How quantity and price are determined through market exchange

These three assumptions--rationality, diminishing marginal utility from consumption, and increasing marginal cost of production--are all that is required to understand market exchange in an ideal-world model.

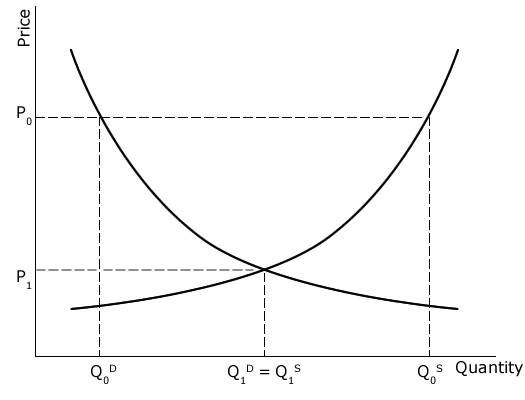

Consider first a simple world with consumers who desire to purchase a good and firms with the ability to produce a good for sale. If markets are free to set prices, then prices will adjust to equate demand and supply.

If price is such that quantity demanded is less than quantity supplied, as depicted by P0, for example, then some producing firms will not find willing buyers for their products. Those firms will reduce their price in order to entice buyers to purchase their goods instead of competing products. Falling prices will encourage demand, but will also discourage supply. (Remember, producers will continue to produce only as long as the marginal revenue exceeds the marginal cost of production.) Price adjustments will continue until a market equilibrium is reached, in which all produced goods find willing buyers and producers no longer face incentives to reduce prices, as depicted by P1 and Q1.

Similarly, if price is such that quantity demanded is greater than quantity supplied, then the market can allocate product to only some consumers. Some prospective consumers who did not receive any goods will increase the price they're willing to pay. After all, consumers receive a relatively high marginal utility from the first unit of good consumed, so we know they're willing to pay more for that unit. Consumer demand will be discouraged as the price they must pay rises above the utility (satisfaction) derived from the marginal good. And production will be encouraged as the price received for goods rises above the cost of producing the marginal good. Price adjustments will continue until a market equilibrium is reached, in which all produced goods find willing buyers and consumers no longer face incentives to increase prices.

This same story can be told simultaneously, to represent the multiple markets within an economy: markets for labor and homes and fuel oil and cars and gasoline and apples and... Economizing agents will simultaneously engage in multiple markets, supplying labor and consuming goods. And those same agents may organize firms, demanding labor and input goods in order to produce output goods. But even in this more complicated sounding case, the dynamics are the same. Market participants will adjust prices until the quantity supplied is equivalent to the quantity demanded in each market. And at this point, market participants have no incentives to continue to adjust their resource allocations. They will have acquired a magnitude of goods for which their marginal utility exceeds marginal cost. And they will have supplied a magnitude of goods for which their marginal revenue exceeds marginal cost.

For a quick demonstration of these concepts, visit Exploring Supply and Demand from the University of Nebraska, and watch the supply and demand curves shift. It's a great way to see how well you understand this!