Market Deregulation and the Cost of Capital

Please read Section II (Problems in Managing the Restructured Industry) from Morgan, et al. and have a look at the presentation from Gary Krellenstein. Krellenstein's presentation in particular, while focused mostly on transmission investment, raises a number of really important issues regarding how changes in market institutions - such as decontrols on wellhead prices for natural gas, or electricity deregulation - have changed the investment environment for large energy projects. These impacts have perhaps been most evident in electricity, but are not confined to just the electricity sector.

The main idea from both readings is that deregulation has done two things simultaneously. First, it has removed the guarantee of cost recovery from major energy projects such as power plants. (Krellenstein's presentation is focused on transmission because, at the time that it was written, the U.S. federal government was considering proposals to deregulate transmission the same way that it had deregulated generation. In the end, it did not, and most transmission lines continue to enjoy cost recovery ensured by the state or federal government.) This means that energy projects need to earn sufficient revenues to cover costs, plus meet the rate of return demanded by investors. Second, commodity prices in deregulated energy markets are volatile - we have seen this in previous lessons with oil, petroleum products, natural gas, and electricity. Since the revenue stream for energy projects became more volatile, the projects themselves are viewed as being increasingly risky.

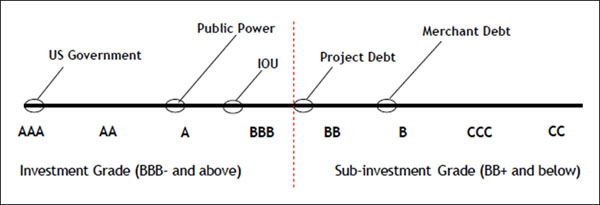

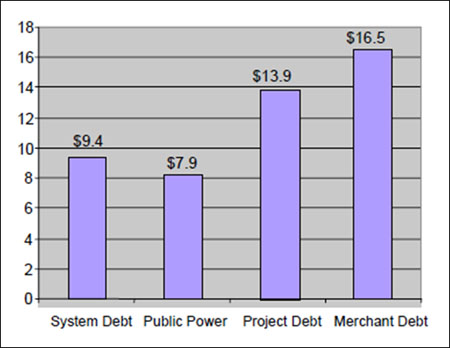

The point that Krellenstein makes on slide 13 of his presentation about "system" versus "project" financing sums it up nicely. From an investor's point of view, regulated energy markets are safe because the risks of cost recovery are effectively shifted from the project's owners to the people who pay energy bills. This may not be economically efficient, but from capital's point of view it is safe. Deregulation has shifted some of this risk back to the project's owners (i.e., the company building/operating the plant and its equity shareholders). This is why Krellenstein points out that the majority of "project financed" energy investments are heavily weighted towards debt financing. Since this debt financing is not highly rated (see Figure 3.1, from Krellenstein's presentation), it carries higher yields. The equity component of that financing also becomes more expensive since investors demand returns over a shorter time horizon, as shown in Figure 3.2 (also from Krellenstein).