Global Energy Demands

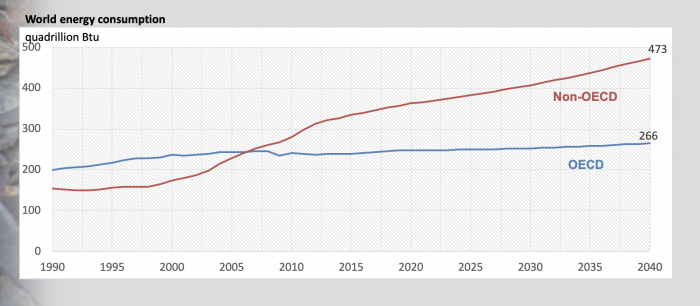

Energy demands are projected to increase globally over the next several decades. As shown in the graph below (Figure 12.1), in 2017 the world used a total of about 600 quadrillion BTUs of energy, which is projected to grow to 739 quadrillion BTU's of energy by 2040. According to the International Energy Agency (IEA), the 2017 global energy use represents an annual increase of 2.1% which is greater than twice the growth rate from the previous year which can be attributed to strong global economic growth. Much of this growth is coming from non-OECD (Organization for Economic Cooperation and Development) countries, in other words, most growth is from countries with emerging economies such as India and China.

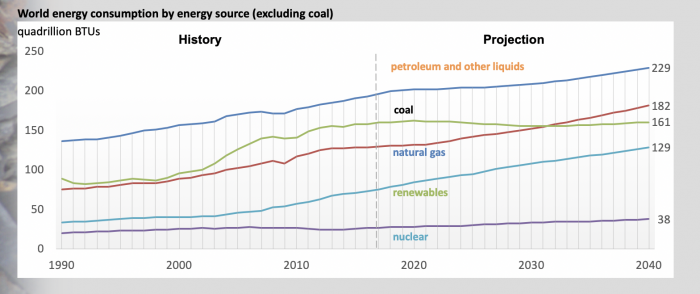

The graph below (Figure 12.2) shows that over 70% of global energy demand growth was met by oil, natural gas, and coal, while renewables accounted for almost all of the rest. As a result global energy-related carbon dioxide emissions reached a historical high of 32.5 gigatonnes in 2017, an increase of 1.4% in 2017, after three years of remaining flat (IEA, 2018). While most major economies saw a rise in carbon dioxide emissions, the United States had the biggest reduction in emissions, driven by higher renewables deployment and use of natural gas for power generation.

Other key findings of the International Energy Agency's 2017 Annual World Energy Outlook include:

- Oil demand grew by 1.6%, greater than twice the average annual rate driven by the transport sector (in particular a growing share of SUVs and trucks in major economies) as well as rising petrochemical demand.

- Natural gas consumption grew 3%, the most of all fossil fuels, with China alone accounting for nearly a third of this growth, and the buildings and industry sectors contributing to 80% of the increase in global demand.

- Coal demand rose about 1%, reversing declines over the previous two years, driven by an increase in coal-fired electricity generation mostly in Asia.

- Renewables had the highest growth rate of any fuel, meeting a quarter of world energy demand growth, as renewables-based electricity generation rose 6.3%, driven by the expansion of wind, solar and hydropower.

- Electricity generation increased by 3.1%, significantly faster than overall energy demand, and India and China together accounting for 70% of the global increase.

- Energy efficiency improvements slowed significantly, with global energy intensity improving by only 1.7% in 2017 compared with 2.3% on average over the last three years, caused by an apparent slowdown in efficiency policy coverage and stringency and lower energy prices.

Clearly, our global society's energy demands are going to continue to increase, and as conventional reservoirs around the world are depleted, new unconventional and renewable energy development seems inevitable to meet these future demands.

In the video below, Thomas Murphy discusses the role that shale energy may play in the US and globally, now and in the future.

Video: Tom Murphy, US Energy Portfolio (2:27)

David Yoxtheimer: How has shale gas changed the energy portfolio in the US and how does that impact energy security?

Tom Murphy: We've seen significant changes in the volumes of fuels now, energy, we'll say, in a broader sort of way, that are coming out of Pennsylvania with the advent of shale energy development and also other types of energy. And there's a real relationship between the two. So as we see more shale development, as it's going forward, and large volumes of gas that are being produced in Pennsylvania, it's offsetting the need for other types of fuel sources, or other types of energy production that might have been there in the past, namely coal. But we're also then seeing the implications to other industries, like nuclear, potentially renewables, and others, you know, even the potential to develop other industries, energy-related industries, over time. So there's a significant impact coming from energy development as it's occurring with shale, shale oil and gas when you think about Pennsylvania, but oil when you think about other aspects of the U.S. more broadly or globally. One of the places that we certainly see major implications is in the power generation side. So we see less nuclear potentially, which could be problematic when we think about carbon, but we also are seeing a greater pairing of renewables. And so, as we see more renewables come forward, there's the demand then, to be able to backfill when renewables aren't producing. So that's a place that often is considered for natural gas, and larger and larger amounts of our natural gas are coming from shale. So, again, there are opportunities that we'll likely see going forward, but there are other issues related to that, that we need to keep in consideration with these other types of fuels that we've been using over the course of time. Now the implications of that to the US, as just stated, also have an impact on a global nature. So as more power, for instance, is being generated from some of these gas supplies, and that potentially is less gas to be shipped, or that's power that we might be distributed in different ways, across the border to Mexico and to Canada. So either power going across some wires or a gas going across back and forth in pipes.