Please read the materials and watch the videos below:

Investing Basics: Bonds (4:47)

PRESENTER: Bonds are a common investment. However, to many investors, they remain a mystery. So let's explore what a bond is and how it might benefit your investment portfolio. A bond is a loan given to a company or government by an investor. By issuing a bond, a company or government borrows money from investors, who in return are paid interest on the money they've loaned. Companies and governments issue bonds frequently to fund new projects or ongoing expenses. Some investors use bonds in hopes of preserving the money they have while also generating additional income. Bonds are often viewed as a less risky alternative to stocks and are sometimes bonds used to diversify a portfolio. Consider this example. The hypothetical city of Fairview wants to build a new baseball stadium, so it decides to issue bonds to raise money. Each bond is a loan for $1,000, which Fairview promises to pay back in 10 years. To make this loan more attractive to investors, Fairview agrees to pay an annual interest rate of 2%, which in the bond world is also known as a coupon rate. An investor buys the bond at face value for $1,000. Now, let's fast-forward. Each year, the city of Fairview pays the investor $20.

These regular interest payments continue for the length of the bond, which is 10 years. Once as the bond reaches maturity, the investor redeem his bond and Fairview returns his $1,000 principal investment. This bond was a good deal for both the city and our investor. Fairview got the money it needed to build a stadium. The investor received regular interest payments and the return of the original investment. Because a bond offers regularly scheduled payments and the return of invested principal, bonds are often viewed as a more predictable and stable form of investing. Compare regular payments of a bond to the experience of owning a stock. With stocks, profits and losses are driven by market forces and are generally less predictable. Of course, like any investment, bonds are not without risk. One risk that bond investors face is the possibility that the issuer defaults on paying back the principle. This is what is known as default risk. Typically, bonds with higher default risk also come with higher rates of return, also known as yield. The amount of risk depends mostly on the financial stability of the issuer. For example, many governments are generally considered stable issuers and issue bonds with a relatively low yield.

Corporate bonds typically represent a greater risk of default. That's why corporate bonds often offer a higher coupon rate. Several credit rating agencies assign ratings to different bonds. This can help bond investors gage the financial strength of the bond issuer. These rating agencies often use different criteria for measuring risk, so it's a good idea to compare ratings when considering a particular bond. Keep in mind, rating agencies aren't always accurate, so be sure to research a bond and its risks thoroughly before investing. Another risk to consider is interest rate risk. This is the risk that interest rates will go up, and any bonds you own will be worth less if sold before their maturity date. After all, when interest As the interest rates rise, more investors allocate their money into the new higher interest rate bonds. If you wanted to unload a low-interest rate bond to take advantage of these new rates, you'd have to sell your bond at a lower price than what you bought it at to make it a worthwhile purchase for another investor. Capital preservation and income generation are just two ways bonds might be part of a diversified portfolio. Many investors use a mix of stocks and bonds to pursue their investment goals, and because bonds move differently from stocks, they can help increase or protect portfolio returns.

Keep in mind that this discussion showed you one simplified way that investors might use bonds and only a few of the risks to consider. Like all investments, bonds are complex and have a variety of uses and risks. Before you invest in bonds, it's important that you invest in your own financial education.

[LIGHT PIANO MUSIC]

Video: Investopia Dictionary: Bond Yield (1:56)

[NARRATION IS SET TO WHIMSICAL BACKGROUND MUSIC]

PRESENTOR: Two popular bond yield measures are the current yield and the yield to maturity. The current yield is the interest it pays annually, divided by the bond's current price. This calculation tells investors what they will earn from buying a bond and holding it for one year. Jane is thinking about buying a bond for $100 with a $10 annual coupon. She divides $10 by $100 to find its current yield is 10%. Since bond prices constantly change due to market and economic conditions, Jane may not really earn 10%. Her actual return will depend on how long she holds the bond and its price when she sells it. Jane might sell the bond after two years for $75. While she earned $20 during the two years she held it, since she sold it for $25 less than she bought it for, she actually lost $5. The current yield approximates what she might earn, which helps her decide whether to invest. Since she wants to buy a bond, Jane also needs to consider yield to maturity, YTM, which is the anticipated return if she holds the bond until it matures. That is, if she doesn't sell before the maturity date of the bond.

YTM is expressed as an annual rate, and it accounts for what all of a bond's future coupon payments are worth today at their present value. Jane needs to know the bond's market price, par value, coupon interest rate, and time to maturity calculate YTM. She plugs these numbers into a computer program that assumes all coupon payments are reinvested at the same rate as the bond's current yield of 10%. YTM is a complex calculation, but it gives Jane a better idea of her potential returns and lets her compare what she could earn from bonds with different maturities and coupons.

[Take control of your financial future today with premier education brought to you by Investools from TD Ameritrade Holding Corp.]

A bond is a financial tool that can help the government and corporations raise money for their investments. A bond is a document that simply means “I owe you” or “IOU.” The Government and corporations issue the bond for a specified period of time (can be weeks to years). Buyers pay the bond at face value (the price that is written on the bond) and purchase the bond once it is issued. In the end of the specified period (known as maturity date), buyers receive the face value. In return, bond issuers agree to pay a fixed annual amount as interest, called bond’s coupon. Some bonds allow the interest rate to be adjusted with inflation rate. And some bonds can be converted to common stock or other securities after a period of time. A good thing about a bond is that buyers don’t necessarily need to wait until the maturity date; they can sell their bonds before the maturity dates in the market. The price of a bond (a bond that is not new) depends on the financial market and interest rates in the market and can be higher or lower than its face value. If the interest rate in the market drops, then the bond can be sold at a higher price than the face value, and vice versa.

The organization that issues the bond usually backs (supports) it with some selected asset as collateral in case of bankruptcy. And if the issuer organization doesn’t provide real tangible assets for supporting the bond, the bond is called a “junk bond.” In general, bonds with a higher level of risk pay higher interest rates.

Brokers and investors usually measure economic performance in terms of compound interest rate of return, which is referred as “yield to maturity” (YTM), as well as the “current yield." Most bonds, debentures, and notes pay interest on a semi-annual basis, but related interest rates are described nominally. This means that the evaluation of a bond must be made on a semi-annual basis and then expressed as a nominal value.

The U.S. Government offers different types of securities including:

- Treasury bills

- Treasury notes

- Treasury bonds

- Treasury Inflation-Protected Securities (TIPS)

- Floating Rate Notes (FRNs)

Please read the materials provided in the above links.

If you would like to know more about the history of bonds and the bond market, you can find some interesting documentaries on YouTube.com.

Example 3-2

Calculate the rate of return for a new bond with a face value of $1000 dollars and a maturity date of 10 years that pays 30 dollars every six months.

| C = $1000 | I=$30 | I=$30 | I=$30 | L = $1000 | |

|

|

|||||

| 0 | 1 | 2 | ... | 20 | |

C: Cost

I: Interest Income (semi-annual)

L: Maturity Value

Present value of cost = present value of income

According to Table 1-12:

With the trial and error method, we can calculate that i = 3% per semi-annual period. So, the nominal rate of return equals 2*3 = 6% per year compounded semi-annually. In bond broker terminology, the term “yield to maturity” is used to describe this nominal rate of return and may be listed by acronym “YTM.”

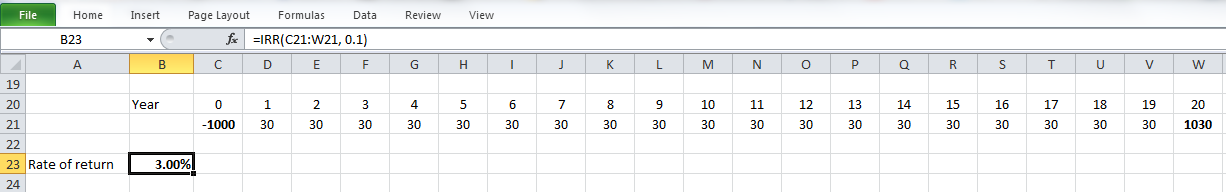

The following figure shows how you can calculate rate of return using IRR function in Microsoft Excel. Please notice the figures and signs, especially the first and last years.

The spreadsheet calculates the internal rate of return (IRR) for a cash flow scenario. It spans columns B through W and rows 20 to 23.

-

Row 20 is labeled "Year" and contains values from 0 to 20 across columns C to W.

-

Row 21 lists cash flows for each year:

-

Year 0: -1000 (initial investment)

-

Years 1–19: 30 (constant annual returns)

-

Year 20: 1030 (final payment)

-

-

Row 23 shows the calculated "Rate of return" as 3.00% using the formula

=IRR(C21:W21, 0.1)displayed in the formula bar.

Old Bond Rate of Return Analysis

As explained before, buyers can sell their bonds in the market before their maturity dates.

Example 3-3

Assume person A buys the new bond that is explained in Example 3-2. After two years (in the end of the year), person A decides to sell the old bond to person B for 800 dollars. Calculate the rate of return of investment for person B.

Person B investment can be shown as:

| C = $800 | I=$30 | I=$30 | I=$30 | L = $1000 | |

|

|

|||||

| 0 | 1 | 2 | ... | 16 | |

We can write the equations for this investment as:

Present value of cost = present value of income

The trial and error technique or IRR function in Microsoft Excel gives that i = 4.82% per semi-annual period and a nominal rate of return 2*4.82 = 9.64%per year compounded semi-annually.

Note: the only thing different from previous the calculation is the time and investment cost.

Please watch the following video, Calculating return on a bond investment (7:53).

PRESENTER: In this video, I'm going to talk about bonds and how to calculate the return on a bond investment.

Bonds are financial tools that can help governments and corporations raise money for their investments. So a bond is a piece of document that simply says, I owe you. So there are three things that you need to know about the bond. The first one is the face value. When buyers buy bond, they pay the face value. The face value is the amount that is written on the bond at the time that it's issued. The second thing that you need to know about the bond is the maturity date, which actually means the expiration date. It is the date that buyers receive the face value of the bond. The third one is the interest that the issuer of the bond pays to the buyers of the bond, and it is called bond coupon and it will be paid as fixed amount. It can be annually or semiannually, every six months.

Some bonds allow the interest rate to be adjusted with the inflation rate. Some bonds can be converted to some common stock or other securities. The good thing about bond is the buyer of the bond doesn't need to wait until the maturity date and receive his or her money. Buyers of the bond can sell the bond at any time before the maturity date.

The price of a bond is dependent on the financial market and interest rate in the market can be higher or lower than the face value. If the interest rate in the market drops, then bond can be sold at the higher price than the face value. For example, if you buy a bond and in the market, the interest rate drops, you can sell your bond at the higher price than the face value because the bond has coupon, which means that you're going to receive fixed amounts of payments per year or per six months, and these are fixed. If the interest rate in the market drops, your bond has higher value in the market.

Usually, the issuer of the bond has to support or back the bond with some selected asset as collateral in case of bankruptcy. Bonds with higher level of risk pay higher interest rate. The interest rate has to be reported nominally, but the interest can be paid on the semiannual basis.

Let's work on this example. Let's assume you are going to buy a bond that has a face value of $1,000 with a maturity date of 10 years that pays you $30 every six months, and you want to calculate the return on this investment.

First, we draw the time line. We are going to have 20 time intervals because there are 10 years and each six months, we are going to receive $30. We are going to have $1,000 investment at the present time, and we are going to receive $30 every six months, which are going to be 20 payments of $30. And in the end, we are going to receive the $1,000 of the face value of the bond. And we are going to calculate the return on this project.

We write the equation. Present value of the cost should be equal to present value of income. Present value of the cost is the $1,000 that we pay for this investment at the present time, and we are going to receive 20 payments of $30. And in the end of the 10th year, which is going to be the 20th period, we are going to receive the face value of $1,000.

And then we have to solve this equation using the trial and error method or IRR function in Excel, which I'm going to explain in the next video. And we calculate the i as 3% per semiannual. And then we need to calculate the nominal rate of return, which equals 2 multiply 3%, which will be 6% per year, compounded semiannually. So this investment of buying a bond at the present time at the price of $1,000 with a maturity date of 10 years and a coupon of $30 being paid every six months, is going to have the return of 6% per year compounded semiannually. The 6% nominal rate of return that we calculated is also called yield to maturity or YTM.

Now, let's work on an other example-- old bond rate of return analysis. Let's assume person A buys a new bond that is explained in the previous example, and then this person wants to sell the bond after two years to the person B at $800. Let's calculate the rate of return in this investment for person B.

So again, the first thing that we have to do is we have to draw the time line. And here, because person A is selling the bond after two years to person B, we are going to have 16 periods of six months. Person B is buying the bond at the cost of $800, and person B is going to receive $30 every six months for 16 periods of six months. In the end of the eighth year or 16 six months, person B is going to receive the face value of $1,000. Please note that person B is buying the bond at $800 but is going to receive the face value of the bond at the end of the maturity date.

And we write the rate of return equation. Present value of cost equal to present value of income. Cost is going to be $800, and person B is going to receive 16 payments of $30 every six months and $1,000 in the end of the 16th period. And we calculate the rate of return for this investment using the trial and error technique or IRR function in Excel, which is going to be 4.82%. And again, this is per semiannual period. We need to report that as the nominal rates per year. So we have to multiply by 2. So we are going to get 9.64% per year compounded semiannually. This is the return on this investment.

Example 3-4

Assume interest rates in the financial market dropped, which causes the price of an old bond to increase. So, person A in Example 3-2 can sell the old bond after two years (in the end of the year) to person B for 1200 dollars. Calculate the rate of return of investment for person B.

Similar to Example 3-3, person B's investment can be shown as:

| C = $1200 | I=$30 | I=$30 | I=$30 | L = $1000 | |

|

|

|||||

| 0 | 1 | 2 | ... | 16 | |

Present value of cost = present value of income

And rate of return per semi-annual period will be i = 1.58% and the nominal rate of return is: 2*1.58 = 3.16%per year compounded semi-annually.

Example 3-5

Now assume this situation: Since the interest rate dropped in the financial market, the issuer organization can call the old bonds after 4 years (from now -- total maturity period of 6 years). This means that at that time, the issuer organization takes the bond and pays the face value. Please calculate the rate of return for person B’s investment if he buys the old bond at $1200.

Person B's investment can be shown as:

| C = $1200 | I=$30 | I=$30 | I=$30 | L = $1000 | |

|

|

|||||

| 0 | 1 | 2 | ... | 8 | |

Note that the old bond will be called in 4 years from now after person B buys it.

Present value of cost = present value of income

The rate of return for person B’s investment will be i = 0.45% per semi-annual period and the nominal rate of return: 0.9% per year compounded semi-annually.