The final step in the logistics chain for natural gas is delivered to the burner tip. This can be accomplished by Local Distribution Companies (“gas companies”), or pipelines can deliver gas directly to connected end-users. We generally classify the end-users as utility, residential, commercial, and industrial.

The following lecture explains the function of Local Distribution Companies (LDCs) and presents various other natural gas end-user groups.

Key Learning Points for the Mini-Lecture: End-Users

While watching the mini-lecture, keep in mind the following key points:

- Local Distribution Companies (LDCs) are gas utilities.

- LDCs lower the pressure of the gas coming from the transmission pipelines and distribute it to end-users.

- Electricity is produced by both public (utilities) and private companies.

- Generation can be simple-cycle, combined cycle, or co-generation.

- Natural gas is used in various commercial, residential, and industrial applications.

- The use of Natural Gas Vehicles (NGVs) is growing.

Mini-lecture: Natural Gas End Users (8:35 minutes)

Now we finally reach the actual end of our logistical path for natural gas from well head to burner tip. We're going to talk about the various types of end users. This is not an all-inclusive list. But we'll cover quite a few of them.

We've got basically local distribution companies which I've referred to thus far as gas companies, that's what they are, and then the various direct end users of natural gas. Local Distribution Companies, otherwise in the business known as LDCs, these are your gas companies. Whoever your local gas company is an LDC. They're going to distribute the gas to the various end users that are connected to their systems.

Their primary operation is to distribute low-pressure gas. When we talked about transmission pipelines, they move the gas at very, very high pressures. And you can't have that type of pressure coming into your house, especially into something like a hot water heater. So, they lower the pressure. You can see here, mainline transmission pipelines can be running 500 pounds per square inch to as much as 1,500 pounds per square inch. Well, the gas flow into your house at the meter needs to be cut down to four to six ounces per square inch. So, we have residential customers, commercial customers, industrial, and electric customers.

Another type of operation, they can actually perform a transportation service. In other words, several states across the country have what's known as a deregulated natural gas industry. And that includes deregulation of the local distribution companies. So, if you're a large enough end user, you actually can buy gas from an entity other than the natural gas company, your local gas company. But they still make sure that it gets delivered to you, and so they charge you a transportation fee.

So, we refer to this as transportation behind the city gate. That means within the distribution territory. So end users can have their own transportation on the LDC system. It's an open access system. So in other words, any entity that qualifies under their regulations to do so can, in fact, buy from someone else and have it transported.

Here's kind of a breakdown of that delivered price. When you get that gas bill and you look at it, these are the components. You've got the commodity is only 34% of that. So the price of the commodity itself. The LDC or the pipeline company is about 19% there of the cost has to do with the transmission pipeline transportation and storage. But then the distribution costs are 47%. So this is your gas company providing that service.

Here's just a typical residential meter. And here, we just have a large metropolitan area. This happens to be Denver. So we're going to address the actual end users. You can just see here some of the end users. Electric power is the largest end user for natural gas, 31%, followed by industrials and then residential. Commercials having a very small percentage as well. And one thing here, notice the vehicle fuel at this point in time, as of 2013, was less than 1% of the consumption of natural gas in the US.

We'll talk about electric generators. There are two different groups. You've got the electric utility generators. These are regulated producers of electricity. They're either federally regulated or regulated by the respective states. And then you have the non-utility electric generators, the so-called independent power producers. These are also known as merchant power companies.

And then, another group is known as the co-generators. These are companies whose plants actually produce electricity and steam-- steam as an actual commercial commodity. It can be shipped by pipeline to nearby facilities such as food processing or actual crude oil refineries.

Within electric generation, we have different types of generators themselves. A simple cycle generator has gas turbines. These are essentially jet engines. They're internal combustion. They use natural gas as a fuel. And then there's also steam turbines where the natural gas goes into a boiler first and creates steam. And the steam is used to push the turbines. It's not the fuel source. It's literally spinning the turbines.

You also have combined cycle plants. This is where you have a combination of gas and steam turbines. The gas turbine, again, is strictly using natural gas as a fuel. But it has exhaust heat. That exhaust heat then is pumped into a boiler where we create steam which then drives a steam turbine. So a combined cycle natural gas plants are among your most efficient. And then again we have the co-generation facilities where they've got a gas turbine which is going to create electricity. But then they also have a steam boiler where are they going to create the steam, as I mentioned, to sell as an actual commercial commodity.

And then, you can see, this is somewhat of a simplified diagram of the process itself. Now, you see on the left you have an energy supply or fuel. Now, the fuel, in this case, doesn't matter. It can be coal. It can be wood. It can be natural gas. It can be nuclear fission. It's anything that can create heat because the idea here is to take water and basically bring it to a boiling point where you have steam.

Now the steam actually drives the turbine. That's the little blue and white area in the middle part of the diagram in the center there. That turbine spins. And on the axle of that turbine are magnets, very large magnets. And they spin within a copper wire field. The magnets are of opposite polarity. And when they spin they actually create current, which as you can see, goes on out into the transmission lines. And most plants re-circulate then the steam. They cool it down. That's what those large cooling towers are that you see. And then, they recycle as much of that water as they can.

Here's what a typical gas turbine looks like. Again, you can see it's got fins on it like a jet engine. Other end users such as industrial end users, you've got petrochemical refining as I mentioned. They're going to have feedstocks created from natural gas, paper production, metals especially things like steel mills use a considerable amount of gas in their furnaces. Stone, essentially cement plants, they have components like clay and glass and silica and sand. And they actually, in addition to having furnaces, once the cement is created it's in a wet mixture, and they use natural gas to actually dry it. All types of food processing, I'm sure that everyone can come up with to use that, and then in fertilizer. Anhydrous ammonia or fertilizer, 80% of that feedstock happens to be natural gas.

Then we also have commercial uses. Believe it or not, there are large air conditioning units at, let's say for instance, in large warehouses or factories that can run off of natural gas, you know, food service, motels, hotels, healthcare, various hospitals, office buildings, and then at the retail level. And then, last but not least, we have natural gas vehicles. The market for natural gas vehicles has grown the last few years. But it's probably going to decline because just recently Honda Motors said they're going to phase out the manufacture of their CNG Civic which has been around for probably 20 years, and then also their Honda Accord CNG vehicle as well.

Now the better ones are dual fuel. You can use gasoline or CNG. But CNG still has an important usage within what we would call fleet vehicles. For instance, metropolitan buses, trucks using on short haul routes like the USPS or FedEx or UPS, and then pool cars. Various companies who have let's say a certain district and they don't need the longer range of cars, they can use CNG. But again the limitations are the limited range and refueling. Now the refueling infrastructure across the United States is getting better. But for most people, it is still a sticking point in terms of buying these types of vehicles.

Mini-Lecture: Liquefied Natural Gas (8:18 minutes)

Here's just pictures of four of the existing LNG import facilities that we have in the United States. And you can actually see there's one off of Massachusetts, one off of Georgia, one off of Maryland, and one of three that we have in the Gulf Coast region. Now, what is liquefied natural gas? It's natural gas that's cooled to a -320 degrees Fahrenheit. Now what this does is it reduces the volume by over 600 times, which makes it easier to transport and store.

So in other words, let's just say if we had a cubic foot of natural gas, there's a certain amount Btu within that. But the same cubic foot of liquefied natural gas would have 600 times the heating value. So you can see where storing the liquid or transporting the liquid, you are actually storing and transporting at a much, much higher heating value than with pure methane. So you can see here a ton of liquefied natural gas is equivalent to 47 MMbtu, or 47 million Btu. And one ocean-going LNG tanker can hold the equivalent of 3.0 Bcf of natural gas.

Pricing around the world varies from region to region. In Japan, they price LNG landed off of the price of crude oil that's imported, the so-called "Japanese Cocktail." What it amounts to is just the average price for the crude oil that's been purchased as cleared through their customs. And so really it's Japanese cleared customs crude pricing, but it's just referred to as the "Japanese Cocktail." In Korea and Taiwan, again, it's the price of LNG landed is tied to the Btu-equivalent "basket" of crude oil postings. In the UK, continental Europe, and Southeast Asia, it's a combination of oil and coal prices. again, converted to a Btu basis. And then the pricing for LNG on a Btu basis is equivalent.

Now in the United States and Canada, we have been traditional importers, and we have very limited export facilities. But we have a competitive natural gas marketplace. As you all know from your studying in earlier lessons, we have the New York Mercantile Exchange. So we have an open, active competitive marketplace for natural gas. Now Russia, China, and the Middle East, they regulate the price-- the various countries, the governments do. And they actually subsidize the price for their citizens. You can see here that because of the growth in the shale gas, we have steadily declined our imports over the years.

Now the US as an exporter, some of the reasons it makes sense for us, we do have a surplus gas supply. The shale plays and the tight formations have resulted in abundant, relatively cheap supply of natural gas. $3 or less is an extremely cheap price for natural gas. And the EIA estimates that we are producing about 3.0 Bcf a day more supply than we have market for.

And as I mentioned in the previous slide, we have a competitive natural gas-based pricing market. This is actually causing some renegotiations of some of the existing global contracts. In other words, Japan sees the coming of LNG exports by the United States. And so they're already talking to some of their suppliers and saying, you know, look, we want to get off of this crude oil pricing type of mechanism in our contracts and convert over to some type of natural gas index.

We have existing LNG import facilities-- those pictures I showed you in the beginning. And we actually, believe it or not, we are exporting virtually at the moment. Since we no longer need natural gas imports in the form of LNG, what's happening is those entities in the United States who have contracted for tanker loads are literally selling them mid-sea, so to speak, sending them to different ports rather than coming to the United States. And then we actually have had, for about 20 years, a small LNG export facility off the coast of Alaska at a point called Kenai, and that's been operated by Conoco Phillips.

You can see here now the red squares represent existing LNG points-- again, off of Massachusetts, Cove Point, Maryland, Elba Island, Georgia, and then we have about four in the Gulf Coast area. Now these are going to be the logical facilities to export. They have about 60% to 70% of the infrastructure in place already. They can handle tankers for offloading. They have onshore storage. They have connections with pipeline companies.

So what they're doing, is they are building the liquefaction trains. We talked about the fact that the natural gas has to be supercooled. Well that takes a liquefaction facility or train to be built. So in other words, they've got a lot of the infrastructure already in place. So some of these other companies that believe they're going to dive into this particular arena are not going to have the facilities. It's going to cost them a considerable amount more investment.

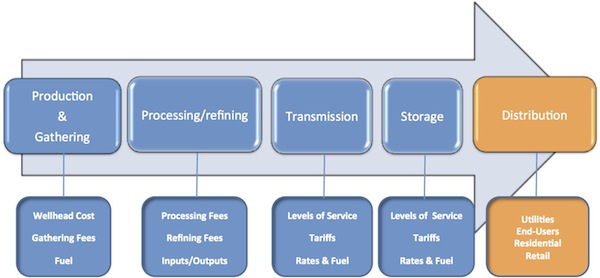

You can see here, of course, the natural gas exports and re-exports by country. Again, we have declined in terms of our imports. And then all of a sudden, you can see we've actually started to do some exporting. And then the ways that it gets to market. Again, this is that logistics and value chain we talk about for natural gas. In the case of exporting LNG, you can see here that the wellhead gas is going to move by pipeline to the liquefaction facility. And then it gets shipped to a particular port of entry where it's regasified and then distributed to the various areas of need. So it's sort of the opposite process that we've been used to for decades now, where we actually receive the LNG, and we regasify it and we utilize it through the pipeline systems of the various end users.

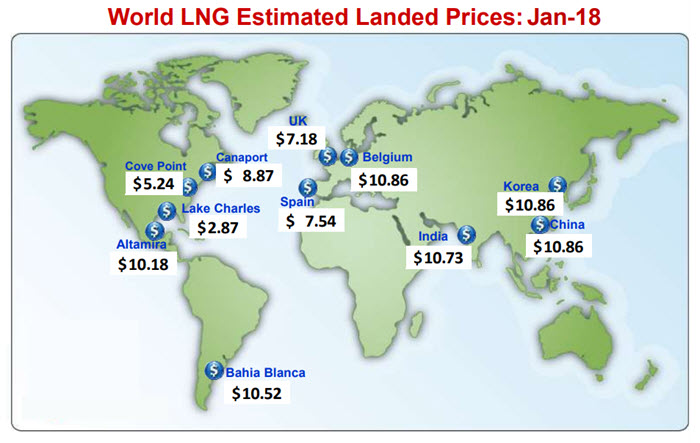

Pricing wise, again, here in the United States, we've got a financial natural gas forward market, which you're familiar with is the NYMEX. It provides price discovery. so everyone knows what the price is. Now just currently based on the one-year average price for natural gas at Henry Hub, it's approximately $3.05 at the time that I put this particular lecture together.

Now these are the estimated supply chain costs in US dollars per MMBtu. Approximately $2.15 represents the process for the liquefaction. Shipping overseas is about $1.25. Regasification at the new port of entry is approximately $0.70 per MMBtu. So you have total costs of about $4.10. So in this particular situation, you're really around $7.15. And I apologize this still says $7.05 on it.

Now when we compare that to world pricing, you can see that there are not that many places in which current LNG exporters can make money at $7.15. Now throughout Asia, that's still a pretty good deal. And they're still going to make money in parts of South America. But over in Europe, you could not at the present time export LNG and make money over there.

Now this situation has dramatically changed. One of the events that created impetus for the US to consider exporting LNG had to be back in March of 2011 with the Fukushima nuclear power plant disaster in Japan. As I mentioned earlier, Japan is solely dependent on imports for natural gas and imports in the form of LNG. Well at the time, they shut down all of their nuclear power plants. So the demand for natural gas in Japan spiked, and we were seeing prices upwards of $14 per MMBtu. So you can imagine at the time those planning the LNG export facilities out of the United States were expecting extremely lucrative business and very, very large profit margins. Such is not the case today. And in fact, Japan is looking at relicensing their nuclear power plants again.

Optional Materials

Liquefied Natural Gas Video by Student Energy (2:24 minutes)

LNG, Liquefied Natural Gas. LNG is natural gas that has been cooled to at least minus 162 degrees Celsius to transform the gas into a liquid for transportation purposes.

To understand why liquefying natural gas is important, we first need to understand natural gas's physical properties. Methane has a very low density and is therefore costly to transport and store. When natural gas is liquefied, it occupies 600 times less space than as a gas.

Normal gas pipelines can be used to transport gas on land or for short ocean crossings. However, long distances and overseas transport of natural gas via pipeline is not economically feasible. Liquefying natural gas makes it possible to transport gas where pipelines cannot be built, for example, across the ocean.

The four main elements of the LNG value chain are, one, exploration and production, two, liquefaction, three, shipping, four, storage and regasification. At the receiving terminal, LNG is unloaded and stored before being regasified and transported by pipe to the end users.

The demand for LNG is rising in markets with limited domestic gas production or pipeline imports. This increase is primarily from growing Asian economies, particularly driven by their desire for cleaner fuels and by the shutdown of nuclear power plants.

The largest producer of LNG in the world is Qatar with a liquefaction capacity in 2013 of roughly one-quarter of the global LNG production. Japan has always been the largest importer of LNG and in 2013 consumed over 37% of global LNG trade.

The extraction process also has environmental and social issues to consider. LNG projects require large energy imports for liquefaction and regasification and therefore have associated greenhouse gas emissions.

Spills pose concerns to local communities. There have been two accidents connected to LNG. But in general, liquefaction, LNG shipping, storage, and regasification have proven to be safe. LNG projects require large upfront capital investments, which can be a challenge in moving projects ahead.

That's LNG.

World LNG Estimated Landed Prices: Jan-18 Diagram

| Country | Price, $US/MMBtu |

|---|---|

| Cove Point | $5.24 |

| Altamira | $10.18 |

| Lake Charles | $2.87 |

| Bahia Blanca | $10.52 |

| Canaport | $8.87 |

| UK | $7.18 |

| Belgium | $10.86 |

| Spain | $7.54 |

| India | $10.73 |

| Korea | $10.86 |

| China | $10.86 |