Market Drivers for the Refining Industry

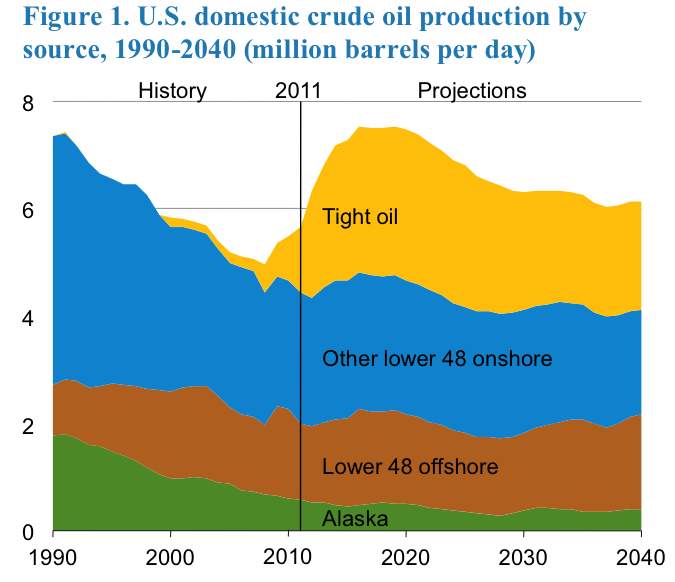

Markets and demand for refinery products depend on the dynamics of a global economy. It is generally agreed that oil and gas will continue to be the primary energy resource in the U.S. and world economies for decades to come. Because of the projected increase in the production of oil in tight formations, the United States is expected to become an exporter of petroleum products and crude oil after decades of being an importer (Figure 1.2, EIA Annual 2013, eia.gov). Petroleum fuels will continue to dominate the transportation sector, but the following trends should be noted:

- increasing fuel economy of vehicles (offset by increasing number of vehicles and miles driven);

- more strict environmental regulations with demand for cleaner fuels;

- biofuels as additives (e.g., ethanol, biodiesel) or alternative fuels in niche markets (jet fuel from algae);

- demand for high-quality, high-performance fuels

Figure 1.2 is showing both the history of U.S. crude oil production since 1990 as well as the prediction of U.S. crude oil production until the year 2040. Since 1990, we have been seeing a decline in oil production from Alaska, offshore drilling, and lower 48 offshore production until 2010 and then those sources are predicted to level off. After 2010 it is predicted that oil production from tight oil will continue to increase.

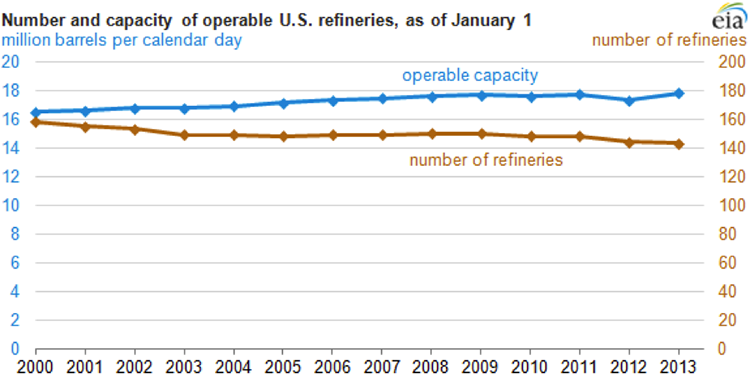

Competitive forces in the global economy lead to joint ventures and mergers and shutting down of inefficient refineries, or shutting down of processing units with low efficiency within refineries. Figure 1.3 shows the changes in the refinery capacity and number of refineries in the U.S. since 2000. The increasing refining capacity, with the decreasing number of refineries, results in the closing down of small inefficient refineries while expanding the large refineries.

Regarding the global competition, the technological advancement addresses the degrading quality of crude oils to produce cleaner and higher quality petroleum fuels. On the supply side, there is the increasing abundance of natural gas liquids (ethane, propane, n-butane, and isobutane) due to increased shale gas production in the U.S. and elsewhere. These liquids enter refineries as new feedstock in addition to crude oil supply.

Refineries need process improvements to advance their capabilities to deal with the changing crude oil base and changing environmental regulations. These improvements in refinery processes would need to create and use, for example:

- new catalysts and new chemistry;

- more sophisticated process modeling and computational methods;

- more effective use of computers in refinery management;

- online monitoring and property measurements;

- new materials to reduce maintenance and extend the useful life of the equipment.

Concerns for efficiency include running a refinery efficiently and producing fuels that will burn efficiently in the combustion engines, as follows:

- Efficiency of refinery processes

- Minimize waste and optimize the yield and properties of the refinery products to obtain maximum value from the crude oil.

- Increase the energy efficiency of each unit in the refinery.

- Fuel economy in internal combustion engines

- Produce high-performance fuels for efficient operation of combustion engines.