Natural gas storage facilities provide the industry with flexibility. During times of “peak” demand such as harsh winters or extremely hot summers, utilities can rely on supplies stored beneath the ground. Likewise, during times of low demand, excess supplies can be stored for when they are needed. For savvy marketers, storage capacity can be used to take advantage of the price fluctuations in the market. There are three main types of natural gas storage facilities: depleted oil & gas reservoirs, salt caverns, and aquifers.

The following lecture covers the types of natural gas storage, traditional and current uses, and the industry players who use storage capacity and why.

Key Learning Points for the Mini-Lecture: Storage

While watching the mini-lecture, keep in mind the following key points:

- Storage facilities provide "peaking" supply in times of increased need.

- Storage facilities can be used to store excess supply in periods of low demand.

- Storage facilities are largely depleted oil & gas reservoirs but can also be salt caverns and aquifers.

- LDCs have long used storage facilities for supply during extreme cold.

- Electric utilities rely on storage facilities for extra supply during peak air-conditioning loads.

- Marketers use them to provide a variety of value-added services and to take advantage of price swings.

Mini-lecture: Storage (12:32 minutes)

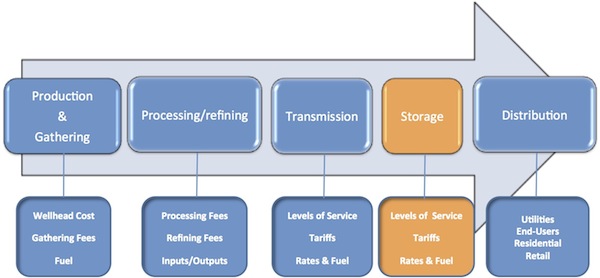

Now we have gathered the gas. We have processed it. We have put it in the transmission pipelines. Before we take it on to the local distribution companies and ultimate end users, there is an incremental step-- which may or may not occur-- and that is the underground storage of natural gas.

Here, again, is the energy commodity logistics and value chain. You can see that the fourth step in our process here is that of storage. Here's a cutaway of what a potential storage facility could look like. Again, it's really just, in most cases, a depleted oil and gas reservoir. So you treat it the same as you would a typical oil or gas well.

Here we have some vertical wells and one horizontal well. This is a good example of what a horizontal well looks like. You can see that by cutting across the reservoir horizontally you can extract more production than the straight, vertical holes that come down in traditional wells.

This is an above ground shot of a storage facility. You don't see the caverns. You just see what's above ground. In this particular case, there is a pipe being laid that's going to connect a power plant directly to this storage facility.

Traditional uses for storage-- mostly by local distribution companies or gas companies in the winter time, when there was high demand and there was not enough wellhead gas to meet the demand. And so gas had been stored, mostly in the summertime, and was utilized for what we refer to as peaking supply, that is when demand peaks due to unforeseen changes in the weather.

The summertime-- low demand for natural gas, because again it was mostly a winter fuel. Also, prices tended to be lower in the summer than the winter time, because of lower demand. Also, pressure relief-- as we saw in those photos as to what can happen when the pipeline pressure gets too high, when the pipeline pressure is, in fact, high, pipeline companies can put some of that gas in the ground and reduce the pressure. Also price opportunity-- when prices dip, one can buy some natural gas at those lower prices, stick it in the ground, and save it for when demand may go up and prices can be higher.

Probably, though, the number one utilization of underground storage by gas companies is for emergency deliverability. We mentioned that term deliverability in talking about the well head, the amount of gas that can be pulled out on a given day. We have seen harsh winters just two years ago, the winter of 2010, 2011, was fairly harsh. And so local distribution companies, your gas company, can rely on gas in storage to supplement the wellhead gas that they're receiving otherwise.

In the Gulf Coast region, if there is, in fact, an active hurricane that enters the Gulf, a lot of the offshore rigs are going to be evacuated and shut down. There's a substantial amount of natural gas that is then curtailed. Well, supply in underground storage facilities can supplement the loss of that natural gas deliverability.

Traditional operators and users of natural gas storage facilities-- mainly the pipeline companies in both the supply and market areas, and then local distribution companies in the market areas themselves.

Types of natural gas storage-- there are mainly three types. Depleted oil and gas reservoirs being the most common. Why? Because you're taking what used to be an oil or gas well, and you're now going to put natural gas down in it. So we already know the characteristics of the wells. We know how much natural gas they can hold.

There are also terms, permeability and porosity. These are geologic terms. The permeability is how much natural gas can actually be held in the formation. And then the porosity, the types of little pores in the formation itself as well. Those two combined can give us a determination of the deliverability of that particular reservoir. That would allow us to determine whether it would make a good storage facility or not.

We can inject gas from the transmission pipeline. If the pressure's high enough, the gas will freely flow into the formation. As we add natural gas to the formation, and the pressure increases, we may actually need to use compression to draw the gas from the transmission pipeline, and shove it down into the reservoir.

Conversely, when it's time to utilize the gas, we can withdraw it. If the pressure is high enough, that is if it's higher than the downstream transmission pipeline, it'll free flow. At such point in time, as the reservoir pressure meets or is less than the downstream transmission pipeline, we'll use compressors to boost the pressure up from the reservoir.

Oil and gas reservoirs converted to storage take approximately 50% of the capacity to be filled first before they can utilize it. We refer to this as the cushion, or base, gas. So, for example, a one billion cubic foot natural gas reservoir that we would like to convert to storage is going to take 500 million cubic feet of natural gas to be put in place first. The tier above that is what we refer to as the working gas. It is the usable space. It is the recoverable gas. This factor itself is one of the reasons why developing storage facilities can be so expensive -- because that initial 50% of natural gas will have to be purchased and cannot be sold until the end of the life of the storage facility when it's extracted.

Another type, and these are very much used along the Gulf Coast, are salt domes, or salt caverns. There is literally a large, impermeable hole. When the natural gas, or natural gas liquids, are put into salt caverns, they do not escape. If you find a salt formation, it's very easy to form one of these.

High pressure water carves out the reservoir. Then you inject gas into the cavern. And free flow it in or compress it, just as you will with the oil and gas reservoirs. The converse process of withdrawing, again, can also be free flow or compression. These actually have very high deliverability. They can be cycled numerous times. That means gas can be injected one day, withdrawn the next day, and so on. And so they make a very, very worthwhile type of storage facility.

Aquifers, these are water formations that are utilized for storage. You generally see these only in the upper-Midwest market areas, where they are used for emergency supply. You're pushing gas into the aquifer, the water comes out. When you need the natural gas, you push water back in and take the gas out.

Now, these are the least desirable types of storage facilities. There's a high development cost because there is no pre-existing facility in place. The aquifer reservoir characteristics are literally unknown. The boundaries of an oil & gas reservoir, or the boundaries of a salt cavern, can be determined, but not an aquifer.

The base gas requirements-- we talked about an oil & gas reservoir requiring about 50% of base gas. In the case of an aquifer, you need 90% base gas to hold back the water. So you only have about 10% of capacity that you can utilize. And then you're going to have to use gas compression to force the gas into the aquifer, or water injection, when you wish to remove the gas.

We have a couple of classifications of storage. We have what we call seasonal, and these are mostly the depleted oil and gas reservoirs. We inject gas in what is normally the lower demand, lower price period of April through October. And then we withdraw the gas in what we refer to as the winter months of November through March.

Now, these time-frames are very key to the industry. Pricing for natural gas, when we talk about seasonal pricing, we use the terminology summer and winter. They are not the typical summer and winter periods that we're accustomed to. There are no four seasons within the natural gas marketplace. We talk about summer being April through October because it corresponds to the injection period for natural gas storage. And we talk about the winter as being November through March, because it is the typical withdrawal period for natural gas storage.

High deliverability classification of storage are your salt caverns and your enhanced depleted oil and gas reservoirs. Has there been additional compression added to the oil and gas reservoir storage facility? Do we have horizontal wells? Both of those will increase the deliverability of the oil and gas reservoir. Salt caverns by themselves have high deliverability characteristics.

Current users-- we see pipelines still using these to provide what we refer to as market-responsive services. Seasonal storage, as well as cyclable storage-- cyclable storage meaning that you can inject or withdraw at any point in time during the term of the contract that you have with the pipeline and their storage affiliate. Park and loans-- this is a short-term service that pipelines can provide. If you have excess gas, they allow you to store it in their facility for a short period of time. If you find yourself short of supply relative to demand, you can also borrow some gas from the pipeline for a certain fee. But you will actually give them the molecules back upon the repayment time.

Local distribution companies, again your gas companies-- traditional storage usage. They're going to use the storage for short-term peaking of services. These days, however, what they pay for storage is going to be regulated by the respective public utility commission in the state where the LDC operates.

The largest group of current users are your marketing and trading companies. We will talk briefly later on about the deregulation of the industry. But there are third-party marketing and trading companies that are now providing services that were once provided by the pipelines and LDC's. We call this the re-bundling of those services. So they can provide peaking gas. They now provide same-day gas. That is, if the utility or end-user needs gas today, for some reason, because they have storage capacity they can sell them gas today.

In other situations, they can provide gas on demand. A marketing and trading company with cyclable storage can literally allow an electric utility, for example, to draw gas from them as they need it. Each one of these services commands a premium. And this is really where marketing and trading companies make their money on these added value services. They cannot provide these added value services, however, without storage.

Storage facilities also allow them to respond to changes at the markets. Price volatility, that is the movement of price up and down, as well as the speed at which price changes occur. Those represent opportunities for savvy marketers to buy and sell. And they can do this because they have storage facilities that will allow them to store the gas when prices are lower, and to sell gas when prices are higher, both in the physical cash market, as well as in the financial market on the New York Mercantile Exchange, which we will talk about in both lessons seven and eight.