As briefly explained in the first lesson, the financial cost of capital for a project (for a privately owned company) can be the average cost of financing current projects (or under consideration projects). The opportunity cost of capital or minimum rate of return (denoted as “i*”) reflects other opportunities that exist for the investment of capital now and in the future. The opportunity cost of capital for an investment is higher and more important than the financial cost of capital. An investor will invest in a project only if the rate of return is higher than opportunity cost capital (minimum rate of return).

Rate of return is a decision method to accept or reject a project and it is not a reliable method to rank several projects in terms of investment. Also, the rate of return for a current project is not necessarily applicable to future projects. For example, if an investment project has the rate of return of 5%, but another investment with similar (or lower) risk (such as interest paid by the bank to the money in your account or interest from buying Treasury Bond) has the rate of return of 6%, then the minimum rate of return and opportunity cost of capital will be 6%, and the project is not acceptable for investment.

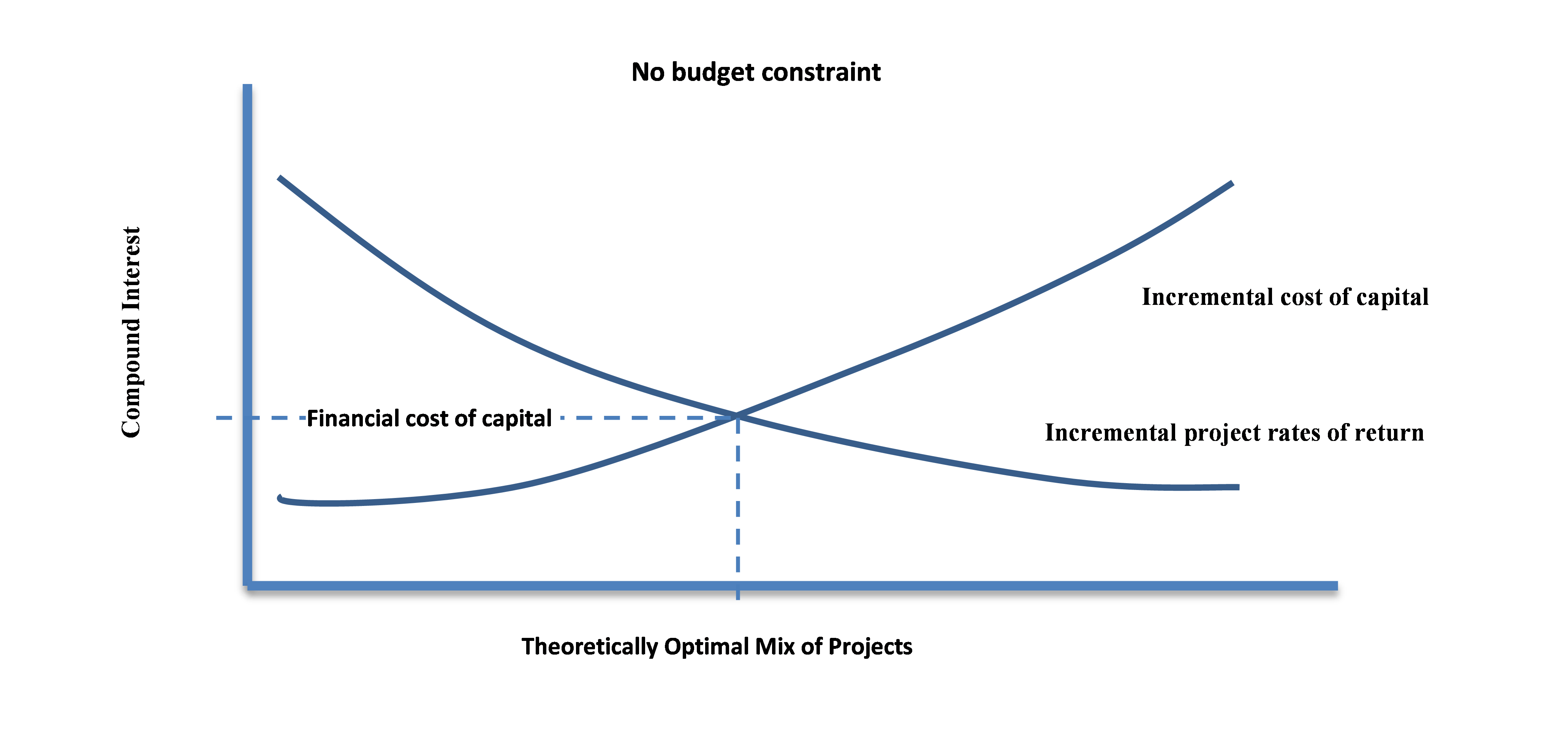

If a company doesn’t have budget constraints, then it would keep investing in a new project until the rate of return on the next project is less than the cost of raising money. See Figure 3-3, below.

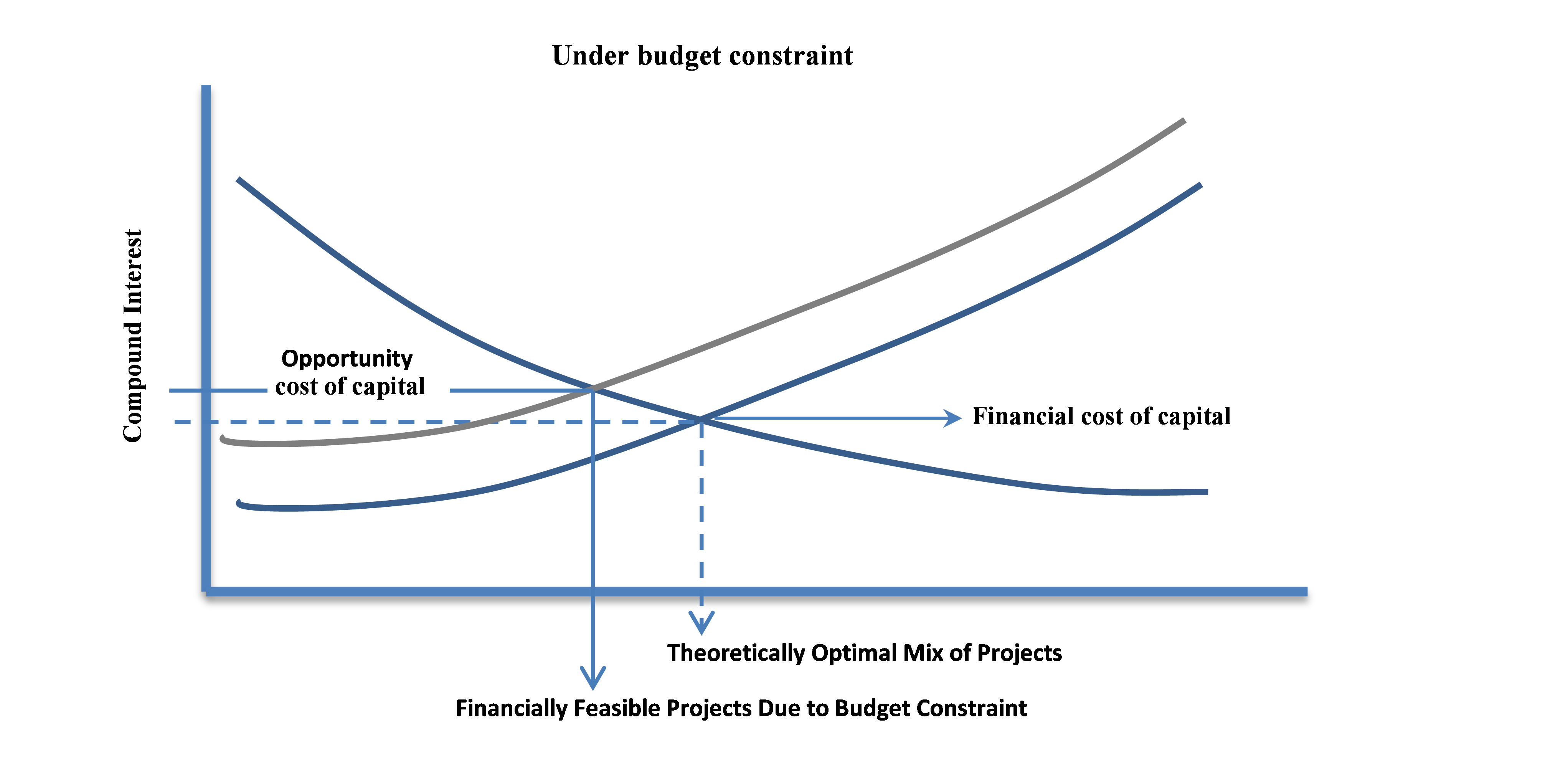

But this assumption is not usually realistic, and in the real world, there is always a budget constraint. As Figure 3-4 shows, budget constraint causes the cost of the capital curve to move upward and also to the left. In this case, the financial cost of capital needs to be adjusted to a minimum acceptable rate of return (MARR). The minimum acceptable rate of return reflects the project’s rate of return that is given up for the project under consideration.

However, if the project that is under consideration is the only possible project or it is not comparable with other projects, or there is enough funding available for all other projects with a higher rate of returns, then the opportunity cost of capital can be equal to the financial cost of capital.