Colorado has a very diverse and often contentious energy landscape. For example:

- On the one hand, the oil and gas industry is very important to the state. According to the U.S. EIA, Colorado is the fifth-largest oil producing state in the country and the 7th largest gas producer. About 36% of its electricity comes from coal.

- There are more than 37,000 unconventional wells (aka fracking sites) in Colorado as of February 2022, according to Fractracker. The oil and gas industry appears to provide a few percent of total GDP (around $11 billion) in Colorado and a little over 1% of all jobs. The oil & gas industry wields relatively significant power, and oil and gas are a frequent target of bills and referenda, both for and against.

- On the other hand, the state is home to the National Renewable Energy Laboratory (NREL), which is one of the premier renewable energy research organizations in the U.S. It is one of the U.S. national labs and is the only national lab that focuses on renewable energy. The EIA notes that: "Since 2010, Colorado's renewable electricity net generation has more than tripled, led by increased wind and solar, and accounted for 30% of the state's total generation in 2020."

While traveling through Colorado, it is not uncommon to see oil pump jacks, wind turbines/farms, fracking operations, solar arrays, and coal-fired power plants. (We will probably see more than a few of each during our time there.) Solar Energy International has its training headquarters in Paonia on the Western Slope (we will visit them), yet fracking wells dot the local landscape and it is not uncommon to see train cars full of coal while traveling to and from Paonia. This variety can and does cause conflict, with fossil fuel advocates having strong disagreements with renewable energy advocates on personal and political levels.

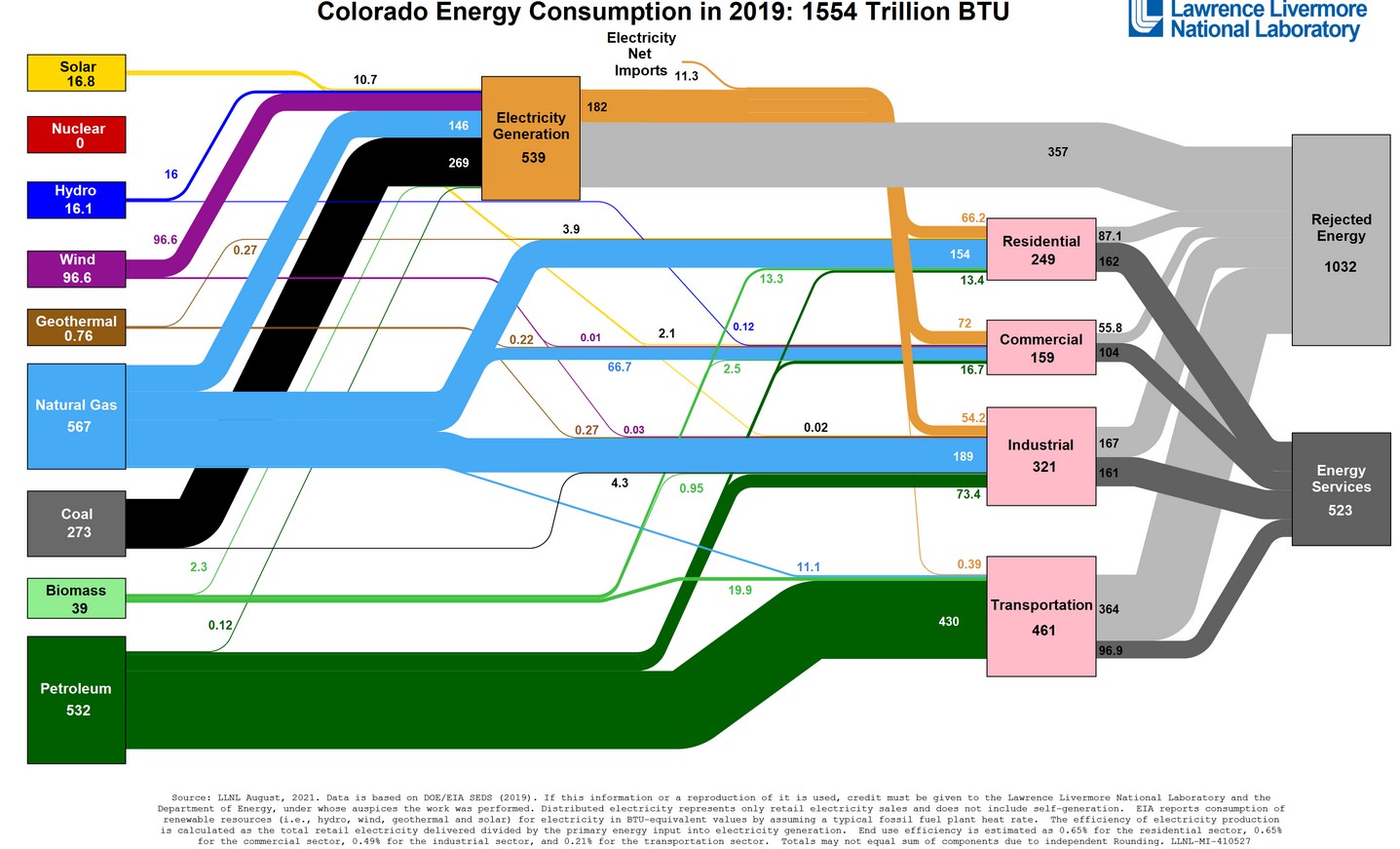

The image below shows Colorado's 2019 fuel mix (the latest data available). You have seen this type of chart in EM SC 240N. Remember that this is called a "Sankey" chart and indicates energy flows. The numbers are all Trillions of BTUs (TBTUs) of energy, and the lines indicate the energy flows to different sectors. Remember that you read the chart from left to right, and can follow each primary energy source (the sources to the left) to see where they are used.

- For example, of the 273 TBTUs of coal burned in 2019, 369 TBTUs were used in electricity generation (98.5%), and 4.2 TBTUs were used in the industrial sector (1.5%).

- You can also analyze individual sectors (electricity, residential, commercial, etc.) by using the chart. For example, the industrial sector used 321 TBTUs in 2019, of which 189 TBTUs were from natural gas, so 58.9% of industrial energy came from natural gas in 2019.

- You can determine the efficiency of whole sectors by dividing the total energy used in the sector by the "useful" energy (useful energy is referred to as "energy services" on the chart).

Energy Policies

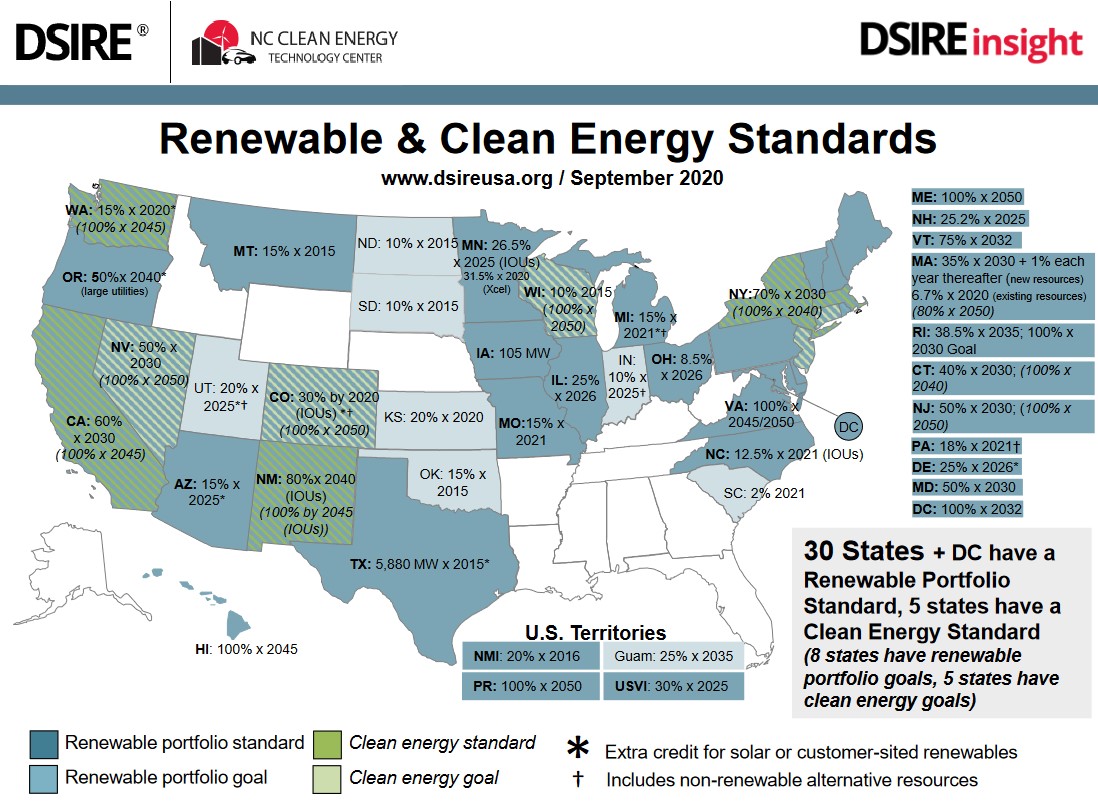

Energy policy can be very intricate and can vary significantly from state-to-state and even within states. If you are interested in finding out which energy policies exist in each state (and nationally), hands-down the best website for details is DSIRE, which is out of NC State University but is managed in conjunction with the U.S. Department of Energy. Believe it or not, DSIRE lists 133 energy policies that apply to the state of Colorado! (Note that some of these are federal policies that apply in all states.) Obviously, we do not have time to go over all of them, but a few of the most prominent ones are below.

Renewable Portfolio Standards (RPS)

Renewable Portfolio Standards (RPSs) are created through legislation and require electricity providers to provide a certain percentage of their electricity from renewable (or alternative) sources. Each state is able to pass its own RPS law (or not), as there is no national RPS in the U.S. Each RPS dictates the percent targets compliance years (see below), and also indicates which energy sources can be used to meet the RPS goal.

Utilities must prove that the required percentage of the electricity they sell is from one of the eligible renewable sources. The three primary ways they do this is a) build and generate their own renewable electricity installations (e.g. a large solar array or wind farm), b) purchase renewable energy from a dedicated supplier (e.g. an independent owner of a large solar array or wind farm), or c) "take credit" for renewable electricity generated by customers on their grid. Utilities rarely build their own generation facilities nowadays (option a), but signing long-term contracts with independent suppliers is becoming very common (option b).

It is very common for utilities to "take credit" for customer-generated electricity, in particular through residential solar arrays. They do this by paying the customer a fee to take credit for the electricity they generate. Each credit is called a "renewable energy credit (or certificate)" (REC), though solar credits are often referred to as SRECs (solar renewable energy credits). REC and SREC prices are set by different mechanisms, but usually, they are sold on the open market. There are too many details to go into here, but here is an example of how this could work: Let's say I have a solar array and I generate 1,000 kWh of electricity in a year (this is 1 MWh of electricity). If the utility agrees to pay $50/SREC, then they would pay me an additional $50 at the end of the year. If I generate 2 MWh, I would get $100, and so on. This is in addition to me not having to pay for the electricity that I generate! In other words, if I generate 1,000 kWh, that is 1,000 fewer kWh that I have to pay the utility for. (This is referred to as net metering.)

RPS benchmarks gradually increase, e.g. 5% in year one, 7.5% in year two, and so on. If a utility does not meet the benchmark in a given year, they are penalized (usually fined).

For example, Colorado passed an RPS in 2004. Details can be found here. Some details relevant to the discussion above are as follows:

- Investor-owned utilities must get 30% of electricity from renewable sources by 2020, with the yearly benchmarks as follows:

- 3% by 2007

- 5% from 2008 - 2010

- 12% from 2011 - 2014

- 20% from 2015 - 2019

- 30% from 2020 moving forward

- Eligible technologies include: "Geothermal Electric, Solar Thermal Electric, Solar Photovoltaics, Wind (All), Biomass, Hydroelectric, Landfill Gas, Wind (Small), Anaerobic Digestion, Fuel Cells using Renewable Fuels Recycled Energy, Coal Mine Methane (if the PUC determines it is a greenhouse gas neutral technology), Pyrolysis of Municipal Solid Waste (if the Commission determines it is a greenhouse gas neutral technology)." As of 2021, renewable energy storage is considered an eligible technology.

- There are a lot of "multipliers," which provide extra incentives for specific types of renewable energy projects. For example, each kWh generated by a community solar project counts as 1.5 kWh toward the RPS goal.

- There are many, many more details of this single policy! I suggest taking a look at the policy to see how intricate policies like this are (and to see one reason why Energy and Sustainability Policy is a useful major!).

Investment and Production Tax Credits

A tax credit is just that, a credit. When an individual or business investor earns a tax credit it means that the amount of the credit will be subtracted from a future tax bill. In the United States, we have a Federal Residential Renewable Energy Tax Credit which provides a tax credit covering 26% of the cost of installation. This is commonly referred to as the investment tax credit or ITC. If you put a photovoltaic system on your roof at a cost of $30,000, you earn a $7,800 tax credit. The government doesn’t mail you a check for this amount. It means you get to deduct that amount from your next tax payment. To realize this money, you will need to have paid at least $9,000 in taxes, but excess credits can "generally" be carried over to future tax years. Note that even if you were owed a refund, this tax credit can be used to increase your refund, as long as you paid at least $7,800 in federal income tax throughout the year. Eligible energy sources include "solar water heat, solar photovoltaics, geothermal heat pumps, wind (small), [and] fuel cells using renewable fuels." This is only applicable to residential customers.

Essentially the same ITC (but it is technically the Business Energy Investment Tax Credit) applies to corporate owners in the following sectors "commercial, industrial, investor-owned utility, cooperative utilities, and agricultural." So basically everyone except for residential, and non-profits. The incentive levels are a little different for some of the energy sources, but solar, wind, and fuel cells earn a 26% credit in 2021, which then decreases at the same rate as the residential ITC afterward.

A production tax credit (PTC) provides an incentive for each kWh of renewable electricity generated and is not based on the up-front cost of the technology. This is a federal incentive. Well, was, anyway. It expired at the end of 2021. This is a per kWh incentive applied to specific installations that were completed prior to the expiration date. The incentives last for 10 years. For example, there was a $0.015/kWh incentive for wind installations prior to 2022. This may not seem like much, but adds up over 10 years! For example, a 2 MW turbine with a 40% capacity factor would generate the following revenue:

- 2 MW = 2,000 kW x 8760 hrs/yr x 0.4 = 7,008,000 kWh/yr

- 7,008,000 kWh/yr x $0.015 = $105,120/yr

A 2 MW turbine is actually on the smaller end of new wind turbine sizes, so even a seemingly meager PTC can be a big deal!

Again, these are only a few of the many, many energy policies that apply to the State of Colorado! This will help provide some context for our experience there, and knowing where to access energy policy information will be helpful for your projects.