When we hear politicians talking about energy policy, one of the buzz phrases that comes up often is energy independence. It's one issue related to energy policy where politicians agree - being energy independent is preferable to relying on the resources of other countries to meet our huge energy consumption demands.

Let's move beyond energy independence as a buzz phrase, though, and take a look at the facts about where our energy comes from, how much that costs us, and how we would really achieve energy independence as a country.

| Country | Percentage of Imports |

|---|---|

| Canada | 60 |

| Mexico | 11 |

| Saudi Arabia | 8 |

| Columbia | 4 |

| Brazil | 2 |

Petroleum - the EIA categorizes crude oil and other petroleum products (including gasoline, diesel, heating oil, propane, liquefied natural gas, and biofuels) together. These fuels are used for a variety of functions, including transportation and home heating. In 2022, the U.S. consumed an average of 20.01 million barrels of oil.....every day. This added up to 7.3 billion barrels of oil for the year.

Are you surprised when you look at the previous chart? I was the first time. I had assumed that a much higher percentage of our oil came from the Middle East.

Take a look at the EIA Energy Explained site to learn more about energy production and consumption.

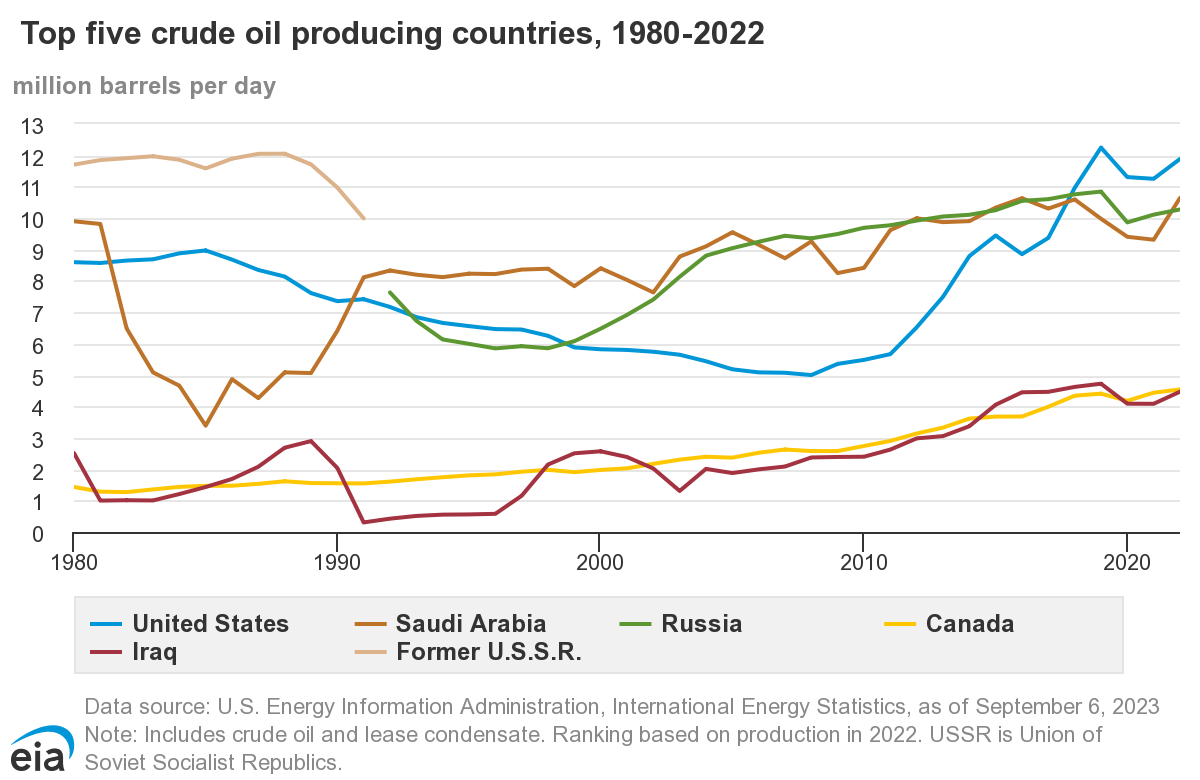

The chart above illustrates the fluctuating production rates for the top five crude oil producing countries in the world. Does anything surprise you? Notice how shortly after 2000, Russia began producing almost as much annually as Saudi Arabia. US production has increased sharply in recent years and is now the world leader, while Iraq has been slowly increasing since around 2005, but has been in the 2-4 million barrels a day range since 1980 (conflict times aside).

Natural gas - most of the natural gas that we use in the United States is extracted and distributed domestically, with small amounts coming from Canada. In recent years, substantial gas reserves in rock formations across the country have been discovered and are starting to be explored and processed. We've already talked about one of these, the Marcellus Shale region across Appalachia. Natural gas is used for heating and cooking, and increasingly as a fuel for large vehicles like buses and trucks.

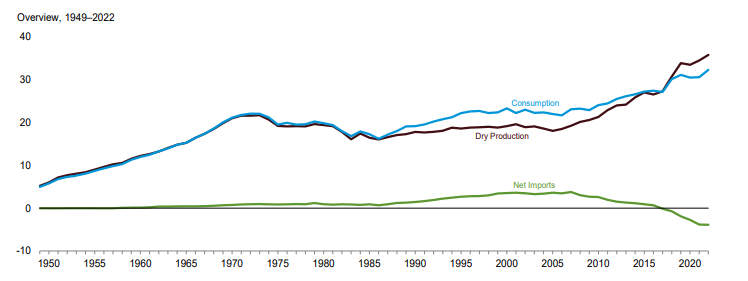

The chart below shows the US consumption, production, and imports for natural gas from 1950-2016. If you look around 2005, you can see the impact unconventional production has had on overall production and consumption. Why the increase in consumption? As natural gas prices fell, many coal-fired boilers in steam plants were converted to burn natural gas or replaced with natural gas boilers. You can also see that as domestic production has increased in recent years, imports have gone down, which is what you would expect.

A gateway fuel? - Natural gas is often touted as a bridge to a cleaner, more reliable energy future. With greenhouse gas emissions roughly half those of coal combustion, natural gas is being marketed as a cleaner fossil fuel. Partially because of the direct emissions reduction, but also because it has become cheaper to produce than coal, mostly due to fracking. The U.S. currently generates about 40% of it's electricity from natural gas.

Lifecycle assessments evaluating the entire processes involved in extraction and processing for both fuels are being done to determine the true environmental footprint of using these fuels. This includes recent research out of Harvard, Duke, and NASA that found that natural gas has just as much of a climate impact as coal and will continue to until gas companies "all but eliminate leaks," according to the New York Times.

Working with renewables? - In addition to the (possibly) lower greenhouse gas emissions than coal, power plants fueled by natural gas have another distinctive benefit of offering reliable, scalable backup power generation for renewable sources like wind and solar. Wind and solar supplies are less predictable and may fluctuate in short cycles. With little ability for commercially-available large-scale storage options for these energy sources, the presence of a reliable back-up source is crucial. Natural gas-fired power plants have the ability to cycle more rapidly than their coal-fired counterparts, quickly adjusting the amount of electricity they can produce to meet demands.

Coal - the abundant domestic fossil fuel is in many ways an iconic and cultural fixture in our society, denoting progress and growth. Coal is cheap (not including externalities, of course), readily available, and we've got the infrastructure to burn it. Coal is responsible for about 20% of the electricity in the US. We also use coal in the production of steel. Unfortunately, coal combustion results in high greenhouse gas emissions. In addition to consuming a lot of coal domestically, we also produce and export large quantities of coal. Some areas of the country (like the Gulf states) actually find it cheaper to import foreign coal than to transport it from the distant domestic places of origin.

Five states produced approximately 70% of US coal in 2021 (EIA, 2023):

- Wyoming - 41%

- West Virginia - 14%

- Pennsylvania - 7%

- Illinois - 6%

- Montana - 5%

The Road to Energy Independence - as you can see by examining the roles of various fossil fuels in our overall energy picture, we are not, as a country, currently totally at the mercy of foreign energy supply. But remember, as we gulp down over 20 million barrels of oil a day, even a fraction of that is still a large volume.

Will increasing our use of natural gas be the answer to solving our shorter term goals of reduced reliance on foreign oil? Remember that it's not as easy as flipping a switch....things currently running on petroleum-based products must be converted or replaced to accommodate a new fuel source like natural gas. One major barrier to fuel-switching is that about 2/3 of our oil use is in the transportation sector. Natural gas vehicles are not the answer, but electric vehicles might be if - and only if - we switch to less carbon-intensive (and eventually, carbon-free) sources of electricity. Not only will this require a scale of transportation technology deployment that hasn't been seen since the automobile started to be mass-produced (I wonder what they did with all of those out-of-work carriage horses?), but it also requires us to change our electricity fuel mix, our electrical grid, and generate more electricity to accommodate the increased the electricity demand. This is possible, but what will be the drivers for these changes? Consumer demand? Escalating energy prices? Volatility in oil exporting regions? Political will? Do you think we'll see an energy independent United States in our lifetime? If so, what role could/should energy policy play in this transition?

Global Markets, Local Effects: Several years ago, we witnessed a ripple of protests across oil producing countries, as citizens demand democracy and freedom. Here's an article explaining how unrest in Libya influenced global oil prices. Read this and do some research on your own to better understand the price fluctuations at the pump. Here's another article explaining how Saudi Arabia's price war with Russia at the start of the coronavirus pandemic also created chaos. Just another reason to bolster our domestic clean energy initiatives!

The EIA offers a summary of Oil Prices and Outlook is certainly worth 5 minutes of your time because it offers perspective that is 1) factually correct and 2) all too often missing from the dialogue regarding the subject to which we're exposed via the popular media and our politicians.