The following mini-lecture traces the flow of crude oil from the wellhead to the refinery using various forms of transportation. We also discuss the two global standards for crude oil, West Texas Intermediate, and Brent North Sea. The major supply/demand districts in the US are presented, as well as supply and demand statistics.

The history of regulation for crude oil and liquids pipelines goes back to the first regulation of the railroads in the 1800s. A fear of a monopoly by the few railroads in existence prompted the US government to form the Interstate Commerce Commission. The body was later given jurisdiction over interstate crude oil pipelines based upon the same monopoly fears. Today, that responsibility lies with the Federal Energy Regulatory Commission (FERC).

Under federal regulations, pipelines must file “just and reasonable” rates and provide access to any shipper requesting space, if available.

Key Learning Points for the Mini-Lecture: Crude Oil Logistics & Refining

While watching the mini-lecture, keep in mind the following key points and questions:

- What are the steps in the crude oil value chain?

- What are the costs and revenue opportunities on the value chain?

- What are the crude oil standards? “West Texas Intermediate” crude oil vs. “Brent North Sea” oil

- How is crude oil transported?

- What is the role of pipeline in crude oil transportation?

- What entity regulates crude oil pipelines?

- How does The Federal Energy Regulatory Commission (FERC) regulates the crude oil pipelines?

- FERC replaced the Interstate Commerce Commission as the regulatory body for crude oil pipelines.

- “Common carrier” status

- Non-utility vs. natural gas pipeline utility status

- Explain the rate schedules – “tariffs”.

- What are “PADDs”?

- Which PADDs have the highest crude oil Supply & Demand?

The following lecture is split into two parts.

The first video is 11 minutes long.

In this lesson, we're going to talk about crude oil, the actual logistical path getting it from the pump at the wellhead to the pump, basically, at the retail gasoline station. And then, we'll talk about the value chain. Crude oil itself has no real value. It's what the refiners can turn it into is where the value actually lies.

Here, again, is this schematic of the value chain for both natural gas and for crude oil. But if you look at the crude oil parts, basically we go from the wellhead where there is the cost to lift the crude oil. Then, we've got the refining, and then, there's fees associated with that. Then, we're going to have to get it, the crude, to the refineries via various methods that we'll talk about.

Then, we also have to take away the refined products to market itself. You can store crude oil. You can also store the refined products. And, ultimately, you get to a distribution point where you're at the retail level. Or, in the case of crude oil, you're also manufacturing some petrochemical feedstocks.

So, we're talking, again, about crude oil logistics from pump to pump. Here's an old wooden derrick, crude oil, probably back from the time of the first discoveries in Titusville, Pennsylvania. West Texas Intermediate Crude Oil is going to be the standard we talked about. We did talk about that in a previous lesson when we talked about the contracts with the New York Mercantile Exchange.

But it's the North American standard. It is known as low-sulfur sweet crude, traded in international currency as the US dollar. It is priced free on board in Cushing, Oklahoma. And again, as we talked about in a previous lesson, it is traded on the New York Mercantile Exchange as a financial derivative, which does allow for hedging.

And then, Brent crude is the North Sea global standard. It is traded on ICE Futures Europe in London, which is formerly the International Petroleum Exchange in London. There are financial derivative instruments over there that are similar to the NYMEX crude contract. A lot of traders take the price opportunity or arbitrage between the London contracts and the NYMEX contracts in New York City.

Currently, still due to some supply bottlenecks, US Gulf Coast refiners are paying higher prices since imports are priced off of the Brent crude price. Now, we can't get enough of the surplus domestic supply that we have to the Gulf Coast refiners at the present time.

Here is, basically, what the EIA shows to be the growth in crude oil production over the last year or so, going back actually two years to 2013, a four-week average on each plot point, and then showing the 2014 to 2015 period, again, four-week averages on each plot point. So, you can see, there's been a significant increase in US domestic crude production. And then, imports-- as you would guess-- imports have declined steadily over the same two-year period and will continue to do so.

The pipeline infrastructure, of course, is critical to balancing the supply and demand for energy across the United States. And the same holds true for crude oil and petroleum product pipelines. Here is a very simplified schematic of the grid across the US.

Crude oil and petroleum pipeline product lines are supplied to major demand centers in the United States by over 200,000 miles of pipelines, representing about a $31 billion investment. Pipelines transport over 38 million barrels of crude oil, feedstocks, and petroleum products each day. 17% of the nation's freight is transported via pipelines for only 2% of the nation's cost.

The infrastructure now for crude oil in terms of various pipelines, you've got pipelines to transport the crude oil from major producing basins and various ports, import ports, to various refining centers and/or supply hubs. Other pipelines transport refined petroleum products, including gasoline, diesel, jet fuel, and LPGs, which are liquefied petroleum gases, from refineries and ports to end-user markets. Other liquids, energy-related petrochemical feedstocks are transported between supply chain points, perhaps from the tailgate of a refinery to the inlet side of a petrochemical processing plant.

Various modes for crude oil delivery, the primary one is the pipeline. You've got, in essence, it's a wellhead to transmission pipeline to the refineries themselves. You have pump systems along the way. And they can batch process the crude, put it in different volumes at different times, and separate them with a batch separator.

The interstate grid in the United States transports about 2/3 of all the oil. The pipelines are subject to the Federal Energy Regulatory Commission and the former Interstate Commerce Commission. They are labeled as common carriers. They do not have utility status, which natural gas pipelines do get.

The US network of petroleum and petroleum product pipelines is the largest in the world. It's also the cheapest method on a cost-per-barrel basis to move crude around. We also truck crude oil, mostly from wellhead tanks to refineries or from the wellhead tank batteries to rail terminals where it's loaded onto rail cars. It is the most costly method, you can imagine. It's the smallest amount that can be transported. It's the least volume capacity, approximately 200 barrels per tank, per truck tank, or 8,400 gallons.

Other modes of transportation, rail cars, they're very large capacity, 2,000-barrel tank cars, relatively cheap cost. The problem is there is limited access. Railroads obviously aren't everywhere.

Tankers, we're mostly familiar with those. Generally, for import purposes, they are very large capacity. Of course, they vary from standard tankers to what they call VLCCs, which are the very large crude tankers, so-called supertankers. Now, these are water-bound. We also can barge crude oil intra-country. These are large capacity tanks also. But they are strictly water-bound as well.

Here's just a schematic, kind of a simplistic map, of petroleum refined product transportation infrastructure across the US. What you see here on the map is pipeline, rail, barge, and tanker locations around the US.

Just a quick couple of thoughts on the actual regulation of crude oil. We've talked about regulated and non-regulated industries before. And pipelines have been regulated going way far back. You can see here, in 1887, the Interstate Commerce Act placed pipelines under the regulation of the ICC, the Interstate Commerce Commission, because railroads had been regulated. And now, there was a concern about potential monopolistic power for those who owned the pipelines.

This then, in 1906, pipelines where placed under what was known as the Hepburn Act. And then the Interstate Commerce Act of 1887 set some ground rules which still apply to the pipelines today. Rates that they can charge have to be just and reasonable. They have to disclose their terms of service, in other words, the rules and regulations under which they will transport the crude oil.

They have to have form and content of tariffs. That means they have to have some documentation in terms of how they are going to conduct operation, the rules for you to be a shipper to move crude oil, on there. And then, tariffs are the rates that they're going to charge. Accounting methodologies, all reporting requirements, and then disclosure of shipper information, all of these things are requirements for pipelines to operate and, again, come out of this Interstate Commerce Act from 1887.

And today, the Federal Energy Regulatory Commission, or FERC as its most widely known, has jurisdiction over the crude oil pipelines. Congress abolished the Interstate Commerce Commission in 1995. Again, they have common carrier status. That means they need to be able to carry or ship crude oil for just about everyone. They don't have utility status. Natural gas pipelines received utility status under the Natural Gas Act, or the NGA, of 1938. So, they don't have franchises, in other words.

Crude oil pipelines don't have protected territories. They also have no right of eminent domain. The right of eminent domain, especially for those of you who are familiar with land law, allows the entity to come in and condemn the property if the property owner protests the building of the pipeline. But again, these pipelines still have to provide just and reasonable rates and have the reporting requirements that I mentioned above.

Here's just a sample crude pipeline tariff. This is from Shell Pipeline Company. They have a pipeline and a crude line in the Houston, Texas area. And if you look at the top, the issuer is Shell Pipeline. The regulator in the state of Texas is the Texas Railroad Commission.

And we have, in essence, the originating point or the input points to the pipeline for the crude oil. And then the destination is East Houston, which is more than likely the very large Houston ship channel, which is the world's largest petrochemical refining corridor. That is the US Gulf Coast. They're shipping petroleum. You can see that the date of this particular contract agreement was June 1st of 2012.

The unit measuring, they're going to be paying so many cents per barrel. And if you get all the way down to the bottom here, you can see that the actual tariff rate for volumes of 0 to 65 million barrels, they're going to be paying $0.16 per barrel. If they ship a greater amount than 65, almost 66, million barrels, they will only be paying $0.08. So this would be a typical crude oil pipeline tariff. If you were interested in being a shipper, you would be issued one of these by the operator of the pipeline.

The second video explains the PADDs and crude oil supply and demand from these regions. This video is 6:07 minutes long.

Here's just a shot, actually just a partial shot, of what is the Houston Ship Channel Complex east of Houston. It's a huge crude refining and petrochemical refining complex.

Back during World War II, there was concern about the amount of crude and refined products that we would have for the war effort. And so, the Department of Defense came up with what they call the Petroleum Administrative Defense Districts. And this is the way that they could keep tabs on the supply, the demand, and at times of rationing, set the rationing limits for the various districts across the United States. Well, these have remained in place today, and we talk about the various PADDs, the supply, the demand, the pricing and those types of things.

Now, PADD 1, it's the highest petroleum consumption rate in the United States. And you can see, I mean, it's running from Maine down to Florida. So several very, very large metropolitan areas. They are highly dependent on imports for both crude oil and refined products. 100% of the crude oil, traditionally, has been imported. But now, they do have access to some of the oil coming from the shales, such as the Marcellus and the Utica.

There's also crude oil coming from the Bakken by rail. But in this case, they mean imports as in importing crude oil from other PADD regions. 25% of the refined products in the Northeast, they do, in fact, import. They are the largest recipient of supplies from the other PADD districts.

The south Atlantic region is experiencing higher population growth rates and the slower growth in New England. So, again, demand is expected to expand in the southeast part of the United States. It's also the largest concentration of oil-heated homes. There's still a considerable amount of heating oil used in the Northeast. It's used to create hot water, as well as for space heating purposes.

And when we had our discussion about the supply-demand fundamentals that impact crude oil, we talked extensively about the idea that the Northeastern part of the United States is the world's largest consumer of heating oil and fuel oil.

PADD 2, as you can see, it runs all way down to Oklahoma, and Tennessee and all the way then up to the Canadian border in what we generally call the Midwest region. They're dependent on crude oil imports, mostly from Canada. Except now, we do have the Bakken oil, which can help supply the region as well, coming from North Dakota.

Second highest crude oil demand region in the United States. Again, several major metropolitan areas, including Cleveland, Detroit, Chicago, Kansas City, St. Louis, those areas. They are chronically short, the market, due to a combination of demand growth and refinery closures.

So, they don't have a lot of crude being produced in that area, with the exception of the Bakken and, potentially, Utica shale. There is crude oil in Oklahoma. The question is are they getting it to the refineries? And as this indicates, there have been, anyhow, reductions in the refining capacity over the years.

PADD 3, this is the origin of 90% of the crude oil and 80% of the refined products shipped among the various other PADD regions. It's the largest crude oil and refined product supply region in the US. And only two OPEC nations, that is Saudi Arabia and Iran, have a higher crude oil production rate than PADD 3.

So, you can look and every one of these is an oil-producing state. And then, no foreign nation has a higher refined product output than PADD 3. Again, the Gulf Coast petroleum refining and petrochemical manufacturing corridor is the largest in the world.

PADD 4, which is sensibly the Rocky Mountain region. PADD 2 and 3 have historically supplied the market to augment local production. It's a small, but growing, market. There's minimum demand for specialty products. The infrastructure's not developed due to long distances, limited markets, and high costs.

The Rocky Mountains are running right through this region. And so, it makes it tough to, basically, transport, have an interchange, so to speak, of crude and refined products. There is a large refinery in the Denver area.

And then, PADD 5 is the entire west coast plus Alaska. And West Coast is traditionally isolated from other US supply regions, again, due to the Rocky Mountains. Growing population continues to increase demand for products. Alaska North Slope crude oil is an important source of supply for West coast refineries. North Slope Crude oil has been around for decades. And it is piped. And in some cases, they do use large tanker ships to bring it down to the lower 48.

The California Air Resources board rules, they kind of isolate the market, which limits supply options. In other words, I think a lot of you've seen the fuel standards for California, from an emission standpoint, are much more restrictive than the rest of the country. And so refiners in that region or refiners wanting to sell to that region have to meet those standards.

Just an overview of supply and demand. Over 50% of all the US crude oil demand exists in the Gulf Coast. The demand, yes, because when we talk about crude oil demand itself, we're talking about refinery demand. Production from the Gulf Coast region supplies the majority of the Midwest and East Coast refined product deficit.

New England regions becoming increasingly dependent on foreign imports as the South Atlantic region continues to grow. The Midwest deficit is expected to grow as regional refineries struggle to keep up with demand. And the West Coast and Rocky regions are fairly well-balanced between regional refined products, supply, and demand.

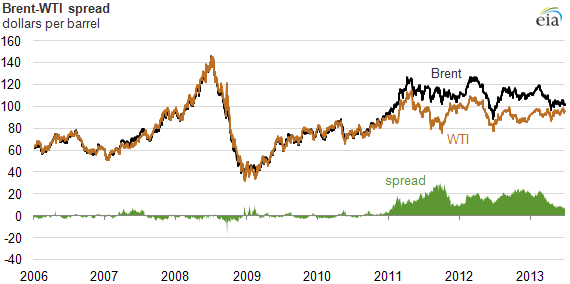

Figure 2 displays the price difference between Brent and WTI crude oil. As you can see in this graph, there has always been a price difference between WTI and Brent. Before 2011, this difference was very small with Brent being slightly cheaper than WTI. In 2011, increased domestic light crude oil production, along with pipeline and transportation limitations, caused the WTI to be traded at a lower price with a larger gap compared to Brent. Recently, infrastructure limitations are decreasing and the difference is once again becoming smaller; and WTI can be supplied to the Gulf of Mexico. The green area in this graph indicates the price difference. More recent charts and data can be found here.

Please review Figure 1 and Figure 2 in Lesson 2 to see the upward trend in oil production and the downward trend in oil imports for the same time period.

Crude oil transportation

The following links provide good resources for the U.S. pipeline infrastructure:

Please go to this map on Pipeline 101.org and find Cushing, OK.

More information about tankers can be found on this article, "Oil tanker sizes range from general purpose to ultra-large crude carriers on AFRA scale", on the EIA website.

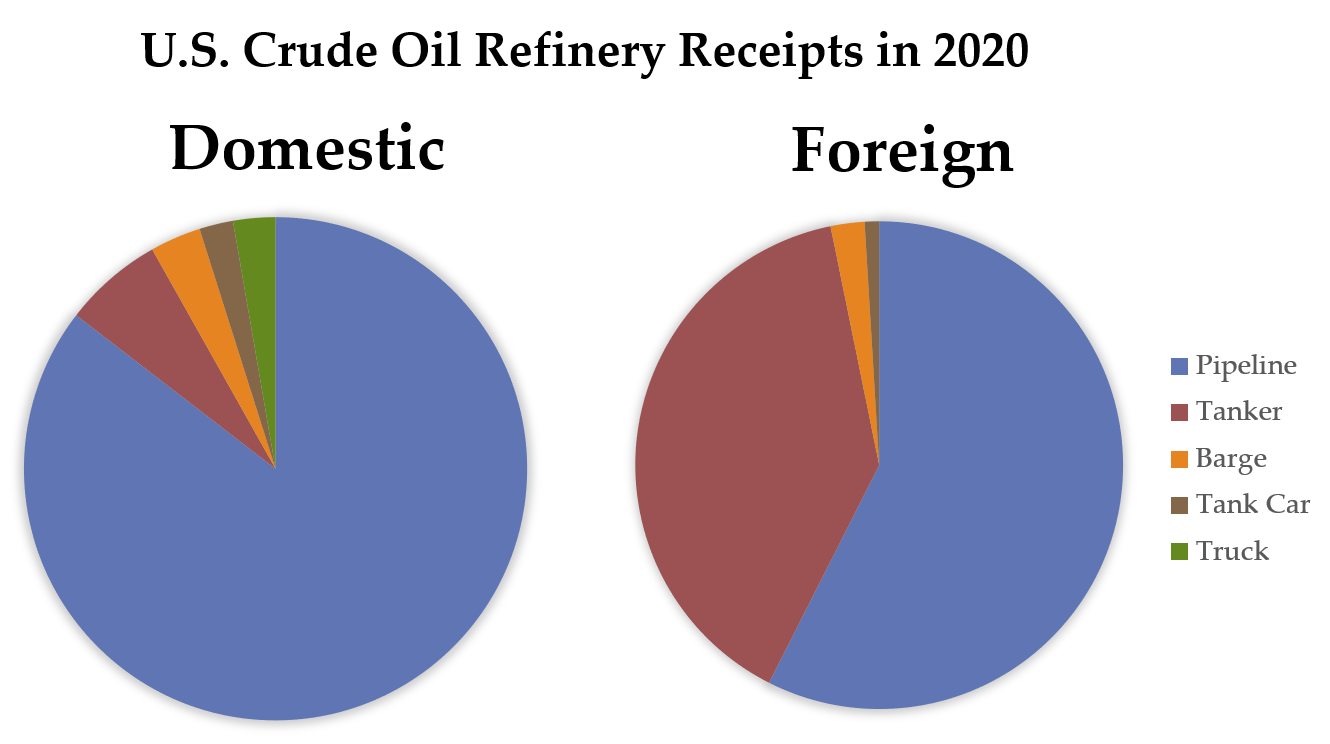

Figure 3 is drawn from the EIA data for the U.S. Crude Oil Refinery Receipts by mode of transportation in 2020. As you can see, pipelines transport the largest portion of domestic crude oil, and tankers transport the largest portion of foreign crude oil to the refineries.

| Percent of Receipts | Domestic | Foreign |

|---|---|---|

| Pipeline | 85% | 56% |

| Tanker | 6% | 39% |

| Barge | 4% | 2% |

| Tank Car | 2% | 1% |

| Truck | 3% | 0% |