Geopolitics of Shale Energy

The shale energy revolution has dramatically changed the United States energy landscape by expanding the ability for energy companies to commercially extract natural gas and oil from shale and other low-permeability formations. The United States had been projected to remain an energy importer for the long term, however all natural gas demand for can be met by domestic production, while a large increase in oil production has America set to become the world’s largest oil producer. These shifts in the United States energy portfolio have potentially significant geopolitical ramifications on a national and global scale. For example, natural gas prices in the US have declined sharply as a result of shale gas exploration, causing electricity prices to go down while investments in industries in the US have gone up. This economic success, coupled with greater energy security, has lead countries around the world (including China, India, Argentina, Poland, Ukraine, and many others) to consider the economic viability of their own shale formations.

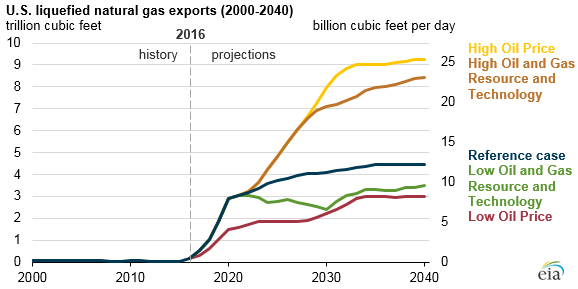

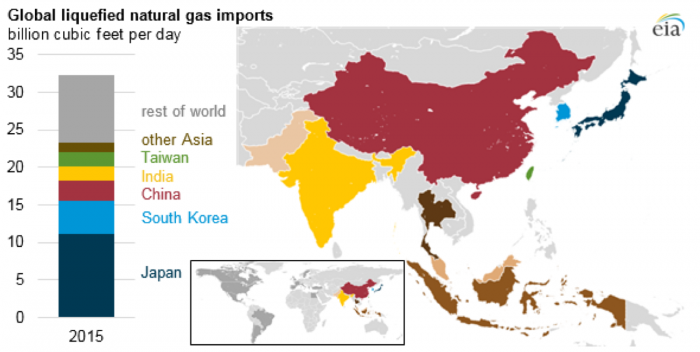

Shale oil and gas prospects in other countries may not "boom" as it has in the US due to a variety of reasons, including a lack of oil and gas rights ownership outside the US, environmental concerns, stricter regulatory standards, geologic constraints, and more densely populated areas minimizing prospective drill sites. However, the shale energy revolution may still have global consequences, especially for European and Asian imports and Russian and Middle Eastern exports. For example liquified natural gas from the US is beginning to find its way into the global market as is an increasing amount of US coal, causing redirection of these energy sources internationally and lowering natural gas prices on global spot markets.

Strategically as US energy import dependency is greatly decreasing, the emerging economies in countries such as China and India will likely use more imports of Middle East oil and natural gas. The impact of the US shale gas revolution could help to diversify the European energy mix, increase the competitiveness of European manufacturing and industries, while negatively impacting important oil and gas exporters to the EU, particularly for Russia. It is difficult to determine if and how these global transformations may take place, but it is clear that shale energy has the potential for significant short and long-term geopolitical implications.

In this video, Tom Murphy discusses the role of shale energy in the geopolitics of shale.

Video: Tom Murphy, Geopolitics (2:15)

Dave Yoxtheimer: Describe liquefied natural gas and how it might play a role in international geopolitics.

Tom Murphy LNG, or liquefied natural gas, being produced in much larger quantities here in the U.S., is now finding its place into a much bigger global market. That being the case, along with other countries that are now producing liquefied natural gas themselves and shipping it, along with new technology to be able to offload those cargos and bring them ashore in countries that are dependent on natural gas, and/or are trending towards natural gas, very often moving away from coal or diesel or another type of fuel source, is creating a very large opportunity for both ends of that equation. Whether they are the country that is exporting it or the country that is importing it. All that then combined, collectively, is causing a change, a very big change actually, in the geopolitical situation on a global basis. Meaning countries that were big producers of energy in the past, some of which may have been adversarial politically to the stance of the U.S. now are finding themselves faced with new suppliers of, in this case LNG, in the market place. It's really changing the economic situation in those respective countries and it's changing the economic opportunities for those that are exporting the gas. So there's really a twofold implication there, one, from the economic side and two, from the geopolitical side. We also recognize that shale gas, as it's being developed around the world, about 80% of that or at least some of the assessments that we are seeing at this point, are in countries that have about 30% of the conventional resource. And what that means then is that you have large potential new players coming to the marketplace that could be exporters that in the past were importers. So again, a geopolitical dynamic there that is slowly starting to change the political story around the world and will likely have very large ramifications going forward.