Reading Assignment

Please read "Special Topic: Are We Running Out of Resources" in Gwartney et al. (no reading in Greenlaw et al.).

An enduring concern, one that continues to be raised time and time again, is that we are running out of resources. This manifests itself in several ways. In the big picture, some people claim that the continuing existence of human beings on the planet is unsustainable - that the rate of population growth that has been observed over the past century will render the earth "full" sometime soon, with the result being a massive reduction in aggregate human welfare.

One of the most comprehensive recent assessments of this issue was written by Lester Brown, a well-known and active environmentalist who has been issuing warnings about our impending decline for many years.

Recommended Reading

The reference for this article is: Brown, Lester R. Nature's Limit, (Chapter 1) from the State of the World 1995, Worldwatch Institute, Washington, D.C.

In brief, Brown asks: Is civilization about to crash? He is not alone in asking this question - there are many geographers and sociologists that devote their entire careers to studying the “carrying capacity” of the earth, which is the maximum number of people the earth’s resources can provide food and water to.

This number, the maximum number of people the earth can "sustainably" support, has grown over the years with changes in technology, especially agricultural advances. Brown is the champion of the concept of "sustainable development", which refers to a way of life in which humans are "in balance" with nature, and not causing a net draw on nature's resources. The idea being, if we are diminishing the quality of the environment, and continue along the same path, then, inevitably, nature will be destroyed, and the human society that it supports must also fail.

This way of looking at the world is known as "Malthusianism", so named after a 18th-19th century English scholar and parson named Thomas Malthus. Malthus made the observation that while the population of England was increasing at some exponential rate in the early 19th century, the quantity of food being grown was only increasing at a linear rate.

Recommended Reading

Malthus's most famous work on this issue was entitled "An Essay on the Principle of Population", and a decent summary of "An Essay on the Principle of Population" can be found at Wikipedia (I won't ask you to read the original!)

It is not difficult to see that Malthus was in error: Britain (and the world) has many times the population it had in 1800, but widespread food shortages and starvation have yet to appear. The clear answer is that food production has more than kept up with population growth, to the extent that today the global population has never been higher, but on an average basis the world is consuming more calories than at any time in human history. Why? The short answer is, technology. We'll talk more about this in a little while.

Malthusianism is a strain of what is called "resource pessimism", the general idea that we are forever close to running out of something important, and dooming humanity to either a wretched existence or a miserable end. It is sometimes referred to as "doom-saying". This appears to be somewhat of a built-in human trait, and probably has some value as a survival mechanism, although I am not an expert in psychology and thus will refrain from further comment on that issue. There is, however, an opposite point of view to pessimism and doom-saying, a worldview that is sometimes referred to as "cornucopianism", from the word "cornucopia", which refers to the "horn of plenty', a symbol of abundant food supplies dating back to the ancient Greeks. The most ardent recent advocate of cornucopianism was a University of Maryland economist named Julian Simon. Please read the following article from Wired Magazine, which is a good summary of Simon's outlook.

Reading Assignment

Regis, Ed. The Doomslayer. Wired Magazine.

In the above article, you will find an explanation of Simon's bet with Paul Ehrlich, a doom-saying environmentalist who claimed that civilization was on the brink of collapse in the 1970s. Simon offered to bet that Ehrlich was wrong. The details of the bet were that Ehrlich would pick any five commodities, and the price change over the period 1980-1990 would be examined. If the prices were lower in 1990 than in 1980, Ehrlich would pay the difference. If higher, Simon would pay. Economic theory tells us that as something becomes scarcer, its price will increase - that is, the cost of supplying it will increase, because it is harder to obtain. Couple this with the fact that as population grows, the demand curve for commodities moves outwards. We learnt earlier in the course that an upward movement of the supply curve coupled with an outward movement of the demand curve would result in a definite increase in price.

Ehrlich chose five metals that he thought we were going to "run out of" in the 1980s: chromium, copper, nickel, tin, and tungsten. A virtual purchase of \$200 of each was made in 1980. By 1990, this \$1,000 worth of metals could be purchased for \$424. The price of each metal had fallen, some in a major fashion (tin went from nearly \$9/lb to under \$4.)

I will note that the consumption of each of these metals increased over the 1980s, while their price fell. Looking back into our course notes, we discover that this is the result of two things: an outward movement of the demand curve coupled with a downward movement of the supply curve. A downward movement of the supply curve means that the cost of producing something has dropped. In this case, the costs of producing each of those metals fell, primarily due to improvements in the efficiency of mining technology.

This takes us back to the notion of sustainability: if we take any current practice, and extrapolate out from the past few data points to some point far into the future, it is almost certain that we will bump up against some sort of system constraint. The fault lies in extrapolating based upon past data, especially recent data, which typically occupy a larger space in one's consciousness than more distant data. However, the world is not linear. As we approach constraints, we change our behavior. When something gets excessively scarce, its price rises, and we choose substitutes. More frequently, we advance technological methods and increase efficiency. A couple of examples: in the first half of the 19th century, the most common source of fuel for domestic lighting was whale oil. As population grew, the amount of whale oil consumed grew, and people began to get worried about humanity killing off all the whales and running out of whale oil. Well, as it turned out, we use basically no whale oil today, and certainly none for lighting our houses. Not because we ran out of whales, but because we developed a substitute, in fact, two substitutes. The first was kerosene, which was derived from petroleum.

Trivia note: petroleum gets its name from the Greek word for rock, "petra", and the Latin word for oil, "oleum", so it was initially marketed as "rock oil", to differentiate it from whale oil. It is like "television" in that it is a word formed from one Greek root word and one Latin root word.

OK, back to the topic: the first major use of petroleum, during the period 1860-1910, was for lighting homes. The automobile did not become the main consumer of crude oil until early in the 20th century. It was a cheap and easier-to-obtain alternative to whale oil. However, it was not without its faults. It gave off vapors that smelled bad and could be dangerous, and having open flames inside a house was often fatally dangerous. Thus, kerosene as a home lighting source was replaced by an even cheaper and easier to use product - the electric light bulb. The whales were saved not by environmentalists or government actions, but by technology, first in extracting oil from the ground, and secondly in building a light bulb that was able to use remotely-generated electricity.

The second example of what appeared to be an intractable resource problem refers to transportation in New York City. At the turn of the 20th Century, New York was a fast-growing city enjoying rapid growth in wealth. One thing people do when they get a little money is travel, and in New York in the 1890s, the most popular form of transport was by horse-drawn carriage. Unfortunately, horses present a bit of a pollution problem: they have, to put it politely, "emissions". The number of horses plying the streets of New York was so great that the city was having great difficulty with the amount of waste product that came from horses: It was difficult to remove manure quickly enough, and the gutters were running full of urine, which attracted a lot of flies and disease and made the city generally a very unpleasant place to walk around, due to the very unsavory aromas. Since the city was growing, it was assumed that the number of horses in the city would grow, and the problem would only get worse. Nobody could imagine a workable solution. Of course, there are far more people in New York today than 115 years ago, but we seem to have solved the problem of horse manure. The answer, obviously, was the development of the automobile. It is perhaps easy to see why the urban planners of 1894 could not see the solution, since it was just in the process of getting invented a few thousand miles away in Europe.

Recommended Reading

You can read a little bit more about this topic here: Morris, Eric. From Horse Power to Horsepower, Access, Number 30, Spring 2007.

Mineral Scarcity

The spate of overpopulation doom-saying in the 1970s and 80s has abated somewhat. However, it has been replaced in large part by another type of resource-scarcity pessimism. This is the notion that we are going to run out of energy, specifically, we are going to run out of the fossil fuel energy that powers much of modern society.

This is not a recent development - indeed, questions about the impending exhaustion of a fossil fuel began shortly after we began using fossil fuel. In 1865 an eminent British economist named Stanley Jevons wrote a treatise entitled The Coal Question, where he raised the scary thought that at the current rate of consumption, Britain was due to run out of coal in perhaps 30 years.

Recommended Reading

A brief summary of the Coal Question can be found at Wikipedia.

I should note that there are still coal reserves in Britain, 145 years after Jevons' essay. That they are not being extracted, and why, is another question we will address shortly.

Petroleum (crude oil) was first produced in commercial quantities in northwestern Pennsylvania in the 1860s. After about 10 years, the Pennsylvania oil fields were largely tapped out - mostly because of poor oil reservoir management - this was the very first commercial oil find, and the people producing it did not understand the proper way to optimize production from an oilfield. Stated simplistically, underground pressure pushes the oil to the wells, and it can either push the oil out of the well, or the oil can be lifted. But we need reservoir pressure to "squeeze' the oil out of the rock. Maintaining reservoir pressure is one of the most important aspects of oil production, but because the early producers did not know this, they drilled thousands and thousands of wells in close proximity to each other, and bled off the pressure in the reservoir, and thus ended the great Pennsylvania Oil Rush. All that is left of it are two famous oil company names - Pennzoil and Quaker State - and a little bit of oil production still in place around Bradford, PA. So, within a decade of the first big oil find, we had the first scare about us running out of oil. We have had many since.

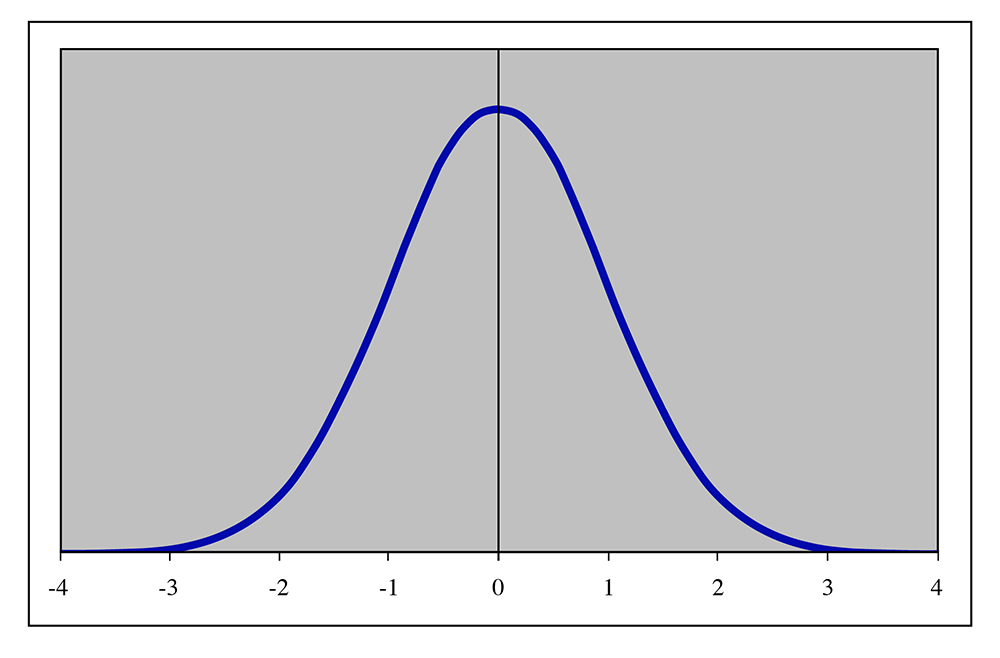

Today, the argument about oil scarcity is addressed under the umbrella of the term "peak oil". This term refers to the idea that the production of oil from an individual oil field, when plotted against time, approximately follows the shape of a normal distribution, whereby it starts low, increases to a maximum value at a peak, and then declines in a symmetrical fashion. The following figure shows what a normal distribution looks like.

The idea that oil production follows such a function was developed by a geologist named M. King Hubbert, and as such are called "Hubbert Curves".

At this point, you can probably guess what I am going to say next. This curve looks very scary: as soon as we pass the peak, the decline will be very fast, and many, many bad things happen as we "run out" of oil, and, of course, there is no shortage of people who believe that we are at the peak, or that we have passed the peak, or we will be over it very, very soon. "The end is nigh", says the man with the sign on the street corner. He may be right one day, but he has not been yet.

Why should we not worry about running out of oil? It seems like an eminently sensible proposition: oil is created very slowly, over hundreds of millions of years, and we are using it up much faster than it is being made. There is a finite amount in the earth's crust, and every barrel we extract means one less barrel in the ground. Surely, this can only mean that one day we will run out; how can it possibly be otherwise?

Your humble professor's contention is that we will never run out of oil. By this, I mean that for the entirety of future human existence, no matter how many thousands or millions of years that may be, there will be oil left in the ground. How so? Why, economics! As the oil in the ground gets scarcer and scarcer, the cost to extract it will increase, and its price will go up. One day, maybe soon, maybe not, the oil that is left in the ground will be so expensive to extract that we will not be interested in extracting it, much like we are no longer interested in harvesting lamp oil from whales. Economic theory tells us, when the price of a good increases, the quantity demanded of its substitutes will increase. One day, oil will be more expensive than the alternatives.

In the meantime, the price of finding new oil has not increased meaningfully over the past 20 years. The market price of oil has gone up and down wildly, gyrating from lows of almost \$10/barrel in the late 1990s to \$140/barrel in 2008 to about \$105 in July 2014, and down to about \$40 in November 2015, and between \$50 to \$60 in 2019 (this changes very frequently). However, much of this price variation is a response to short-term shortages and capacity crunches that are caused by politics, not technology. Much of the world's oil is in places that are hard to get to (offshore, the Arctic), have governments that do not properly reinvest in the oil companies they run (Mexico, Venezuela), have rebel factions that make extracting the oil dangerous and difficult (Nigeria), or choose to voluntarily restrict output to maintain a certain price range (OPEC). However, when one examines the publicly available data on oil lease sales in the US, or the publicly available data on the sales of oil companies (which own oil reserves), it can be shown that the cost of acquiring oil in the ground has not gone up very much recently. This tells us that the difficulty lies with getting the oil out of the ground in sufficient quantities as to keep prices low, and not with finding the oil. The technology for getting oil out of the ground is forever improving - the real obstacles tend to be political, and not technical or economic.

Every time the price of oil rises, we start looking for more, and every time we start looking for more, we find more. If you are interested in looking into this further, here are two words you can give to Mr. Google to see what he tells you: Tupi and Bakken.

So, I am claiming that there is plenty of oil, and we are not near the peak, at least based on available data for the cost of finding new oil. But I also spoke of "substitutes" for oil in the case that we do start to run out. I will talk about these possible alternatives later in this lesson.