Critical Analysis of Public Filings

Finding Areas of Opportunity

In finding areas of opportunity, undertaking competitive intelligence or understanding trends, for decades the perennial resource was to pore through public filings, most notably a company's last five years of 10-K reports. These reports provide a comprehensive view of a company at a point, its financial health, areas in which it may be investing through either acquisitions or R&D efforts, and management's view of risks which could have a significant bearing on the success of the company.

Remembering the importance of materiality in publicly traded companies and their disclosures to investors, these 10-Ks act as a bit of a "truth serum" in many ways, laying bare many statements and facts which a company would otherwise be reluctant to disclose. For example, Section 1A of the 10-K is a significant disclosure of "Risk Factors" the organization faces. Here is an excerpt from the risk factors section of Tesla Motors' 2014 10-K:

If we fail to manage future growth effectively as we rapidly grow our company, especially internationally, we may not be able to produce, market, sell and service our vehicles successfully.

Any failure to manage our growth effectively could materially and adversely affect our business, prospects, operating results and financial condition. We continue to expand our operations significantly in North America as well as in Europe and Asia. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. Risks that we face in undertaking this global expansion include:

- finding and training new personnel, especially in new markets such as Europe and Asia;

- controlling expenses and investments in anticipation of expanded operations;

- establishing or expanding sales, service and Supercharger facilities in a timely manner;

- adapting our products to meet local requirements in countries around the world; and

- implementing and enhancing manufacturing, logistics and administrative infrastructure, systems and processes.

We intend to continue to hire a significant number of additional personnel, including manufacturing personnel, design personnel, engineers and service technicians. Because our high-performance vehicles are based on a different technology platform than traditional internal combustion engines, we may not be able to hire individuals with sufficient training in electric vehicles, and we will need to expend significant time and expense training the employees we do hire. Competition for individuals with experience designing, manufacturing and servicing electric vehicles is intense, and we may not be able to attract, assimilate, train or retain additional highly qualified personnel in the future, the failure of which could seriously harm our business, prospects, operating results and financial condition.

In fact, this is only one of fifty-eight specific, named risks to the business along with nine more common stock risks Tesla presented in its 10-K in this year. This is not uncommon for 10-Ks.

A Deeper Examination of a Single Stated Risk

For example, let's consider just one of the implications from that single Tesla risk statement [emphasis is mine]:

Because our high-performance vehicles are based on a different technology platform than traditional internal combustion engines, we may not be able to hire individuals with sufficient training in electric vehicles, and we will need to expend significant time and expense training the employees we do hire. Competition for individuals with experience designing, manufacturing and servicing electric vehicles is intense, and we may not be able to attract, assimilate, train or retain additional highly qualified personnel in the future, the failure of which could seriously harm our business, prospects, operating results and financial condition.

Now, consider the following:

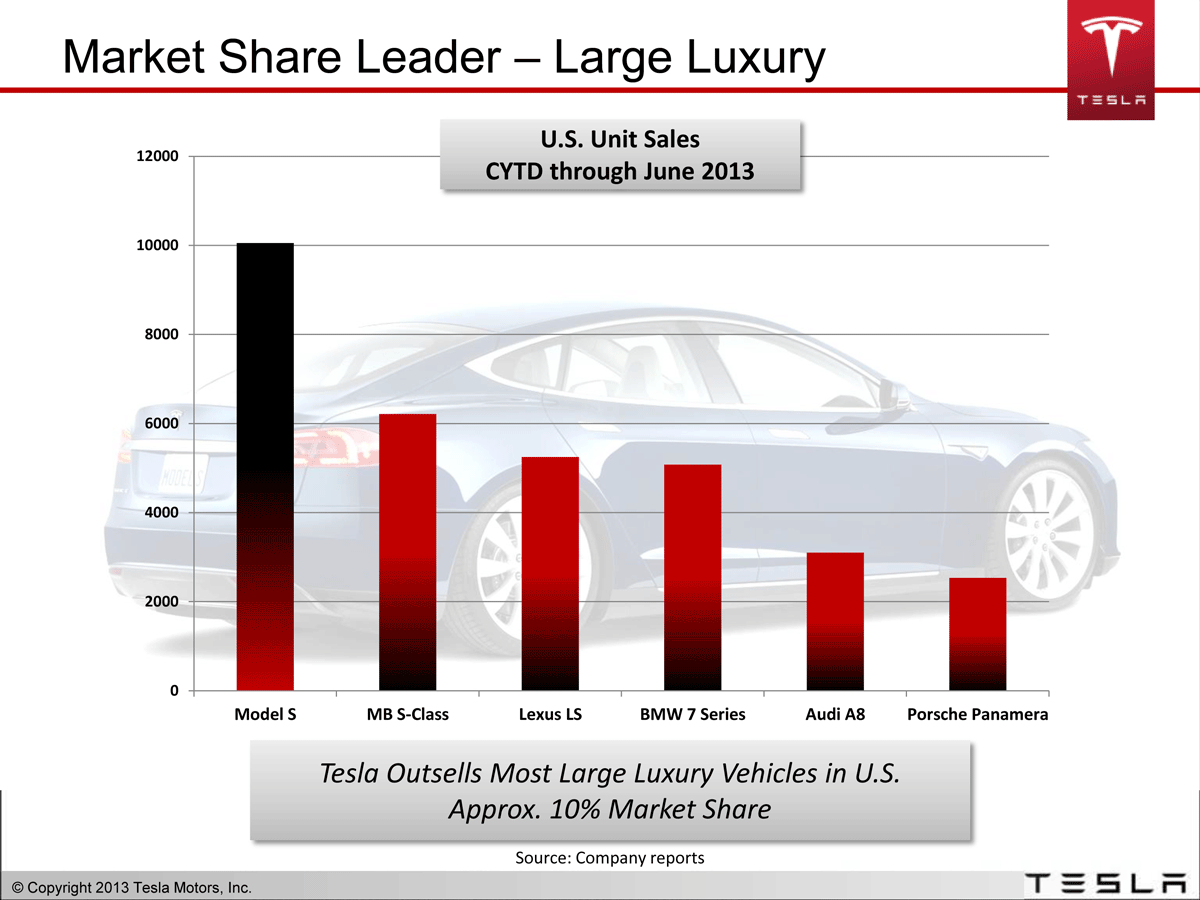

- In its second year of production, Tesla would already create a significant market share lead in the large luxury segment

- Delivered 33,000 units in 2014, a 47% increase over 2013

- Forecasts 50% unit growth again in 2015

- Doubled its number of workers in one year, from 5,859 in 2013 to 10,161 in 2014

- Preparing to release a $35,000 Model 3 in 2017, which, if current Federal incentives are extended, will equate to a MSRP of $27,500

So, we have Tesla in dire need of technicians, facing explosive growth, and selling cars loaded with new to the world technologies... and a technician training pipeline completely unprepared and lacking leadership.

Two of the major automotive training institutes, WyoTech and Universal Training Institute, have courses ranging from core automotive technician training to "Motorsports Chassis Fabrication," but not a single course for hybrid or electric vehicle service.

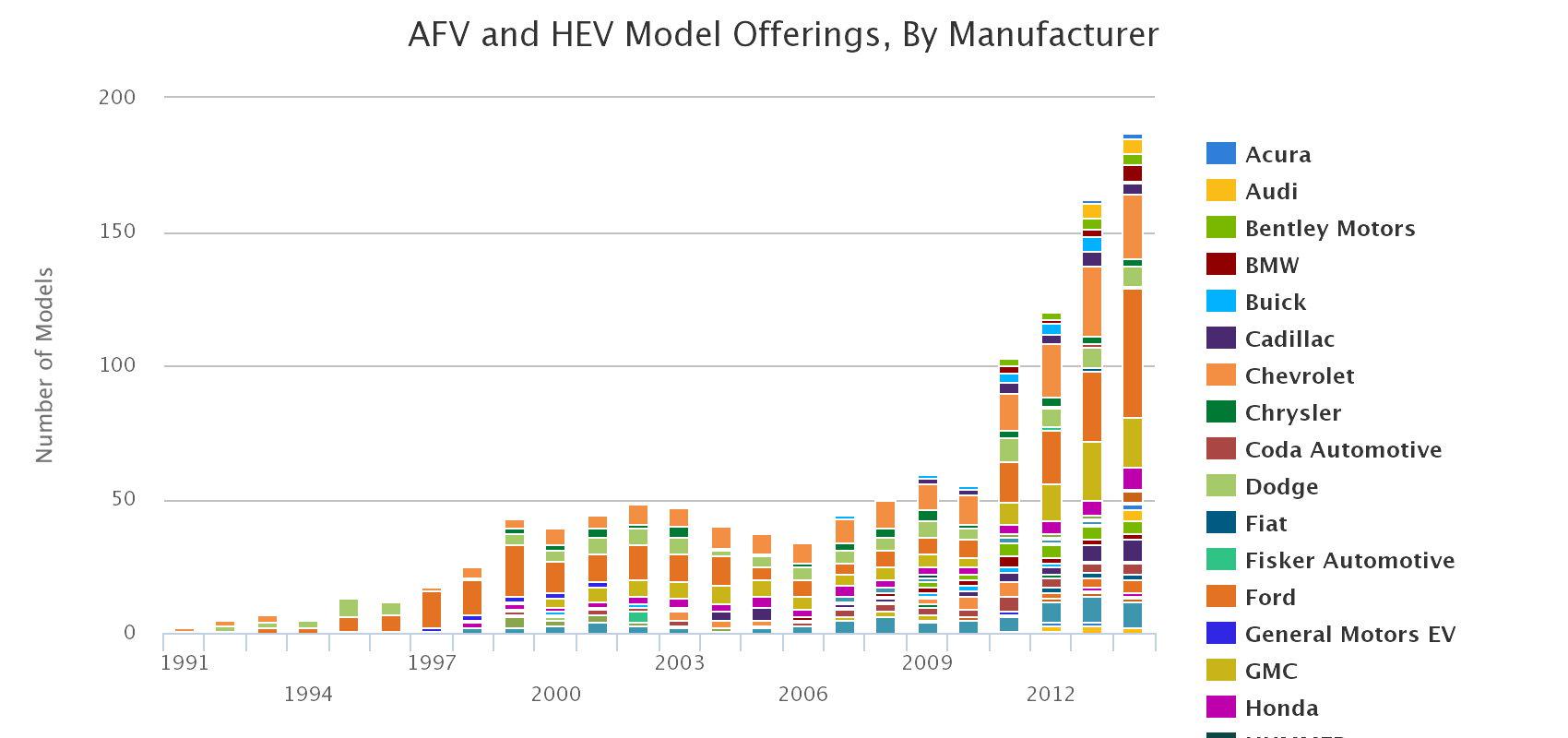

Furthermore, it took ASE (The National Institute for Automotive Service Excellence, the major technician testing and certification body in the US) until 2015 to have even a single tech certification for hybrid or electric vehicles. Consider that Toyota has been selling the Prius in Japan since 1997 (the US since 2001), and the number of alternative fuel vehicle models sold in the US is rapidly approaching 200.

If the tech sector took the same glacial approach to training as the auto sector has in training on hybrid and electric technology, today's students would be prepared to enter a market... using Windows 98. (If you don't know what Windows 98 is, consider it was released in 1998... a time then you had to actually go to a store to buy physical software contained in a highly-protected plastic security box and AOL was a very successful company.)

I offer this analysis not as some massive proponent of Tesla, electric vehicles, or any other cause, but as an impartial view of the opportunity laid before us through a brief analysis of public filings. I believe you will find that as we become proficient in the critical analysis of financial and sustainability filings we will find insights few others may have. For example, as of the time of this writing, I was unable to find a single article or blog post written about the coming demand for electric vehicle and hybrid technicians, but literally hundreds on the explosive growth of Tesla and electric vehicles.

If we are to view ourselves as innovators, investors, and leaders concerned with sustainability, we must become proficient at finding and discerning opportunity–wherever it may be.

Critical Analysis of Filings as a Defensive tool

As we will examine in this Lesson and in much of the course from this point, "innovation" is far too often coupled with the idea of revolutionary, new-to-the-world offerings. What we will see is that the opportunities for innovation we find may be quietly incremental, but will still have the potential to lead the market and fill important sustainability needs. Upon hearing "sustainability-driven innovation" many may think of "Tesla," but we will see that much of the opportunity may look more like 'training technicians to meet Tesla's emerging needs in an exploding electric vehicle market.' In this case, the defensive facet from our critical analysis comes into play when considering there are frankly tens, if not hundreds, of major national automotive training schools which could have been training on this technology years ago.

Consider also other defensive positions from this type of analysis: your organization may be an existing supplier to a publicly-traded company, and you should therefore be first in line to read every 10-K and CSR they release. Every one of these filings will represent opportunity for incumbent suppliers to grow based on the stated needs of the company... or potentially find themselves at risk to newly identified needs and trends. Just as Tesla discusses risks in its 10-K, it also discusses supplier relationships, needs, and other issues important to the success of the company. Especially in the case of sustainability filings, it will identify specific needs and struggles... all of which would be an excellent opportunity for an existing supplier to deepen their relationship.