Taxation is one mechanism relevant to energy policy we explored early in the course. By levying a tax on a good or service, the government can fairly accurately predict the cost of the policy. Let's take a closer look at state and federal taxes on fuel to understand the role taxes play in our energy policies, how they are implemented, and what is done with the revenue they generate.

| Fuel Type | Price | Taxes | Distribution and Marketing | Refining | Crude Oil |

|---|---|---|---|---|---|

| Regular Gasoline (January 2023) | $3.34/gallon | 15% | 10% | 20% | 55% |

| Diesel (January 2023) | $4.58/gallon | 13% | 19% | 28% | 40% |

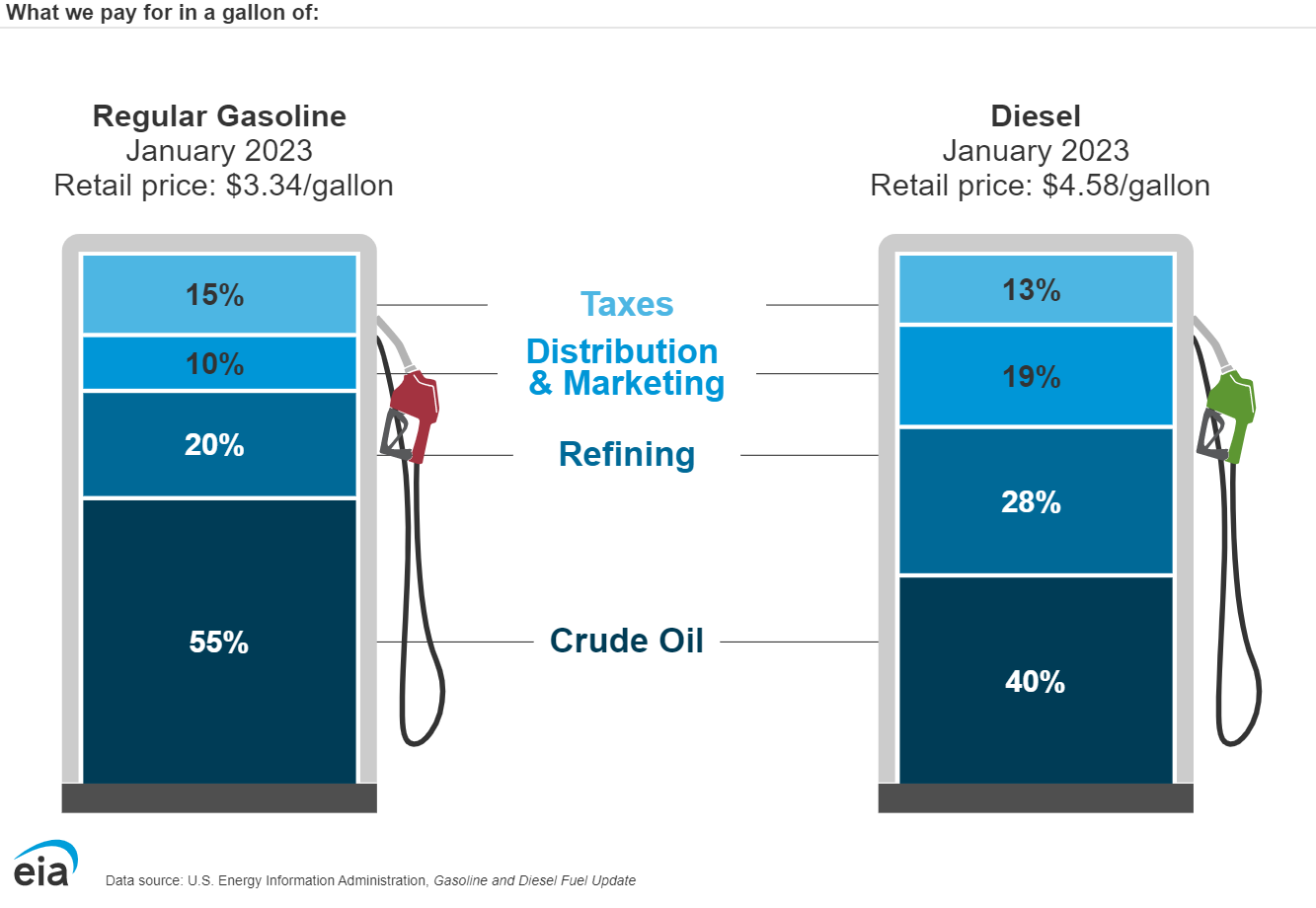

Gas prices - we've watched them skyrocket as the war in Ukraine dragged on, disrupting supplies and making investors uneasy. But what are we really paying for when we fill up? This graphic illustrates the breakdown of the gasoline prices we pay at the pump.

Notice the top, light blue box devoted to taxes. This is comprised of both federal and state taxes. The federal tax on a gallon of gasoline in the US right now is 18.4 cents (24.4 cents on a gallon of diesel). According to EIA, in addition to that federal tax, states add an average of another 22.01 cents per gallon in excise taxes and 12 states also charge additional state sales or other taxes on gasoline. There are even some locations where county or city taxes can also be included in the price.

Learn more about the factors influencing the price of a gallon of gas.

What are the taxes levied on gasoline used for? Excellent question! The American Petroleum Institute updates this interactive map each year to illustrate the relative taxes in gasoline across the country. As you look at these numbers, remember that the federal excise tax on gasoline is 18.4 cents of the number that you see printed on this map. The rest is whatever additional tax that particular state charges.

Federal Gasoline Tax (18.4 cents/gallon)

- 15.44 cents/gallon to the Highway Account of the Highway Trust Fund

- 2.86 cents/gallon to the Mass Transit Account of the Highway Trust Fund

- 0.1 cent/gallon to the Leaking Underground Storage Tank Trust Fund

In the case of the individual taxes levied by each state, there is much variability in how those revenues are utilized. Many states also contribute a portion of their taxes to the Underground Storage Tank Trust, or for state road work, or charge other environmental service fees. On top of the additional fuel taxes that states charge, there are 9 states that currently charge sales tax on gasoline as well.

It is worth noting that many European countries have significantly higher fuel tax rates than the U.S., which is why gas prices are higher in Europe - sometimes significantly so - than in the U.S.

What role do taxes on gasoline and other liquid fuels really play? Are they a deterrent to use? Not really. Are they meant to be? Not really. The taxes associated with liquid fuels finance projects related to the use of those fuels. People are going to drive, so if the government taxes the fuel they use, that creates a fund from which road maintenance can be completed. Storage tanks for these fuels will inevitably leak - having a fund set aside to handle the environmental problems associated with a fuel leak is another reasonable use of gasoline tax dollars.

Take a good look at the API map, what do you notice about the geographic distribution of gasoline taxes across the country? Which states have the lowest total gasoline taxes? The highest?

But what about taxes for other purposes? We've talked earlier this semester about potentially taxing greenhouse gas emissions in an effort to slow down anthropogenic climate change. A carbon tax would serve a very different purpose than a gasoline tax. A carbon tax would be designed specifically to deter the use of carbon-intensive fuels by bringing their costs more in line with alternative energy sources. The revenue generated from a carbon tax could be used for a variety of programs to aid in a transition to a less carbon-intensive economy. One of the ideas that has gained some bipartisan traction is a revenue-neutral tax, which would divide tax revenue up and provide an equal amount to each citizen of the U.S.

As we learned, though, carbon tax (like any potential solution for pricing carbon) has its drawbacks. It is difficult to know how high the tax needs to be set to ensure the desired results. If set too low, firms may just be willing to pay the additional cost and continue on with business as usual, netting no real emission reductions. It also runs the risk of driving emitting firms out of the country, where they can emit freely without the costs of a tax. The implementation of a successful carbon tax would require an appropriately set tax rate and a strict enforcement mechanism to ensure all emissions are included in the accounting. Impossible? No. Challenging? Yes. Impossible? No.

One burgeoning policy issue that should only become more important relates to gas taxes and electric vehicles (EVs). Since EVs do not use any gas, what are the potential policy (and economic) implications of state and national goals to increase the use of EVs?

According to the Urban Institute, state and local governments received $53 billion in revenue from gas taxes in 2020, and about 80% of the federal government's Highway Trust Fund (used for construction and maintenance of roads, bridges, etc.) comes from gas taxes. The erosion of this revenue is a very important policy consideration and is something worth keeping an eye on as you go out into the policy world. It will be difficult to make up that revenue, though some states have started to have specific utility rates for EV charging, which could be used to levy a tax on EV charging. As citizens already pay taxes on the energy they use, as you see in your electric bill, this would need to be clearly managed to avoid double taxing. For example, if I charge my EV by plugging into my home supply, should I pay another EV tax on top of my home electric bill?