In 2008, most economists in the world recognized that we were truly a global society and all of our economies were intrinsically tied-together. Growth or recession in one region of the world could now have a ripple effect on other regions. China and India were emerging as large-scale industrial countries with vast exports of manufactured goods. Both were consuming new, higher levels of energy, and most specifically, crude oil. News of increasing crude imports by both countries sparked buying of the financial commodity contracts.

The so-called “speculators” were blamed for a lot of the price increase that year, but there was a whole new set of players who greatly influenced the market. Investment funds and private investors, both domestic and international, saw the crude market as a “safe harbor” from the ups-and-downs of the stock market and the US dollar. When the stock market fell, they bought crude oil contracts. And when it rose, they sold those same contracts. The dollar is a little more complicated. When the value of the US dollar falls relative to foreign currency, overseas investors have more “buying power,” that is, they can buy more crude with their currency than those holding US dollars. So to some extent, it is true that “traders” had a major influence on oil prices that year. But the definition of “trader” had changed from the stereotypical “day trader,” who wreaks havoc on markets, to sophisticated investors and real demand from emerging nations.

Today, the economic health of various countries still impacts the volatility in oil prices, and the US dollar and crude prices have a very high but inverse correlation. Concerns over the stability of Portugal, Ireland, Spain, and Greece (not so politely known as the “PIGS”) impact the perception of world demand for oil on a daily basis as the collapse of even one of them could create a “domino effect” across other economies. Various economic reports on growth, manufacturing, etc. are monitored continuously.

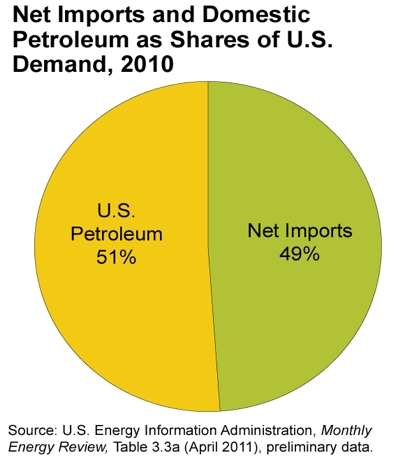

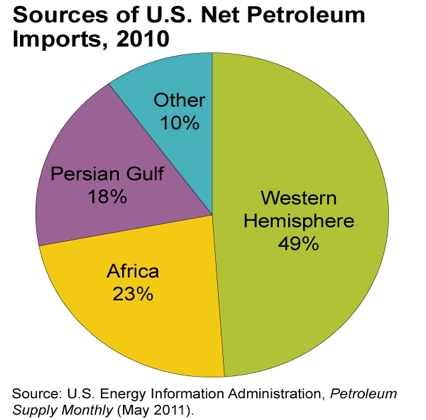

The US currently produces about 6.2 million Bbl. per day of crude oil, representing only about 51% of consumption, with the remainder coming in the form of imports. Domestic production is expected to represent 57% of demand by the end of 2012, reducing imports to 43%. The rise in domestic oil production is mostly attributed to the new, “unconventional”, sources found in shale formations. Advances in seismology (“3-D”), directional drilling (“horizontal”) and, fracturing methods (“fracking”), have made this once inaccessible resource common place today. Contrary to some beliefs, the number one source of imported crude oil in the US is not the Middle East but, Canada. Oil from tar sands in their Western Provinces is shipped via pipeline into the US.

Figure 2 illustrates the current mix of domestic/import crude and liquids while Chart 3 shows the mix of import sources. (Based upon the latest completed study by the Energy Information Agency of the US Department of Energy.)

Among the major factors influencing US crude oil prices are:

- US weather – mostly winter, as the demand for heating oil impacts crude oil prices. The Northeastern part of the US is the world's single largest consumer of heating oil.

- US dollar vs. foreign currencies - as mentioned previously, a de-valued US dollar gives foreign investors more money to buy crude oil contracts.

- US economy - strength or weakness directly impacts the perception of energy consumption. Several economic indicators are released weekly.

- World economy - as stated in the introduction, we are now in a truly global economy and what happens in one country can affect all others.

- Production & imports vs. demand - reports on domestic oil production & imports vs. consumption can cause prices to vary greatly.

- Baker Hughes Drilling Report of active rigs - this oilfield service company keeps track of the total number of rigs actively drilling for oil and gas, and they report the statistics weekly. A rise in rigs means more potential supply coming-on down-the-road. A drop in the rig count could mean less supply down-the-road.

- West Texas Intermediate (WTI) crude vs. Brent North Sea crude - Brent crude prices reflect demand in continental Europe which can influence the price of imported crude here in the US.

- Weekly Crude Oil & Distillates Inventory Report (Energy Information Agency) - The Department of Energy releases a report every week that gives the current amount of crude oil and distillates in the nation's storage facilities. (Distillates include heating oil, diesel, gasoline, jet fuel, etc.) Increases in the inventory are viewed as an increase in supply, while decreases are seen as an indicator of increased demand.