Canvas |

| Complete | Complete Quiz 1 | Canvas |

Questions?

Each week an announcement is sent out in which you will have the opportunity to contribute questions about the topics you are learning about in this course. You are encouraged to engage in these discussions. The more we talk about these ideas and share our thoughts, the more we can learn from each other.

The Prize, Chapter 4 Overview

The Prize, Chapter 4 Overview

The chapter is characterized by additional themes. We see the rapid, and fortuitous transition of the industry from primarily supplying fuel for lighting to now supplying fuel for transportation- mainly for the newly commercially mass-produced automobile. And not a moment too soon because the invention of the electric light completely decimated the oil for lighting business. To this day, fossil fuels are fundamental to transportation of all types. From cars to airplanes to ships, they move because of fossil fuels. The time period also saw the oil industry keep up with rapid industrialization of the economy, with the growing use of fuel oil to power boilers in factories.

This chapter also highlights that the oil sector was growing, and it was no longer all about Standard Oil. We see the birth of new companies and new producing areas. No longer was Pennsylvania the center of action. During this period Texas and California came online as substantive producing areas. Unlike Pennsylvania, which has faded a bit, places like Texas and California still dominate as major US producing regions. The famous Spindletop in Texas occurred in this period. Spindletop exemplified that despite many lessons learned over time, certain things were done the “old way,” resulting in the same problems. The same issues of over-drilling and uncontrolled production that crashed the industry in Pennsylvania also hurt Spindletop. Unfortunately, those drilling at Spindletop did not learn that production rates must be controlled to maintain reservoir pressure and price stability. An interesting development as the California oil sector evolved in 1900-1911 was the use of science, specifically geology, to be more logical and accurate in searching for oil. The days of finding oil by chance gave way to using science. Geology helped explain how oil forms and where to look for it. Eventually, the “petroleum geologist” became its own profession.

As to competition, we saw the birth of many new companies that have since become iconic household names today. Shell, Gulf, Sun, and Texaco all came of age during the late 1800’s and early 1900’s. We also saw the establishment of the “integrated company” where a single entity controlled everything from getting oil out of the ground all the way through to refining and distribution.

The Prize, Chapter 4 - The New Century

Sections to Read

- Introduction

- Markets Lost and Gained

- Breakouts

- Patillo Higgins' Dream

- The Deal of the Century

- Sun: "To Know What to do With It"

- "Buckskin Joe" and Texaco

Questions to Guide Your Reading:

- What was happening with the markets at the time?

- What threatened kerosene’s dominance?

- In addition to Russian & Sumatra Oil, where was new oil was found?

- What was happening to Standard Oil’s dominance?

The Prize, Chapter 5 Overview

The Prize, Chapter 5 Overview

All was not ideal as far as the general public was concerned. Rapid industrialization spawned big monopolies and giant companies. Society felt threatened and suspicious and called on the government to institute controls. Reminds us of today and big tech companies, does it not? That fear of “big oil” combined with a growth of progressivism set the government and Standard Oil on a collision course that would change the face of the industry forever. This fight was as much about socialism versus capitalism as it was about oil. Ida Tarbell’s mission to dismantle Standard Oil aligned with President Roosevelt’s belief that government need not destroy these monopolies and trusts, but should control them.

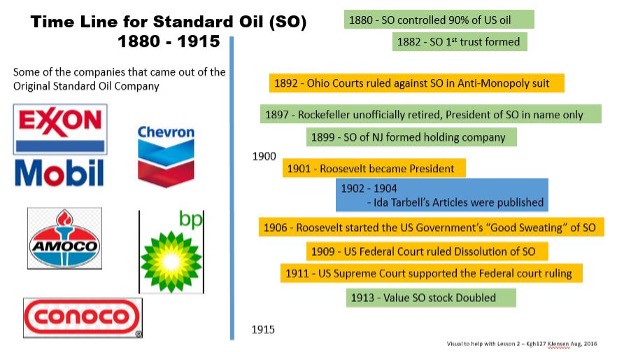

Standard Oil established a holding company, but that was not enough to insulate the company, and by 1906, the government filed a lawsuit, and in 1909, the dissolution was ordered. Interestingly, the dissolution of Standard Oil was the end of an era, and Rockefeller retired, but it also triggered a new movement. Out of the dissolution came forth a number of new smaller companies who today are great in their own right. But as we see today, over a century later, the market is still adjusting. At one time, Exxon and Mobil were powerhouses competing with each other, but now we know them as ExxonMobil. Some companies that came from Standard Oil have since disappeared.

The early 1900s was jampacked with new technology, new areas of development, new uses for the product, and a new relationship between government and big business. This dynamic relationship between government and big business exists to this day; and we see it with telecommunications, banking, technology, and others. Think of Twitter, Facebook and others.

| Year | Event |

|---|---|

| 1880 | SO Controlled 90% of US oil |

| 1882 | SO 1st trust formed |

| 1892 | Ohio Courts ruled against SO in an Anti-Monopoly suit |

| 1897 | Rockefeller unofficially retired, President of SO in name only |

| 1899 | SO of NJ formed a holding company |

| 1901 | Roosevelt became President |

| 1902-1904 | Ida Tarbell's Articles were published |

| 1906 | Roosevelt started the US Gov't's "Good Sweating" of SO |

| 1909 | US Federal Court ruled Dissolution of SO |

| 1911 | US Supreme Court supported the Federal court ruling |

| 1913 | Value SO stock Doubled |

The Prize, Chapter 5 - The Dragon Slain

Sections to Read

- Introduction

- The Holding Company

- "The Red Hot Event"

- Rockefeller's "Lady Friend"

- The Trust-Buster

- The Suit

- The Dissolution

- The Liberation of Technology

Questions to Guide Your Reading:

- What forces were contributing to declining market share by Standard?

- What happened to sow the roots of hatred against big oil?

- Who did the public seek as the ultimate check on monopoly power?

- What started to happen between politics & business?

The Prize, Chapter 6 Overview

The Prize, Chapter 6 Overview

One tried and true rule of business success, and which is clearly demonstrated in what we see in Chapter 6, is that if you invest in one part of the business, you must invest in other parts to maintain a balance. A supply with no market or way to get the product to market is not very valuable. Similarly, a market with no product quickly collapses. This “supply chain” concept became a household term recently during the COVID and immediate post-COVID period.

The birth of Royal Dutch-Shell, one of today’s largest and most iconic oil giants, illustrates this concept well. As you will read in the chapter, the evolution of Royal Dutch-Shell was a series of mergers, deals, market manipulations, and conflicts. The goal to integrate all aspects of the business as a way to make it most resilient meant pulling together oil supply, transportation options, and outlets to markets. As you read about the journey from separate Royal Dutch and Shell, through iterations of British Dutch and Asiatic, you will see how things had to adapt in order to bring in the necessary pieces. Shell is a great example of a company at death’s door being reborn as a success story by adapting to new business models and accepting reality. But the Royal Dutch-Shell story also taught us another frustrating reality in that companies continued to be undisciplined in developing fields, and as quickly as areas grew, the reservoirs lost pressure and reserves, and prices crashed due to overproduction.

In Lesson 1, we focused on the US market in the story of Standard Oil. But covering approximately at the same time period, Lesson 2 tells the story of Royal Dutch-Shell and describes the story of the Russian, European, and Far East oil markets. We must remember that we not only have huge oil reserves in the US, but also in many other parts of the world. Those regions had to go through the evolutionary process, but unlike the US markets, those markets had the added challenge of social unrest, regional wars, and extremely difficult conditions. Russia best exemplifies how social and political unrest and chaos can affect the private sector, global industry. Just because you are not government-run does not mean you are insulated from government conditions.

One final additional element we learn in Lesson 2, and something we will see continue throughout the rest of the history of the oil industry, is that multinationals were moving more widely among markets. Until now, the US market was dominated by Standard Oil and the Europe/Far East markets was by Royal Dutch-Shell. Standard Oil was known for intruding into other parts of the world, but in Lesson 2 we see Royal Dutch-Shell coming to the US, especially in California and Oklahoma.

The Prize, Chapter 6 - The Oil Wars: The Rise of Royal Dutch, the Fall of Imperial Russia

Sections to Read

- Introduction

- The First Step Toward Combination

- The "British Dutch" - the Asiatic

- "The Group" - Samuel Surrenders

- "To America!"

- Return to Russia

Questions to Guide Your Reading:

- What does a vertically integrated company do for the oil business?

- What is required for investment in a new field?

- How can you avoid strategic mistakes?

- What is something that can cause major oil supply disruptions?

The Quest

Chapter 2 - Caspian Derby

Sections to Read

- Introduction

- The Oil Kingdom

- History on Display

Chapter 4 - "Supermajors"

Sections to Read

- Were He Alive Today

Major Themes to Ponder as You Read:

- What are some similarities and differences between the 1860s oil industry and today?

Lesson 2 Connection Video

Lesson 3 - Asian Oil Development and World War 1

Lesson 3 Introduction

Concepts to Consider for the Lesson

We are used to hearing about important oil producing areas around the world. But they did not all come online at the same time. Oil exploration evolved over time, with certain periods of history focusing on specific geographies. In Lesson 2, we studied the development of the markets in Russia, Europe, and the Far East. In Lesson 3, we start to see the expansion into what we now know as the Middle East oil region, one of the most important, and prolific, oil markets in the world. We will discuss the beginnings of oil discovery in the Middle East, specifically in Persia, the clash of British and Persian cultures, and the emergence of Anglo-Persian Oil Company.

This lesson also covers the changes in the markets as well. Recall changes in Lesson 1 when more uses for oil products were being developed. Then in Lesson 2 was the automobile. Lesson 3 will introduce us to the role of the internal combustion engine and the need for gasoline. It was not that long before where gasoline as a by-product was seen almost as a nuisance, and now it is evolving into its own product in demand.

Lesson 3 also reminds that even as new concepts crystallize; some old habits die hard. We still see the up and down aspects of the market with companies oscillating between doing quite well and experiencing imminent collapse. We also still see squabbling among companies, distrust, and cutthroat competition, punctuated with moments of cooperation for the greater good. But we must realize that the “greater good” in many cases meant to ensure their own survival.

As important as all of that is, one of the most impactful elements of Lesson 3 content is the emergence of oil as a strategic commodity- becoming central to global crisis and military positioning. The uptake of the internal combustion engine and its use of gasoline, combined with the transition from coal to oil, completely changed the face of military readiness and national security. As you will read, it is safe to say that the use and availability of oil drove the progress, and ultimate outcome, of World War I. The transitioning of the Navy from coal to oil is one thing but imagine the rest of the military equipment if they didn’t run on oil and had to use coal!

Learning Objectives

By the end of this lesson, you should be able to:

- Recall course concepts relating to Asian oil development and World War I

- Demonstrate an understanding of the role of oil in relation to pivotal events in history

- Discuss the role of oil in business applications, global markets, conflicts, energy security, and various unconventional applications

- Produce an evaluative statement that justifies your answer to a posed homework question

What is due for Lesson 3?

This lesson will take us one week to complete. Please refer to the Course Syllabus for specific time frames and due dates. Specific directions for the assignment below can be found within this lesson.

| Activity | Location | Submitting Your Work |

|---|---|---|

| Read | The Prize: Chapters 7, 8, 9, & 10 (select sections) The Quest: Chapters 2 & 13 (select sections) |

No Submission |

| Discuss | Participate in the Yellowdig discussion | Canvas |

| Complete | Complete the "Analyze a Quiz Question" assignment | Canvas |

Questions?

Each week an announcement is sent out in which you will have the opportunity to contribute questions about the topics you are learning about in this course. You are encouraged to engage in these discussions. The more we talk about these ideas and share our thoughts, the more we can learn from each other.

The Prize, Chapter 7 Overview

The Prize, Chapter 7 Overview

In the early days of the oil industry, we saw the emergence of powerful companies- Standard Oil in America, Royal-Dutch Shell in Europe, and the Far East, and in this chapter, we are introduced to Anglo Persian Oil Company. Anglo Persian was born from a syndicate of other companies, an arrangement necessary to deal with the logistical challenges of this new area, as well as managing competing interests from nearby countries, not the least of which was Russia. There was little to no transportation network in Persia at the time of initial oil exploration. Among the many challenges were difficult terrain and weather (workers' quarters could get to 120 degrees), hostile culture towards the outside world, lack of technical skills, and feuds between tribes.

What makes the oil picture in this part of the world so volatile is that the history of the area is volatile. During the days covered in this chapter we speak of Persia, in 1935 it became what we know today as Iran. We all know from the news that Iran is not only a challenge politically, it is also gifted with incredible amounts of oil reserves. Control of these oil reserves would be pivotal in geopolitics from then to the present. We shall see in future chapters that this marriage of political turmoil and oil riches are characteristic of many of these Middle East countries.

The Prize

Chapter 7 - "Beer and Skittles" in Persia

Sections to Read

- Introduction

- Russia versus Britain

- The "Syndicate of Patriots"

- To the Fire Temple: Masjid-i-Suleiman

- Racing the Clock

- The "Big Company": Anglo Persian

Questions to Guide Your Reading:

- What are some characteristics of the clash of British vs. Persian cultures?

- What emerged as key to the strategic positioning of Russia vs. Britain in regard to their navies?

- What was happening to Standard Oil?

The Prize, Chapter 8 Overview

The Prize, Chapter 8 Overview

Chapter 8 is best characterized by the statement “oil is an instrument of national policy, a strategic commodity”. The British Royal Navy pioneered the connection between oil and military advantage. Prior to this period, the Royal Navy was powered by coal, as most other Navy’s were, including Germany’s. But the Royal Navy had the foresight to switch from coal to oil. The advantages were obvious, both logistically as well as tactically. The Navy would be more mobile, maneuverable, and reliable. And it would operate without having to cart around tons and tons of bulky coal. But with this decision came the negative aspect of needing to ensure a reliable supply. For Britain, access to coal was not a problem, they had an incredible amount within their national borders. Oil on the other hand, was for the most part, sourced from elsewhere. Resolving that conflict took some time and persuasion, but eventually the Navy pivoted to oil. With this decision, the support and pressure from the government, and specifically the military, fell on the oil industry to produce.

It was clear that the government was not effective or positioned to manage their own oil operations, they had to look to and actually depend on what the big private companies were doing. But being passive observers was not prudent, and we see the beginnings of these public-private partnerships between government and the private sector.

As mentioned before in prior lessons, similarities between the early days of the oil industry, and the situation today are remarkably similar. And it makes you wonder if we learn anything from history. The concept of needing to be energy independent and reducing dependency on outside sources that one cannot always control was the leading issue of the day. And pressure to control and ensure supply led to the rapid development of these new reserves in Persia, in spite of the logistical challenges.

Another similarity is the conflict between the government’s military spending and social spending. Social unrest in the early 1900s characterized the conflict between sharing limited budgets between the military and the people. But a great global conflict of a scale not seen since the oil industry started to take off in the mid 1800s was just around the corner- a world war was coming. Eleven days after Churchill's bill, on June 28th, 1914, Archduke Franz Ferdinand of Austria was assassinated at Sarajevo. Russia mobilized its forces on July 30th and on August 1st, 1914, Germany declared war on Russia. Churchill flashed the order to the entire British fleet to "Commence hostilities against Germany" starting the First World War!

The Prize

Chapter 8 - The Fateful Plunge

Sections to Read

- Introduction

- "The Godfather of Oil"

- "Made in Germany"

- Speed!

- The Shell Menace

- Aid for Anglo-Persian

- A Victory for Oil

Questions to Guide Your Reading:

- How did Britain's Navy compare to the US or Germany?

- What were some benefits of the oil conversion in the navy?

- What was seen as a strategic aspect of oilStrategic access to oil?

- What interests were at play in the political theater?

The Prize, Chapter 9 and The Quest, Chapter 2 Overview

The Prize, Chapter 9 and The Quest, Chapter 2 Overview

Overview, The Prize - Chapter 9: The Blood of Victory

While previous wars depended on men and horses, WWI depended on men and machines powered by oil intensifying the extent of damage and destruction. It is interesting that in wars with horses, planning required one horse for every three men and 10 times the food of each man for every horse! WWI was characterized by oil and the internal combustion engine. And to have the oil required rapid development and exploitation of Persia, and as we shall see, what is now Iraq.

For a period of more than two years, the battle lines hardly moved more than 10 miles in either direction until the British turned to technology to break the stalemate by designing, developing and building a new vehicle funded by Churchill’s Navy under the codename “tank”. With the tanks and motorized transport, suddenly speed and mobility became possible as the tanks moved on traction, impervious to machine guns and barbed wires, and amplified the devastation. Towards the end of the war, the British had 56,000 trucks, 23,000 motorcars and 34,000 motorcycles. The US entered the war in 1917 with another 50,000 vehicles to France—all powered by gasoline! Eventually more than 13 million died during World War I, and victory of the truck over the locomotive was demonstrated.

Aviation technology also advanced during the war and provided strategic importance and advantages of the air with a bird’s eye view of the battlefield (reconnaissance and observation) and the ability to bomb enemy positions and airplanes. The planes powered by oil as fuel provided another reason to maintain access to petroleum products. The advanced aviation technology yielded fighter planes that had greater lethality and were much faster. The Germans actually took the lead in strategic bombing with the use of Zeppelins and Strategic Bombers. The war constantly pushed innovation for larger numbers, faster, and better planes. In fact, by 1915, all machines that had been in the air at the beginning of the war were obsolete. The war proved Churchill and Fisher right in their conversion of the British fleet to oil as it provided advantages over the German fleet powered by coal--greater range and speed and faster refueling. Oil also proved useful not only for transportation fuel to power all of these new pieces of equipment, but as a new, better source of toluene- needed to make TNT.

The more things change, the more they stay the same. During this period we see more inter-company squabbling and the desire by companies to be more integrated, leading Anglo Persian to acquire British Petroleum.

Many military aspects of WWI are actually rooted in oil. The German U-boat attacks were meant in large part to disrupt the access to oil for the allies. In return, many battles were fought with the intent to disrupt oil fields and transportation routes. Dealing with this supply challenge led to the entry of the United States into the fray, and it was the lack of a secure oil supply that eventually led Germany to surrender. By October 1918, the situation of Germany with respect to oil was desperate as Germany was anticipating a crisis in the coming winter and spring, and within a month a worn-down Germany surrendered. The Armistice or Peace treaty was signed at 5 AM on Nov 11, 1918, and went into effect 6 hours later, ending the war. The impact of oil in the war is eloquently summed up by Lord Curzon of Britain, “The Allied cause had floated to victory upon a wave of oil,” and by Senator Bérenger of France, “Oil-the blood of the earth was the blood of victory. Germany had boasted too much of its superiority in iron and coal, but it had not taken sufficient account of our superiority in oil. As oil had been the blood of war, so it would be the blood of the peace.”

It must be noted that while it was the governments who wanted this secure supply, it was the private companies that made it happen. It was a mutually beneficial engagement- the companies had a secure demand, and the government was able to leverage the reach and know-how of the oil giants.

The supply shortage and high demand resulted in rapid increases in the price of oil. The price changes clearly had no negative effect on the demand as the demand remained strong even with the increasing prices. Thus, the demand for oil had become relatively inelastic, or oil was exhibiting inelastic demand in economic terms.

The Quest - Chapter 2: The Caspian Derby

Fast forward to the end of the Cold War and we see a somewhat similar scenario to pre-WWI. Like the fall of the Ottoman Empire into many smaller new nations looking for a foothold in the world order, the dissolution of the Soviet Union also led to new nations. And like with the Ottoman Empire-derived new countries, the post-Soviet Era countries had a wealth of oil; they only needed to find a way to play in the global marketplace. Hence the Caspian oil region was born, and these new places were now dealing with the likes of Russia, Great Britain, the United States, Turkey, Iran, and at one point China.

The new opening up of the Caspian region would bring up recurring rivals, most notably Russia and Britain, and continual competition and striving for control and influence. But the situation would take on new characteristics in the 20th Century, revolving around oil transportation. The oil in Baku was essentially landlocked. The advances in tanker technology would do nothing for transporting this oil. It would require a network of pipelines to get the crude from the drill point to the consumer. The many countries surrounding the Baku Oil Region would all want their piece of the pie. Each country would want to negotiate individual terms for oil to travel through a pipeline over their land.

The Prize

Chapter 9 - The Blood of Victory: World War 1

Sections to Read

- Introduction

- The Taxi Armada

- Internal Combustion at War

- Anglo Persian Versus Shell

- The Man with the Sledgehammer

Major Themes to Ponder as You Read:

- What was one of most transformative impacts to the oil industry?

- What was new in regard to waging war?

- What about oil was critical to survival and decisive in World War I?

- How were oil prices different than supply and demand responses?

The Quest

Chapter 2 - The Caspian Derby

Sections to Read

- The New Great Game

Major Themes to Ponder as You Read:

- How did countries perceive the pipeline in regard to revenue?

- What did the pipelines need?

- Who was deemed responsible for monitoring the pipeline?

- In addition to spills and cleanup, what other concerns were there?

The Prize, Chapter 10 Overview

The Prize, Chapter 10 Overview

Chapter 10 highlights the breakup of the Ottoman Empire, and the entry of what is now Iraq into the world oil market. We also see in this chapter various arrangements such as the Sykes-Picot Agreement. The growing complexity of who was in charge of what required some degree of collaboration and to an extent, “sacrifice” for the greater good. The British, German, and Royal Dutch/Shell common goal was to get as much access as possible to the speculated petroleum. Under the agreement, the Turkish Petroleum Company (TPC) became the only entity with access to concessions in the area within the Ottoman Empire, and all oil production had to be done jointly as all parties had to agree to the "self-denying clause." This clause required all parties included in the agreement to work together or not at all. The investment would be shared, and the profits would be shared. The only areas of the Ottoman Empire exempted from the clause were Egypt, Kuwait, and territories on the Turco-Persian border.

America, fearing the exhaustion of petroleum under their own land and the return of "Gasolineless Sundays" sought access to the brightest prospects – the Middle East. To add to the fears, demand for oil in America increased by 90% from 1911-1918 and the number of registered cars went from 1.8 to 9.2 million from 1914-1920. George Otis Smith, the director of the U.S. Geological Survey, warned that the known American reserves would be gone in exactly nine years and three months-which would have been before 1930. This influenced the price of oil to increase and encouraged the government to support the oil companies in their quest for foreign supplies. Thus, the fear of shortage and competition helped to push American companies to now explore for oil wherever they could find it with support of the US government - and that meant the Middle East.

Britain had much economic and strategic collaboration with the US and was not willing to jeopardize its relationship with America and reconsidered. Besides, they also realized that entry of American capital and technology would accelerate the development, and the presence of America would also improve the political climate and strengthen the position of the companies in any political conflict. In the words of the Permanent Undersecretary of the British Foreign Office, according to the Prize, "it would be better to have the Americans inside than outside competing and challenging the concessions."

In the ultimate irony when viewed against the early days of trust busting and the downfall of Standard Oil, Herbert Hoover, the Secretary of Commerce, suggested that a syndicate of companies should be formed to operate in Mesopotamia. It felt remarkably like the dragon that had been slain by the Supreme Court was back to life… and Standard Oil of NJ sat at the top! A few years back, the group would have been a target of the government for antitrust and restraint of trade, but now they were being cheered on as the champions for promoting the Open Door policy!

The US constantly refused to recognize the 1914 granting of concessions to the TPC. Eventually, however, a new concession agreement was signed on March 14, 1925, between the TPC and the Iraqi government that satisfied the Open Door policy after lengthy and contentious negotiations. Despite all the controversy between the oil companies, ethnic groups, and the British appointed king, a joint geological expedition in Iraq started drilling in April 1927. Six months later in October 1927 at Baba Gurgur, six miles northwest of Kirkuk, oil was gushing 50 feet above the derrick into the air. The oil flowed until capped at 95,000 BPD.

With the availability of oil in the area proved, the final settlement of the negotiations that was to bring the American companies into the TPC had to be completed with urgency. This happened on July 31, 1928, with Royal Dutch/Shell, Anglo-Persian, the CFP (French), and the Near East Development Company (which held the interests of the American companies) each receiving 23.75% with the remaining 5% going to Gulbenkian.

The "self-denying" clause still remained, and at one of the negotiation meetings a red line was drawn around the old Ottoman (Turkish) Empire on a map, and the "self-denying" clause became known as the "Red Line Agreement." Within the Red Line that included the entire Middle East, except Kuwait and Persia, the group was bound to operate together. As expected, the Red Line Agreement continued to be a focus of tension and bitter conflicts for many years to come, as it constrained exploration and development by requiring all the partners to work together in all oil production.

Note that the events in this chapter were between the two world wars, when countries had found out in WWI that access to oil was of critical strategic importance to national security and strategies. Also, note that Kuwait and Iran were the only parts of the Middle East not included within the Red Line.

The Prize, Chapter 10 - Opening the Door on the Middle East: The Turkish Petroleum Company

Sections to Read

- Introduction

- Mr. Five Percent

- "A First-Class War Aim"

- Clemenceau and His Grocer

- Oil Shortage and the Open Door

- "The Boss": Walter Teagle

- Faisal of Iraq

- The Architect

- Toward the Red Line

Questions to Guide Your Reading:

- Where did Britain want to assert its influence?

- France had claims to what parts of current-day Iraq?

- What did the Great War make clear about petroleum?

- What was the issue between Britain and US in the Middle East?

The Quest, Chapter 13 Overview

The Quest, Chapter 13 The Security of Energy

The story from The Prize chapter 7-10 is a cautionary tale that we face even today. Nmely, that there are dimensions to energy security. Simply finding oil is not enough. In this part of The Quest, we learn about the other dimensions. An argument can be made that some current policy decisions are not being true to the importance of these principles. It is important to note that we as a country are not anywhere near a position to halt fossil fuel production and still remain functional and secure. Therefore, for the time being, we will be dependent on oil from other places, as we will surely need it for the foreseeable future, regardless of green energy policies. It is simply the practical nature of where we are.

If we relate to the present-day argument for no fossil fuels to the early 1900s situation, you see how pivotal the US being a potential exporter actually was. We also see the dire straits Britain found itself in as they had no oil of their own, but sorely needed it for their national security. And it was not just military needs, the shortages meant no transportation or heat for the general public. Are we learning from history in setting modern day energy policy?

The dimensions of energy are:

- Physical Security: Infrastructure, supply chains, trade routes - an example of this would be the Oil Tanker making its way to Britain from Russia - 6000 miles. How is it protected? Can this route be disrupted? Thus, the supply is then not where it is relied upon to be.

- Access to Supplies: Physically, contractually, commercially - remember Reynold’s “Beer and Skittles” challenges in Persia? He struggled with everything from actually finding the oil to negotiations with local Persians to basic infrastructure to transport it to the Oil Tanker.

- Energy Security: This refers to the challenges with the many Government Policies, Non-Governmental Organizations (NGOs) - for example Greenpeace, the Red Cross, International Government Organizations examples - for example United Nations (UN), World Trade Organization (WTO) European Union (EU). Coordination between these many organizations impacts the security of the oil supply. The teamwork between these organizations is illustrated in how they respond to the disruption of emergencies in supplies. These organizations also partner with many International Oil companies to ensure our house is warm and gas is available for travel so each of us can have what are now considered necessities every day.

Many non-oil related situations can impact this teamwork and thus impact the supply of oil. A non-oil related situation could be a religious difference between two countries that want to have a pipeline connection. What happens when that religious difference becomes more important than the oil profit or oil-related products? A disruption in the oil supply.

The Quest, Chapter 13 - The Security of Energy

Sections to Read

- Dimensions

- Introduction

Questions to Guide Your Reading:

- What are two dimensions of energy security?

Lesson 3 Connection Video

Lesson 4 - Middle East Oil Development & the Rise of Automobiles & Gasoline

Lesson 4 Introduction

Concepts to Consider for the Lesson

The more things change, the more they stay the same; a recurring theme as we work our way through the textbook. In this lesson we will cover the impact of different cultures on the industry, and how the industry changed the American culture. You will be introduced to the sudden rise in oil demand in the United States and the proliferation of gasoline stations as a result of the increase in mobility/transportation. The Teapot Dome and associated kickback scandals and their impact on individuals, industry, and government will be discussed.

The emergence of nationalism in Persia and Mexico and the Mexican expropriation that sent chills through the oil industry will be discussed, including some discussions on the tensions over stability and sovereignty that led in some cases to revolutions and political unrest and how they impacted investments and oil development. This will highlight the challenges that the oil industry has in being a civilian and military commodity.

In addition, we will learn about the discovery of East Texas oil, how overproduction and hot oil led to the fall in crude prices, and the actions taken by the states of Texas and Oklahoma to stabilize the market. We will also discuss how the federal government had to step in and work with the states to regulate production via unitization and pro-rationing.

Learning Objectives

By the end of this lesson, you should be able to:

- Recall course concepts relating to oil development in the Middle East and the rise of automobiles and gasoline

- Demonstrate an understanding of the role of oil in relation to pivotal events in history

- Discuss the role of oil in business applications, global markets, conflicts, energy security, and various unconventional applications

What is due for Lesson 4?

This lesson will take us one week to complete. Please refer to the Course Syllabus for specific time frames and due dates. Specific directions for the assignment below can be found within this lesson.

| Activity | Location | Submitting Your Work |

|---|---|---|

| Read | The Prize: Chapters 11, 12, 13, & 14 (select sections) The Quest: Chapter 5 (select sections) |

No Submission |

| Discuss | Participate in the Yellowdig discussion | Canvas |

| Complete | Complete Quiz 2 | Canvas |

Questions?

Each week an announcement is sent out in which you will have the opportunity to contribute questions about the topics you are learning about in this course. You are encouraged to engage in these discussions. The more we talk about these ideas and share our thoughts, the more we can learn from each other.

The Prize, Chapter 11 Overview

The Prize, Chapter 11 Overview

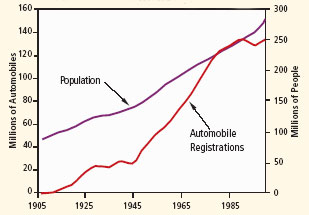

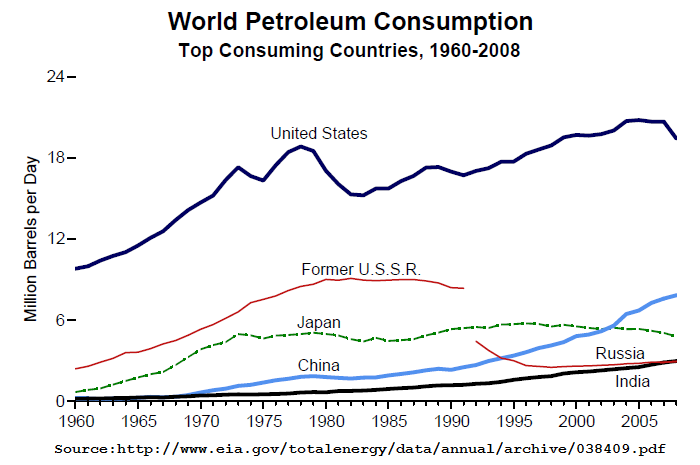

With Chapter 11, we enter “The Age of Gasoline”, arguably an age we are still in it to this day. The demand for gasoline increased and still continues to increase. In 1919, the U.S. used 1.03 million barrels per day; ten years later, demand had increased 2.5 times to 2.58 million barrels per day. The demand of oil for light had transferred to the demand for oil used for mobility. The increase in demand was driven primarily by the increase in the number of automobiles. In 1916, the U.S. had 3.4 million registered vehicles, and by the end of the decade, the number had jumped to 23.1 million, with cars being driven farther and farther. By 1929, nearly 80% of the world’s automobiles were in America, and oil’s share of total energy consumption had gone from 10 to 25% in the decade 1919 -1929, with gasoline and fuel oil accounting for 85% of the total oil consumption.

The graph shows national trends in population and automobile registrations in the United States from 1907 through 2000. Both have risen since 1907, but at different rates. Since approximately 1945, automobile registrations have outpaced population growth.

Although we are so used to it that we hardly notice it, a new culture emerged around gasoline, the emergence of the gasoline station. Before 1920, most gasoline was sold by storekeepers, who kept it dangerously in cans in the store. The Automobile Gasoline Company is credited with the first drive-in gas station in St. Louis in 1907. However, the proliferation of gas stations did not catch on until the 1920s. But selling a commodity such as gasoline is tricky. In general, gasoline is gasoline so why would you buy from one instead of another? Price is one way to ensure market share, however you can only reduce price so far before you are losing money. So the oil companies developed trademarks to distinguish themselves and promote competition. The filling/service stations added features that would help their customers with their vehicles by checking/selling tires, batteries, and accessories. Today, we see gas stations and “convenience stores” that sell gasoline. The appearance of the gas station revolutionized how gasoline was marketed.

Chapter 11 discusses the increasing trend we saw in Lesson 3 of oil becoming a key element of national policy and national security. Oil was becoming more of a factor in economic stability and the resilience of the military. As you would expect, with this growing role, also comes controversy and challenges. The Teapot Dome scandal illustrates this aspect in the sense of collusion between private sector companies and government, criminal kickbacks, and political favors. And Teapot Dome itself illustrates another emerging idea, an organized, government-supported reserve to be used for the military. The idea being that the US Navy would have a reliable source of fuel regardless of what was happening geopolitically, and whether imported supplies were threatened.

Today, we are seeing a different challenge associated with such reserves. We have the Strategic Petroleum Reserve created by the government to hold a supply of fuel to be used in times of national emergency. As we will see in this course, when you depend on other countries for oil supply, you tend to be at their mercy in terms of volume, prices, and stability. There has been current controversy around releases from the SPR, including claims that releases are for political reasons- to stabilize fuel prices. Some argue this is not the intended use of the SPR, and is putting national security at risk.

We remember from prior lessons the idea of “Rule of Capture.” A nice way of saying “grab all you can get as fast as you can”. This mentality compromised the efficiency of oil fields, resulting in lost reserves and price volatility. The industry was realizing that this approach clearly does not work in the long run. Enter the concept of “unitization” where producers work together in developing a field to ensure that it is managed as efficiently as possible. A good analogy is a children’s Easter egg hunt. There are two ways to do it- you let all the children run out in the field and grab as much as they can (Rule of Capture), or you establish some rules such as a maximum number of eggs allowed per child, sperate areas for age groups, and so on (Unitization). As you can imagine, and as the companies learned, unitization makes sense if those involved agree to cooperate.

New discoveries were few in the years 1917-1920, resulting in pessimism about production and increased prices. For example, Oklahoma crude that sold for $1.20 a barrel in 1916 was selling for $3.36 in 1920. In the 1920s, technology for finding oil improved as geophysicists led the way in developing tools for oil exploration. So, in spite of the shortage fear, the new innovations helped in the discovery of several major fields including the Signal Hill and others which made California the number one oil-producing state in 1923; the Greater Seminole field in Oklahoma in 1926 (flowed at 527,000 barrels per day (BPD) on July 30, 1927) and the Yates field in West Texas and New Mexico.

In addition to innovations in exploration and production, innovations in crude processing/refining such as cracking enabled more and superior gasoline with better anti-knock properties to be extracted out of a barrel of crude, reducing the demand for more crude. With demand decreasing and the many producers each maximizing their production, the flush production led to oversupply and devastating consequences on the price of oil. With the glut and low prices, the opinion of the oil industry began to lean toward an approach of conservation and production control. This time, not based on shortage but as a means to prevent the flood and its catastrophic effect on pricing. Still, opposition to direct government regulation or involvement was extremely strong.

Restructuring and the Deep Depression

Rockefeller actually set the example of confronting imbalances in supply and demand through consolidation and integration within Standard Oil and the oil industry years before. Consolidation – implies the acquisition of competitors and complementary companies, and Integration – implies the fusing of the upstream (exploration and production) and the downstream (refining, transportation, sales, and distribution) under one company working for the same goal.

The oil industry realized that the strategy of restructuring via consolidation and integration has its advantages and would form the foundation for our modern American oil industry. There were now many big companies and several independents by the 1920s, as by 1927 45% of the refined products were controlled by the various “Standard companies” compared to the 80% two decades earlier.

The stock market plunged in October 1929 ushering in the Great Depression that led to many people losing their jobs, savings, and standard of living. There was massive unemployment, poverty, and hardship throughout the nation, ending the constant growth in demand for oil. Just when the country was realizing in autumn 1930 that the stock market crash was not a simple correction but a true economic disaster, as luck would have it, the largest oil field in the lower 48 states, the Black Giant in East Texas, was discovered. Now, there would be a flood of available petroleum with a consequent drop in prices.

The Stock Market Crash, just like the COVID outbreak in recent years are what is call a “Black Swan Event.” Such events are surprises and unexpected, but when viewed in hindsight, should have been expected. The idea is that a black swan is very rare, but genetically it can happen and should be expected to occur at some point. Regardless, Black Swan events are very disruptive to even the best laid plans.

The Prize, Chapter 11 - From Shortage to Surplus: The Age of Gasoline

Sections to Read

- Introduction

- A Century of Travel

- The Magic of Gasoline

- The Tempest in the Teapot

- The Tycoon

- The Rising Tide

Questions to Guide Your Reading:

- What was happening with gasoline in the 1920s?

- What reduced concern about supplies?

- How is oil different from other commodities?

- What is the Rule of Capture and unitization?

The Prize, Chapter 12 Overview

The Prize, Chapter 12 Overview

Chapter 12 is characterized by the introduction of the national oil company, and the challenges of dealing with other countries, especially those with different cultures and where unrest is imminent. As you read the sections of Chapter 12, pay particular attention to the differences between Mexico, Venezuela, Persia (Iran), and Russia. Very different places, very different situations, but similar outcomes. The outcomes being challenges and risks for the oil companies, and potential disruption of supplies. Chapter 12 is a cautionary tale of why energy independence is so important for economic and national security.

Interactions with these countries illustrate the necessary love/hate relationship between the country and the oil companies. The companies would rather not deal with the governments due to the very high risks, but they must in order to have access to the supplies. The countries would rather not deal with the private companies who they did not trust, but they also realize the companies are necessary to develop the fields and market the oil. Sitting on large fields is of no value if there is no one to develop it. The battle between government and oil companies boiled down to two issues:

- stability of agreements for the oil companies, and

- the question of sovereignty and ownwership for the producing countries.

And the companies realized that although they were competitors, and did not always trust each other, they had to join forces to operate in this changing, and challenging world. Recall the saying “the enemy of my enemy is my friend.”

The Prize, Chapter 12 - The Fight for New Production

Sections to Read

- Introduction

- Mexico's Golden Lane

- General Gomez's Venezuelan "Hacienda"

- Duel with the Bolsheviks

- Price Wars

Questions to Guide Your Reading:

- How did war illustrate that oil = power?

- Why was oil considered a symbol of sovereignty?

- What did Mexico sacrifice by exerting ownership over oil reserves?

- What did Venezuela do different than Mexico?

- What tactic did the Soviet Union use after they eventually nationalized oil?

The Quest, Chapter 5 Overview

The Quest, Chapter 5 Overview

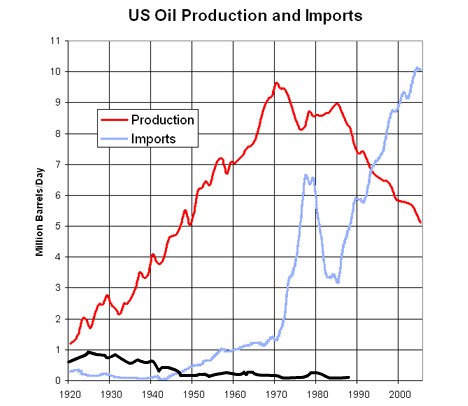

We include a short reading in The Quest to provide more insight into the impacts to a country that is an exporter of energy vs one that imports. And you can then imagine how disruptive it is for a country to switch back and forth. In recent years, the USA went from importer, to exporter, to importer again. That can’t be good for economic stability, let alone risks in regard to energy security. And we sometimes hear the terms net exporter or net importer, which means a country can be an importer and exporter at the same time. The “net” then is based on which dominates at any given time. A country can be one for gas and the other for oil. Finally, if you are a net exporting country, it makes a profound difference to the stability of your economy if it depends primarily on that export or if the oil and gas is one of many exports. Countries like the USA are less impacted than a country like Venezuela because we have many exports compared to Venezuela. But do not be fooled, having many types of exports does not make us immune to risks associated with being a net energy importer.

The Quest, Chapter 5 - The Petro-State

Sections to Read

- Crisis for Exporters

- Reversed Midas Touch

Questions to Guide Your Reading:

- What were differences in concepts between importing vs exporting?

- What was an Impact of the sudden flood of oil exports?

- What were some lasting challenges with exporting oil?

- What were some protection measures used by governments?

The Prize, Chapter 13 Overview

The Prize, Chapter 13 Overview

As you look back on history, one can point to pivotal events that change things for the long haul. The discovery of the East Texas oil field was one of those. It came at a time when there was concern of dwindling domestic reserves. This brought some confidence and stability to the markets. But it also brought back our old friend overproduction. And again, we had oversupply and collapsing prices. This time, government and industry self-imposed controls were tried. But this created a new problem, “hot oil,” or what we would call today “black market oil.”

Finally, there was stability brought about by the regulatory system in place for the oil industry, and it had taken East Texas oil at about 10 cents a barrel to get the industry and producing states to move in that direction. Other factors that contributed to making it happen were the advances in petroleum engineering, the Great Depression, and President Franklin D. Roosevelt’s New Deal. Two compelling assumptions were central to the regulatory system: 1). Demand for oil is not responsive to price (i.e., demand at 10 cents a barrel would not be much different from demand at $1 a barrel, especially in the Depression) and 2). Each state had its “natural” share of the market.

The Prize, Chapter 13 - The Flood

Sections to Read

- Introduction

- Anarchy in the Oil Field

- The Government Acts

- Stability

Questions to Guide Your Reading:

- What impact did The Black Giant have in East Texas?

- What was the Impact of overproduction and "hot oil" on prices?

- What was needed to deal with insufficient state control?

- What was ironic comparing the oil industry between 1920 and 1932?

The Prize, Chapter 14 Overview

The Prize, Chapter 14 Overview

During that period, industrial rationalization, efficiency and elimination of duplication were the values and objectives promoted by the companies as they explored mergers, collaboration cartels, marketing arrangements, and associations to address the excess supply problem. These and other developments were what contributed to the "As-Is" Agreement, also called Pool Association that was agreed to, but not signed. Under the agreement, each company was allocated a quota in various markets, but the agreement excluded the domestic US market to avoid violating US antitrust laws. In addition to the quotas, the companies agreed to drive down costs, share facilities, and be cautious in building new refineries and other facilities. A few months later, the industry leaders agreed to control production as well. Thus, by the agreement, an international oil cartel was in essence being formed!

Cartels typically control or fix prices, markets, and production. However, the agreement fell apart as the companies resumed attacking each other's markets. Eventually, 17 American companies formed the Export Petroleum Association, under the Webb-Pomerene Act of 1918 that allowed US companies to do abroad what the antitrust law would not allow them to do in the US. Disagreements on the allocation of output between the American and European companies led to the failure of the attempt to "cartelize" US oil exports, further undermining the "As-Is" agreement. Besides, there was too much production outside the "As Is" framework for it to be effective, and the agreement and the attempt to "cartelize" international oil production failed.

The Big Three (SO of New Jersey, Shell, & Anglo-Persian) tried to reformulate an alliance in 1930 dealing with the European Markets. They attempted to make local arrangements, dividing market shares with "outsiders." Again, the system proved ineffective due to the rising volumes of American, Russian, and Romanian oil. In December 1932, the companies came up with an updated "As-Is" understanding: "The Heads of Agreement for Distribution." The initial adherents were Royal Dutch/Shell, Jersey, Anglo-Persian, Socony, Gulf, Atlantic, Texas, and Sinclair. There were, however, many contentious points in the new agreement including chronic cheating and new markets. The companies, being fierce competitors, always plotted new attacks against each other even while they sought cooperation. In addition, there were constant conflicts with implementing agreements or even "agreeing to what had been agreed to."

In a way, the "As-Is" agreement in addition to being a tool to defend against overproduction and the Depression, was also intended to defend against the emergence of political forces in Europe and the producing countries. During the 1930s, political pressure on the oil companies took many forms. Governments imposed import quotas, set prices, and placed restrictions on foreign exchange and also, as a result of the Depression, autocracy and bilateralism were the order of the day. The oil companies sought to insulate and protect themselves from government intervention in the second half of the 1930s after the worst of the Depression was over. Political and economic nationalism had also intensified throughout the world, and, as one oil observer then noted, "Operations in the oil business are 90% political and 10% Oil."

The Prize, Chapter 14 - "Friends" -- and Enemies

Sections to Read

- Introduction

- The Hand of the British Government

- "The Problem of the Oil Industry"

- Discord within "Private Walls"

- Nationalism

- The Shah's New Terms

- The Mexican Battle

Questions to Guide Your Reading:

- What feature of international oil markets formed during this period?

- What was on the rise during this period?

- What was happening between producing countries & oil companies?

- What were companies trying to do in regard to contracts and concessions?

Lesson 4 Connection Video

Lesson 5 - Boom and Bust Cycles

Lesson 5 Introduction

Concepts to Consider for the Lesson

Here we will explore oil discovery in the area that was not supposed to have oil, Arabia (Bahrain, Kuwait, and Saudi), and the problems posed by the troublesome Red Line agreement. The reasons for the economic hardships of the area that made concessions possible in these areas will be discussed. The different objectives of the American and British companies that made it possible for America to beat the British in Arabian oil dominance will also be explored.

Followed by the rise of nationalism and military expansionism in Japan in the 1930s, and the deadly paradox/dilemma Japan faced in choosing food to be a synthetic fuel instead of feeding their citizens. This will lead Japan into the Pearl Harbor attack, its key success elements, objectives, impacts, and the miscalculations of both sides. We will then discuss the innovations in chemistry that helped with synthetic oil production in Germany, and how synthetic oil shaped Hitler’s WWII plans and strategy in Europe. Finally, we conclude with a ponderable comparison to the Iraq War of 2003.

Learning Objectives

By the end of this lesson, you should be able to:

- Recall course concepts relating to Boom and Bust Cycles

- Demonstrate an understanding of the role of oil in relation to pivotal events in history

- Discuss the role of oil in business applications, global markets, conflicts, energy security, and various unconventional applications

- Produce an evaluative statement that justifies your answer to a posed homework question

What is due for Lesson 5?

This lesson will take us one week to complete. Please refer to the Course Syllabus for specific time frames and due dates. Specific directions for the assignment below can be found within this lesson.

| Activity | Location | Submitting Your Work |

|---|---|---|

| Read | The Prize: Chapters 15, 16,& 17 (select sections) The Quest: Chapter 7 (select sections) |

No Submission |

| Discuss | Participate in the Yellowdig discussion | Canvas |

| Complete | Complete the "Analyze a Quiz Question" assignment | Canvas |

Questions?

Each week an announcement is sent out in which you will have the opportunity to contribute questions about the topics you are learning about in this course. You are encouraged to engage in these discussions. The more we talk about these ideas and share our thoughts, the more we can learn from each other.

The Prize, Chapter 15 Overview

The Prize, Chapter 15 Overview

In chapter 15 we encounter much wheeling and dealing in Arabia. In today’s global oil market, not only is the Middle East a key player, but it is also actually influential enough to direct prices, supplies, and overall market responses. But it wasn’t always like that, and in the early days, people were not even sure this area had potential. But like many of the other areas we have explored, an intrepid entrepreneur pursues a rumor or a seep, and the rest is history.

Finding oil is as much about science as it is about agreements and politics. The Red Line Agreement we read about before ended up causing headaches for some companies, while it allowed others to take advantage. The contrasting story of Gulf and Socal demonstrates how such agreements can keep someone out of a market. Ironically, Gulf pivoted and moved to an area where they could work, and it turned out to be quite the strategic maneuver. In addition to the complexities introduced by agreements, there is the issue of nations having to deal with other powers. The interaction of American and British interests, and how they were perceived in this newly evolving oil market was the early manifestations of the conflicts that we face still today. That being the conflict of Western and Eastern cultures that play out on the battlefield of today’s oil markets.

It is interesting that, as we saw in other parts of the world, discoveries of large oil reserves sometimes soften the contempt one country can feel for another, and a greater effort is made to “close the deal.” We see that in this chapter, in regard to how these new oil-rich countries acted with America and Britain, and with each other. Kuwait is a classic example of this, as well as the old adage, “the enemy of my enemy is my friend.” With economic conditions causing problems, Kuwait needed money, but it was sitting on quite a bit of oil. Playing America and Britain off of each other by way of Gulf and Anglo-Persian proved a useful strategy. Conversely, the two companies teaming up also proved to be strategic and prudent.

Having a great agreement means nothing if the oil is uneconomic to develop or if demand is low. This means you have to improvise or temporarily adapt. The Texaco and Socal part of the story, and the birth of CalTex illustrates this well. But in the 1930s, oil was discovered in Kuwait and Saudi Arabia in commercial quantities, and so began the prominence of this area in the global oil market.

Change was once again coming in the form of another war. And like in World War I, although it wasn’t because of oil that the war started, oil did end up playing a major role.

The Prize, Chapter 15 - The Arabian Concessions: The World the Frank Holmes Made

Sections to Read

- Introduction

- Ibn Saud

- Kuwait

- The Blue Line Agreement

- Discovery

Questions to Guide Your Reading:

- What happened between the Americans and the British in regard Saudi oil?

- How was the relationship between Saudi Arabia & United States evolving?

- What was a major influence on agreements and partnerships?

- What was the “marriage of necessity”?

The Prize, Chapter 16 Overview

The Prize, Chapter 16 Overview

In chapter 16, we return to Asia and learn about Japan’s incentive to engage in a war. Several reasons accounted for this shift in military expansionism: vulnerability due to its lack of natural resources, economic hardship from the Great Depression and the collapse of world trade, dwindling access to international markets, extreme nationalism, moral distress, arrogance, and the mystical belief in the superiority of Japanese culture as well as “The Imperial Way” (Asia under Japanese control).

When Prime Minister Osachi Hamaguchi won a large election victory in February 1930 and favored cooperation with Britain and the United States, he was assassinated by a youth, and that killed any spirit of cooperation. Ultra-nationalism took hold thereafter. After being reprimanded for its actions by the League of Nations (United Nations), Japan left the League, rejected liberalism, capitalism, and democracy as engines of weakness, and embarked on its own destructive course. The Emperor sought to establish a “national defense state” in which all resources, especially oil, were targeted for war based on Germany's failure/defeat in WWI from lack of resources (oil).

Japan was a good example of the desperation that comes from lack of energy security and independence. By the late 1930s, Japan produced only 7% of the oil it consumed. It imported the rest, with 80% coming from the U.S., and 10% from the Dutch East Indies. Japan sought to dominate the oil industry to serve its needs. Up to that time, 60% of its internal market was held by two Western companies (Rising Sun & Stanvac). Rising Sun was the Japanese affiliate of Royal Dutch/Shell, and Stanvac was a joint venture between Standard Oil of New Jersey and Standard Oil of New York. In other words, even in cases driven by national interests, the global companies are ever-present.

As with the Middle East experience we saw in Chapter 15, sometimes national feelings toward another country or culture clashes with the reality of dependence, especially with oil. With Japan’s actions, the United States emerged as Japan’s antagonist in the Pacific, as the U.S. had an “open door” policy which was counter to Japan’s strategy. With the U.S. as Japan’s major oil supplier and likely antagonist, the question was where was Japan going to get its oil in case of war? To help address this, the military won passage in 1934 of the Petroleum Industry Law, which gave the government the power to control imports, set quotas, fix prices, and make compulsory purchases. The underlining objectives of the law were to build up refining industry, reduce the role of foreign companies, and prepare for war. The oil companies, U.S., and Britain all recognized and disapproved of the “squeeze and restrictive oil” policies of Japan.

Japan didn’t want any disruption of its oil supply and passed the Synthetic Oil Industry Law which provided a 7-year plan to produce synthetic fuels from coal by 1943. Japan began to establish industrial self-sufficiency and to break its dependence on the U.S. in anticipation of an oil embargo. But in the meantime, it needed to ensure supply and ironically kept buying gasoline from America. This rings of the current paradox we see with Russian oil and the European countries.

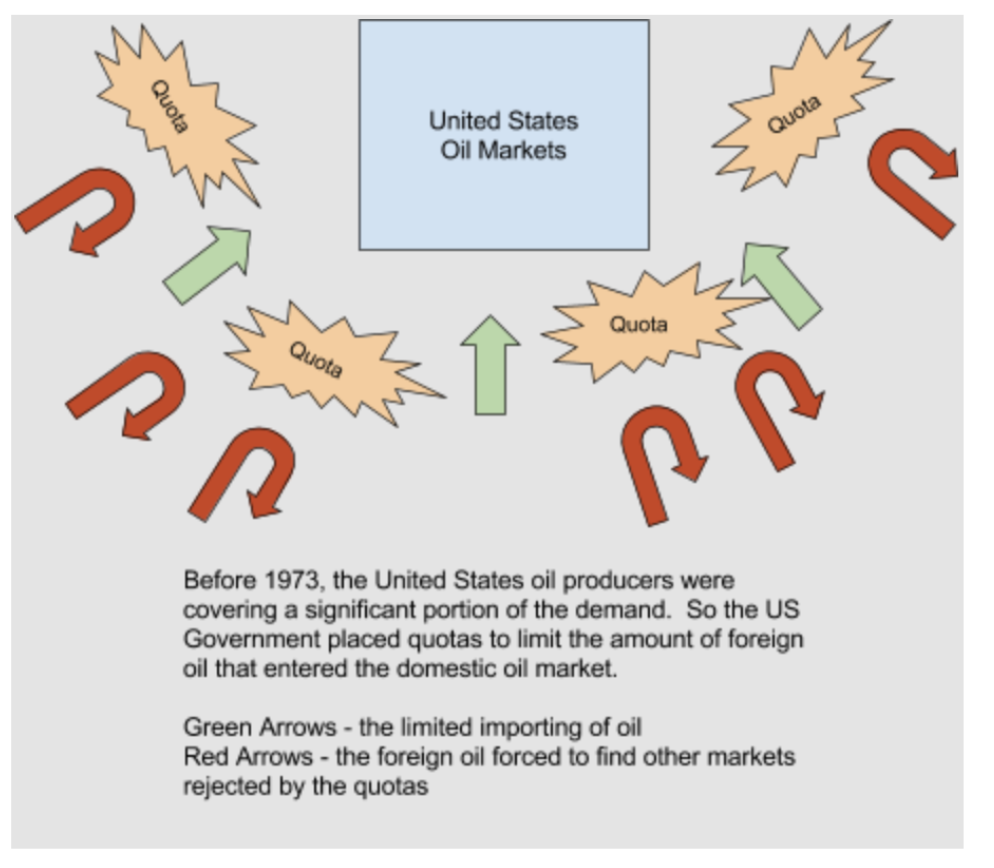

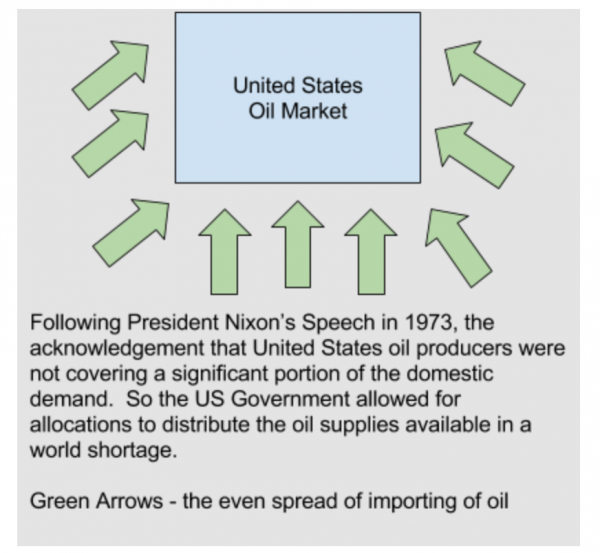

With the increased escalation and tension, an embargo was virtually the only way left, and on July 25, 1941, the U.S. ordered all Japanese financial assets in the U.S. frozen. While it was not an embargo, a lack of assets to buy oil virtually turned it indirectly into an embargo. On July 28, Japan, as expected, invaded Indochina, taking another step towards war. Effectively, by August 1, 1941, there were no more oil exports to Japan from the U.S. Japan’s oil situation was so serious that there were some last-minute diplomatic efforts to avoid the confrontation in addition to intense discussions between the Emperor and his top military generals.