The Prize, Chapter 21 Overview

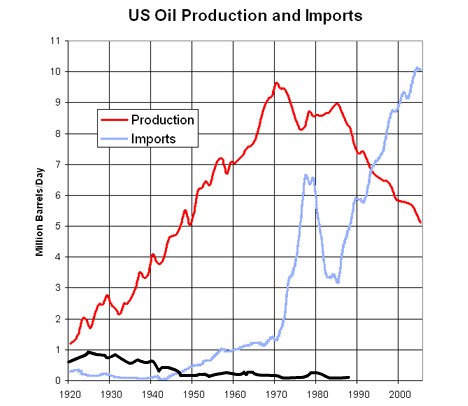

Gasoline rationing was lifted in August 1945 in the U.S. within 24 hours of Japan’s defeat, and the operative phrase for most motorists at the gas station was “Fill ‘er up!” By 1950, oil was meeting more of America’s total energy needs than coal. While demand was increasing, supply was not decreasing as expected, due to new discoveries in the U.S. and even Canada, near Edmonton in the province of Alberta. Eventually, however, there was a shortage of available oil in 1947-48. Consumption rose with unexpected rapidity, and as it took time, money, and materials to redesign refineries to turn out products consumers wanted, supply could not catch up fast enough. But in 1948, imports of crude oil and products together had exceeded exports for the first time, creating an ominous new phrase, “foreign oil.” The figure below shows the stark difference in trends of domestic production and import. This divergence, especially with imports outpacing domestic production, is a red flag for energy independence, security, and flexibility. To this day, we see the challenges of depending on others for our oil needs.

U.S. production increased fairly steadily between 1920 and 1970. Increasing from around 1.2 million barrels/day in 1920 to 9.5 million barrels of oil/day. Production then decreased and flatlined at 9 million barrels/day between 1975 and 1985. Production then decreased steadily until only 5 million barrels were produced per day in 2005.

U.S. imports were between 0 and 500,000 barrels a day until ~1942 when it increased steadily to 1.2 million barrels/day in 1980. Imports then spiked to around 6.5 million barrels/day in 1980, dropped to ~3.2 million barrels/day in 1983. Then imports rose again to 10 million barrels/day in 2005. Imports surpassed production around 1994.

Exports remained fairly low, between 1 million barrels/day to no barrels a day. In 1950, exports decreased to almost nothing, and the graph shows exports being too small to graph around 1988.

Hence, energy security was a big issue for the Western Powers. Oil became the convergence point for foreign policy, international economics, national security, and corporate interests, and both Britain and the U.S. were intent on ensuring access to oil based on the lessons learned from WWII, the growing economic significance of oil, and the magnitude of Middle Eastern resources. Taking into consideration all the risks, Socal realized it would be best to pursue a policy of “solidification” and bring in new partners to gain market access & spread the risk.

Here the delicate dance began for American oil companies to have access to the oil of Saudi Arabia. Saudi Arabia had much oil, but it needed the partnership and agreements to leverage that resource. But it was a very volatile area. Clearly, enlarging the participation to more American companies only furthered the fundamental goals of American strategy to increase Middle East production, ensure that the Saudi concessions remained in U.S. hands, and conserve America’s own resources. Even though it is obvious now, as early as the late 40s, the US saw the strategic importance of the Middle East for oil. All of this led to the setting up of three landmark deals that will change the face of the global oil market for the future. Each of these deals involved a specific Middle East region, and had unique attributes, conditions, and drivers. Not all deals were the same.

The first of these deals involved Saudi Arabia and the expansion of Aramco. This deal was driven by a desire to have only American participation within Aramco. The second deal involved Kuwait and was driven by a need to get Kuwaiti oil into the European marketplace. The third deal involved Iran and was focused on ensuring stability in Iran and protection from the Soviet Union. With the completion of the three huge deals (Aramco, Gulf-Shell, and the Iranian contract) things (mechanisms, capital, and marketing systems) were in place to move vast quantities of Middle Eastern oil into European markets.

The US has experienced its share of energy crises. But in the immediate post-war period, it was Europe that was in dire straits. Throughout Europe, destruction and disorganization were everywhere, and food and raw materials were in desperately short supply after the war. Economic disarray from the longest and coldest winter weather in 1947 and the energy crisis increased the shortage of the dollar that also minimized the ability to import goods and caused a chain reaction that crippled the economy throughout Europe.

We see during the reconstruction period in Europe after the war that although the overall goal was to rebuild the economy, it was rooted in the oil industry. Energy was fundamental to any rebirth. The first issue addressed was the energy crisis. For most of the European countries, oil was the largest single item in their dollar budgets. The Marshall Plan made it possible for the European economy to change from coal-based to one based on imported oil. Without oil, especially Middle East oil, the Marshall plan could not have succeeded. There are periods in

history, where fortuitous alignments of conditions act as a catalyst to enact change. Europe’s needs and Middle East oil production around that time made a powerful and timely combination.

It was also interesting to see how oil markets were so important to some countries, that maintaining that stability forced them to make adjustments contrary to other goals and commitments. As a result, construction of the Tapline continued even during the Arab-Israeli War! So concerned were they to not risk losing the American role in transporting Middle East oil to Europe, that they were against us on one front, but in partnership on another front- at the same time.

Britain’s major sources of oil were Iran, Kuwait, and Iraq, and the U.S. was also becoming an ever more petroleum-based society. Therefore, Soviet expansionism, especially towards the Middle East, brought the area to center stage as the Middle Eastern oil fields had to be preserved and protected on the Western side of the Iron Curtain to assure economic survival of the Western world.

Often, and as we saw in earlier years, crisis breeds innovation. Americans were very much aware of energy dependence on the Middle East and how the security of supplies could be assured in a future conflict, and some argued for importing more oil in peacetime in order to preserve domestic resources for wartime. Many also advocated building a synthetic fuels industry by extracting liquids from the oil shale in the Colorado Mountains and developing natural gas.

With the expensive synthetic fuel route and offshore development, the issue was whether there was another alternative to imported oil. The answer was found in natural gas that was considered a useless, inconvenient by-product of oil production and was burned off or flared. Although not a big percentage of fossil fuel use, natural gas did take some of the stress off by reducing US oil demand. As we see today, natural gas has “saved the day” time and again.

The Prize, Chapter 21 - The Post-War Petroleum Order

Sections to Read

- Introduction

- The Great Oil Deals: Aramco and the "Arabian Risk"

- Erasing the Red Line

- Gulbenkian Again

- Iran

- Europe's Energy Crisis

- No Longer "Far Afield': The New Dimension of Security

- The End of Energy Independence

Questions to Guide Your Reading:

- What happened with consumption and production in the Post-War era?

- What were the three great oil deals?

- How did Middle Eastern oil figures in the recovery of Europe and Japan?