10.2 Ethanol Production and Economics

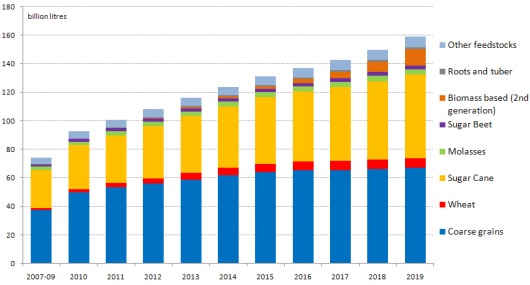

The major feedstock for ethanol has been coarse grains (i.e., corn). Second-generation ethanol (from cellulosic biomass) is around ~7% of the total ethanol production. The figure below shows the global ethanol production by feedstock from 2007-2019.

| Year | Coarse Grains | Wheat | Sugar Cane | Molasses | Sugar Beet | Biomass-based (2nd Generation) | Roots and Tuber | Other Feed Stocks | Total |

|---|---|---|---|---|---|---|---|---|---|

| 2007-2009 | 37 | 1 | 27 | 3 | 2 | - | - | 5 | 75 |

| 2010 | 50 | 2 | 30 | 2 | 3 | - | - | 6 | 93 |

| 2011 | 54 | 3 | 32 | 4 | 2 | - | - | 5 | 100 |

| 2012 | 56 | 4 | 35 | 4 | 2 | - | - | 6 | 107 |

| 2013 | 59 | 5 | 38 | 3 | 2 | 1 | 1 | 6 | 115 |

| 2014 | 61 | 6 | 43 | 3 | 2 | 2 | 1 | 6 | 124 |

| 2015 | 64 | 5 | 45 | 4 | 2 | 3 | 1 | 7 | 131 |

| 2016 | 65 | 6 | 47 | 5 | 2 | 4 | 1 | 7 | 143 |

| 2017 | 65 | 6 | 52 | 4 | 3 | 5 | 1 | 7 | 153 |

| 2018 | 66 | 6 | 53 | 4 | 3 | 8 | 1 | 8 | 149 |

| 2019 | 61 | 6 | 59 | 3 | 2 | 13 | 1 | 8 | 159 |

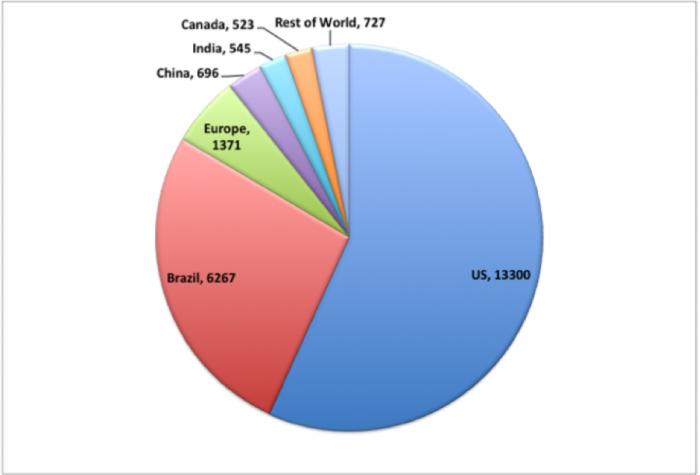

In 2013, world ethanol production came primarily from the US (corn), Brazil (sugarcane), and Europe (sugar beets, wheat). The figure below shows ethanol production contributions, in millions of gallons, from all over the world. In addition to Brazil, ethanol production from sugarcane is also being done in Australia, Columbia, India, Peru, Cuba, Ethiopia, Vietnam, and Zimbabwe. In the US, ethanol from corn accounts for ~97% of the total ethanol production in the US.

| Country | Millions of Gallons of Ethanol |

|---|---|

| US | 13300 |

| Brazil | 6267 |

| Europe | 1371 |

| China | 696 |

| India | 545 |

| Canada | asdf |

| 523 | asdf |

| Rest of the World | 727 |

The table below shows a comparison of costs for first-generation ethanol feedstock along with their production costs. The data in this table is from 2006, but it gives you an idea of why ethanol is made from corn in the US: because it is less expensive and more profitable. However, as seen in the other charts, the use of sugar-based materials like sugarcane and sugar beets is growing, as well as the use of cellulosic materials.

| Cost Item | Feedstock Costsb | Processing Costs | Total Costs |

|---|---|---|---|

| US Corn wet milling | 0.40 | 0.63 | 1.03 |

| US Corn dry milling | 0.53 | 0.52 | 1.05 |

| US Sugarcane | 1.48 | 0.92 | 2.40 |

| US Sugar beets | 1.58 | 0.77 | 2.35 |

| US Molassesc | 0.91 | 0.36 | 1.27 |

| US Raw Sugarc | 3.12 | 0.36 | 3.48 |

| US Refined Sugarc | 3.61 | 0.36 | 3.97 |

| Brazil Sugarcaned | 0.30 | 0.51 | 0.81 |

| EU Sugar Beetsd | 0.97 | 1.92 | 2.89 |

a Excludes capital costs

b Feedstock costs for US corn wet and dry milling are net feedstock costs; feedstock for US sugarcane and sugar beets are gross feedstock costs

c Excludes transportation costs

d Average of published estimates

Credit: rd.usda.gov

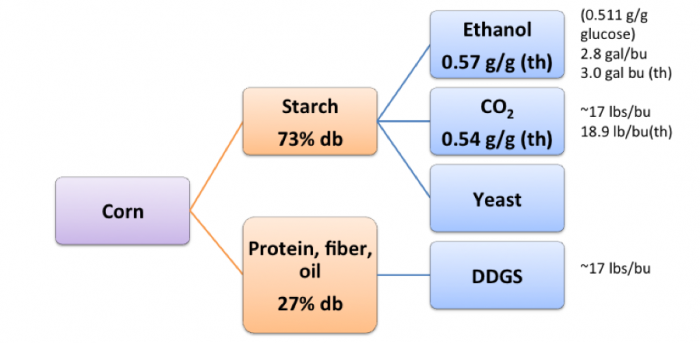

The figure below shows the overall process of making ethanol from corn. It also shows the additional products made from corn. If you recall from Lesson 7, DDGS is a grain that can be used to feed cattle. Corn oil is also produced for use. Typical yields of each product per bushel of corn are shown (2.8 gal of ethanol, 17 lbs. of CO2, and 17 lbs. of DDGS).

- Corn

- Starch – 73% db

-

Ethanol--0.57 g/g (th)

-

(0.511 g/g glucose)

-

2.8 gal/bu

-

3.0 gal/bu (th)

-

-

CO2—0.54 g/g (th)

-

~17lbs/bu

-

18.9 lb/bu (th)

-

-

Yeast

-

-

Protein, fiber, oil – 27% db

-

DDGS

-

~17lbs/bu

-

-

- Starch – 73% db

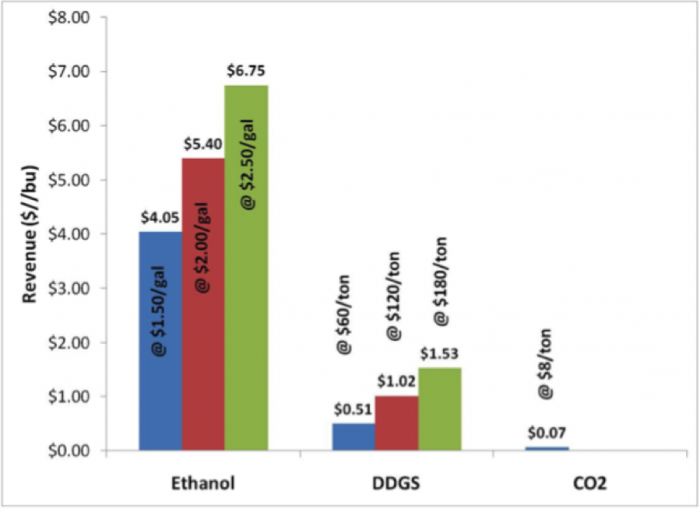

So, what are the ethanol revenue streams? The figure below shows that the revenue streams are ethanol, DDGS, and CO2. The revenue streams are market-driven; ethanol is the plant’s most valuable product and typically generates 80% of the total revenue. The DDGS represents 15-20% of the revenue, and CO2 represents a small amount of revenue. The revenue margins are tight, however, and the sale of DDGS and CO2 is probably essential for the plant to be profitable.

| Product | Revenue $ per bushel of corn | Value ($) of how each product is sold |

|---|---|---|

| Ethanol | 4.05 | 1.50/gal |

| Ethanol | 5.40 | 2.00/gal |

| Ethanol | 6.75 | /gal |

| DDGS | 0.51 | 60/ton |

| DDGS | 1.02 | 120/ton |

| DDGS | 1.53 | 180/ton |

| CO2 | 0.07 | 8/ton |

The figure below shows the volatility of the price of corn, the price of ethanol, and the price of gasoline. Notice the price of gasoline and the price of ethanol are highly correlated, at least since 2009. For example, in 2010, the price of gasoline and the price of ethanol were ~$2.00 per gal. However, in recent months, with the price of oil going down significantly, expect that the profitability of ethanol will be less.

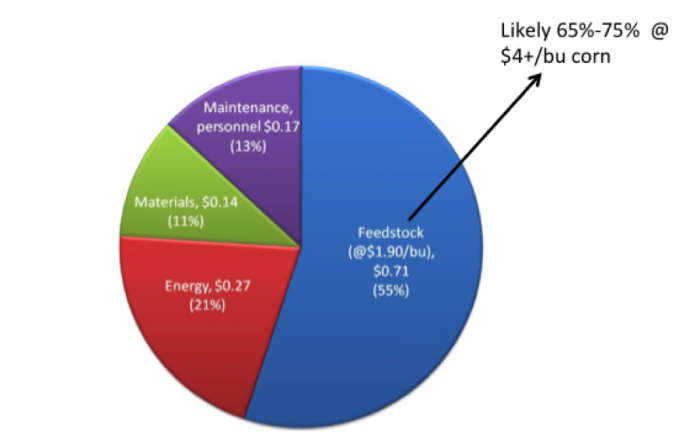

The major cost of producing ethanol from corn is the cost of the feedstock itself. The figure below shows the cost of feedstock is 55% of the expenses for the production of ethanol from corn, while energy is 21%, materials are 11%, and maintenance and personnel are 13%. If a bushel of corn sells for $4/bu or more, then the percentage for the feedstock price goes to 65-75% of the expenses.

Another issue with the production of ethanol is that water is used, and water is becoming less available. Water is used for gasoline production as well, but water use is a little higher for ethanol production (for gasoline, 2.5 gallons of water per gallon of gasoline is used, while for ethanol it is 3 gallons of water per gallon of ethanol). The extra water use is due to growing the plants for harvest.