What is Financial Risk?

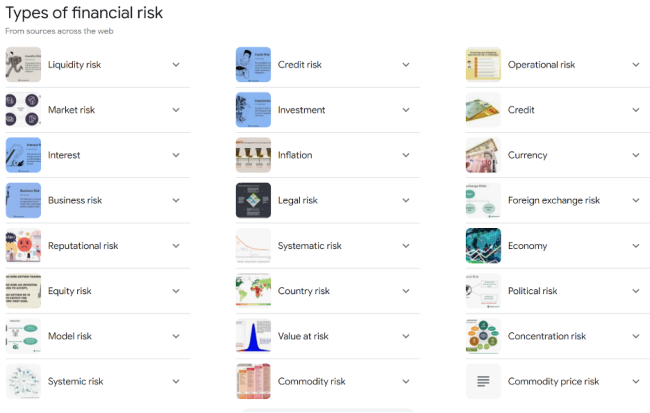

I typed "financial risk" into the search engine as I was putting this module together, and this is the really cool graphic that confronted me:

Figure 7.1: 24 Types of Financial Risk

Click for a text description of this image

Liquidity risk, Market risk, Interest, Business risk, Reputational risk, Equity risk, Model risk, Systemic risk, Credit risk, Investment, Inflation, Legal risk, Country risk, Value at risk, Commodity risk, Operational risk, Credit, Currency, Foreign exchange risk, Economy, Political risk, Concentration risk, Commodity price risk.

Google.com search for "types of finanical risk"

Woah! Twenty four different types of risk? Well yes, the management of each of these risks is important in your energy project. But don’t fret, many of these can be mitigated with simple measures and others might be ignored. First, let's get a definition (or two):

Financial Risk: "The possibility of losing money on an investment or business venture" (Investovepia.com).

Risk can also be defined as: "The probability that actual results will differ from expected results" (Corporate Finance Institute.com).

We'll take a look first at market risk.