Reading Assignment

For this section, please read the "Nuclear Explained" section at the EIA website.

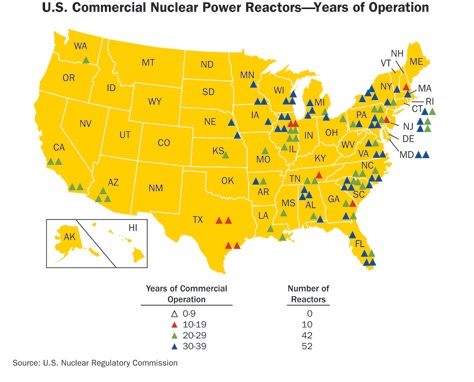

Nuclear power plays an important role in the nation's generation slate. There are 104 commercial nuclear reactors at 65 different sites in 31 states. These plants have a combined generation capability of about 100,000 MW. This is about 10% of the installed generation capacity in the country, but these plants provide about 20% of the electrical power consumed. This is due to the fact that these plants have very high capacity factors - collectively, about 90%. The capacity factor is the average hourly output as a fraction of the maximum possible output, so if a plant was running all of the time, its capacity factor would be 100%, if it ran half of the time, 50%, and so on. This number can be compared to coal generation, which has a capacity factor of about 67%, natural gas-fired plants at 26% and petroleum-fueled ones at 7%.

This 90% factor is more impressive when one considers that a reactor has to be taken out of service for about one month out of each 20 months in order to reload fuel into the reactor. This means that nuclear plants run about 95-97% of the time they are physically available. The result is that nuclear power plants provide lots of very reliable, low-cost, around-the-clock power and, as I have said several times, reliability is one of the most important attributes of the electrical system in the US.

Recommended Reading

Below is a map of the locations of all 104 reactors in the US. Please look at this list at the Nuclear Regulatory Commission website, with links to more information about each plant.

With population growing and the high probability that a lot of coal-fired generation will be taken out of service over the next ten years, there were expectations that we would see several new nuclear plants built by 2020. This is a bit of a turn-around from the line of thinking that was prevalent perhaps 10 years ago, when it was broadly assumed that the nuclear industry in the United States was basically dead, and that all of the existing plants would be retired upon the expiration of their original operating licenses, which were typically for periods of 25 to 40 years. Since all of the existing nuclear plants were built between 1969 and 1996, it was expected that the fleet would start shrinking in the 2000s, and be completely eliminated by 2040. This belief arose in the aftermath of two major nuclear accidents: the Three Mile Island accident in Harrisburg, PA in 1979, and the Chernobyl accident in the Soviet Union in 1986. After Three Mile Island, the construction, licensing and operations protocols in the United States became much stricter. About 60 plants that were planned in 1979 were subsequently cancelled. Construction at plants that were in the process of being built was slowed drastically, and inspections became much more stringent. No new plant was licensed for construction after 1979.

The Chernobyl accident, which was much more severe than the Three Mile Island accident, was, at the time, seen as the death knell for the nuclear industry in the US.

Recommended Reading

Good summaries of both accidents can be found at the following Wikipedia links. Please read if you are interested in learning more about these accidents.

It should be noted that Penn State has acquired a large collection of official documents, reports, photos and tapes concerning the Three Mile Island accident.

However, as we entered the 2000s, it began to be clear that retiring existing nuclear power plants would present some difficulties - primarily, that they would have to be replaced with similar quantities of generation. It was not clear what we would replace them with - coal was beginning to lose favor as the debate about climate change began to ramp up, gas was seen as a shrinking resource that was too valuable to use for making electricity, petroleum was getting to be too expensive, and nothing in the renewable area has the necessary scale to replace large volumes of reliable, dispatchable base-load power. Since Three Mile Island, the safety record of the US nuclear industry improved, and plants were being run at much higher capacity factors due to advances in management and engineering practices. Furthermore, most of the plants had been mostly or completely paid for. It began to make financial sense to avoid retiring these plants, and in the 2000s, the Nuclear Regulatory Commission began extending the operating licenses of existing facilities. The only plants that were retired were small ones that were too expensive to operate due to manpower requirements.

In the mid to late 2000s, there began to be talk of a "nuclear renaissance". For the first time in a quarter century, companies were beginning to talk about building new plants.

Recommended Reading

Given growing concerns about climate change, even many former enemies of nuclear power changed their position - please see this story from the Washington post.

Between 2007 and 2009, the NRC received license applications for 25 reactors at 15 sites from 13 companies.

However, almost all of these new applications are in doubt. The primary reason: economics. Nuclear power plants are expensive to build - estimates have run as high as \$7,500 per kW. For a new two-unit plant with 3,000 MW (or 3 million kilowatts) of generating capacity, that adds up to over \$22 billion. That is larger than the market value of almost every generating company in the US. Put another way, most companies would basically be betting the entire value of the company on successfully completing a new nuclear plant. Not surprisingly, a lot of CEOs are reluctant to take that bet. It should be noted that the \$7,500/kW figure is also hypothetical, derived from engineering estimates - there are no actual data to base it upon, because we have not built a new plant for so long. Most of the plants built in the 1970s and 1980s were plagued with massive cost over-runs, and there is no guarantee that this will not happen again. Several companies were bankrupted by the plants they tried to build in the first wave of nuclear, and the owners and managers of the generation companies all remember that.

Consider also that the construction and operating costs, while covered by the companies that own the plants, are not the only costs. For example, the amount of liability faced by a nuclear plant is limited by a law called the Price-Anderson Act. The plants collectively pay into an insurance fund to the tune of \$12 billion per year, but if an accident occurs and this insurance pool is depleted, the government picks up the rest of the tab. This law was passed in 1957 to incentivize the building of nuclear plants. It is highly unlikely that any plants would be able to obtain insurance without this act.

The other major cost relates to the disposal of spent nuclear fuel. The Federal Government has been trying to build a permanent deep-geological nuclear waste storage facility at Yucca Mountain in Nevada since 1978, but this project appears to be dead, despite expenditures of about \$20 billion of government money. There are no other plans in place, so spent nuclear fuel is currently stored at the power plants, where it is subject to the same levels of security as the reactor facilities. If and when a long-term solution is found, it will likely be paid for by the taxpayer, not the nuclear operators.

On March 11, 2011, a large earthquake off the coast of Japan triggered a tsunami that struck the Fukushima Dai-ichi power plant in Okuma, Japan. The plant, which was safely brought off-line when the earthquake struck, then lost all auxiliary power. This meant that the plant lost the ability to circulate cooling water through the reactors, which caused some of the cooling water to boil off, exposing radioactive nuclear fuel to the atmosphere and causing a major leak of radiation, the largest seen since the Chernobyl accident.

While the "nuclear renaissance" appeared to already be in rather ill health due to the aforementioned cost pressures, coupled with the expectation of low power prices for many years to come due to the new-found abundance of low-cost natural gas in the United States before Fukushima, it now appears to be all but dead. There are calls to revoke the licenses of many existing plants that share the same design as the Japanese plant. The governor of New York is demanding the retirement of the Indian Point reactors, 30 miles from New York City, their licenses expired in 2013 and 2015. After some negotiation, one of the two reactors eventaully permanently closed in early 2020 and the other is scheduled to be closed in 2021. In January 2010 the Vermont State Senate has refused to renew the state license of the Vermont Yankee plant in Vernon, VT, which was expiring in 2012. In early 2012 the owner of then power plant won a court case to veto the state decision and continued operations. However, the owner decided to close the plant due to the economic reasons in 2014. Anti-nuclear activists are again calling for the immediate retirement of the Diablo Canyon and San Onofre plants in California, both of which were built near the San Andreas Fault, which was the cause of several large earthquakes in California.

It remains to be seen what comes of these actions. The President and prominent politicians in both major parties have since reiterated their support for new and existing nuclear power. When looking forward, one must consider the economic factors. This is a classic case of trade-offs having to be made.

Retirement of existing power plants will likely have the following effects:

- Power will get more expensive, as nuclear power will be replaced by power that has a higher marginal cost - most likely, natural gas. This is another case of shifting the supply curve to the left, and we know that shifting an upwards-sloping supply curve to the left with a vertical (perfectly inelastic) demand curve will necessarily involve a higher equilibrium price.

- Electric grids will become less reliable, as the most reliable source of power will be replaced by plants that go off-line or require major maintenance much more frequently.

- Natural gas will get more expensive. Retiring nuclear plants will mean more gas will be burned to generate electricity. This will shift the demand curve for gas to the right, due to the substitution effect. This necessarily involves an increase in the equilibrium price, as was discussed in lesson 4. Since a large number of us burn natural gas to heat our homes, retiring nuclear plants will not only make our homes more expensive to power, it will also make them more expensive to heat.

For these reasons, I consider it unlikely that we will see any immediate retirements of nuclear plants, although I do consider it likely that agreements will be struck to close some of the more contentious plants in the next 5-10 years, with transition periods put in place to allow electrical system operators adapt to the changes in the structure of the market in their regions. But I have often been wrong about issues like this in the past.

Stay tuned...