Prioritize...

After reading this section, you should be able to describe an ARMA and ARIMA model, explaining the strengths and weaknesses of each.

Read...

So now we have seen two models for time series data, the Autoregressive Model and the Moving Average Model. Each has their own strengths and weaknesses. There will be times when the AR model is more appropriate than the MA model and vice versa. But what if our data doesn’t fit a pure AR model or a pure MA model but is instead a mix of both? What if we could combine AR+MA? You can!

ARMA

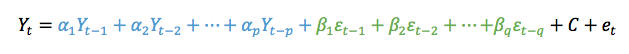

We do not have to use the AR or MA models exclusively. Instead, we can combine the AR terms and the MA terms into the appropriately named model called ARMA. ARMA, in simple terms, is the combination of the p order AR terms and the q order MA terms. Mathematically:

The first part, in blue, is the AR model of order p. The second part, in green, is the MA model of order q. C is a constant and et is the error term. The equation estimates the Y value at time t as the sum of p terms of the AR component and the q terms of the MA component. As AR and MA have order, ARMA has an order that is reflective of each component. We say that the ARMA model has an order (p,q) or ARMA(p,q). As with the individual components, ARMA assumes the data is stationary.

ARIMA

It is highly likely with meteorological variables that your data will not be stationary and will exhibit trends and/or periodicities. So what can we do if the data does not meet this requirement? Removal of these nonstationary components can be carried out by differencing the data until it is approximately stationary. You difference the data until it meets this basic assumption and then run an ARMA model. Although that works, why don’t we take a shortcut and use the ARIMA (sometimes called the Box-Jenkins model) model instead? An ARIMA model is an ARMA model that has been initially (I) differenced. The results are integrated to create a forecast.

ARIMA has one more component, the differencing component. Formally, this parameter, d, is called the order of the differencing. ARIMA combines the differencing of a nonstationary time series with the ARMA model, following the form (p,d,q) or ARIMA(p,d,q).

So what exactly goes on in an ARIMA model? We start with the differencing. Differencing in statistics is used to transform a dataset to make it stationary. In short, you difference the time series until the stationary requirement is a reasonable assumption. Mathematically, first order differencing (d=1) looks like this:

We compute the value at time t as the value at time t minus the value at t-1. Second order differencing (d=2) mathematically looks like this:

Most times, you will only need to apply differencing once or twice (order 1 or 2). Once you difference, you simply create the ARMA model that best fits the new stationary time series.

You can probably start to see the benefits of ARIMA. It’s easy to use and allows for both stationary and non-stationary time series. However, there are three parameters now: p,d,q - meaning there are many possible models that can be created to fit your data. So, how do you pick the ‘best’ model? Here are some general guidelines:

- Similar to linear regression, we want the simplest form of a model. This means you want to minimize the values of p,d, and q. Simple is always better in this case.

- The model fit should be as good as possible. This is the least-squares approach we discussed in Meteo 815. We try to minimize the squared difference between the predicted and the observed.

- Finally, if we automate the process, we can create multiple models and select the best model by minimizing metrics such as the AIC or BIC.

But similar to linear regression, we won’t know how good a model is until we use it to predict future events.

Periodicity ARIMA

As you have probably seen throughout this course and Meteo 815, meteorological data tends to have a periodicity component, specifically referred to as a seasonal component. This requires us to do an additional differencing technique (outside of possible trends or other components that lead to non-stationarity). The differencing discussed above focused on non-stationary components, arising primarily from trends. Instead, we can use a periodicity ARIMA model that includes a quasi-periodicity or a seasonal periodicity component. We write a periodicity ARIMA as:

ARIMA(p,d,q)(P,D,Q)m

The purple part is the non-seasonal part of the model. Or in our course, we call this the non-periodic part of the model with the components, p=non-periodic AR order, d= non-periodic differencing, q=non-periodic MA order. The orange part of the model is the seasonal or periodic part of the model with the components: P=periodic AR order, D=periodic differencing, Q=periodic MA order, and m=time span of the repeating pattern.

We determine m by looking for the spike at lag m in the ACF or PACF. If you look back at the Bangkok precipitation, there are spikes at 6 months and 12 months. The periodic terms are then multiplied by the non-periodic terms to create the full model. Again, the main point here is we add a component that focuses on removing seasonality, whereas the original ARIMA model, talked about above, only removes non-quasi-periodic non-stationary components.

Model Type Selection

Although we will be able to automate the ARIMA function in R to select the best model and pick the best order, it’s still important to verify that the order makes sense. So let’s talk a little bit about how to select (or confirm) the values of p,d,q, and the model type. For the MA and AR models, we already discussed the visualization of the ACF or PACF to estimate the order. These same traits hold true for ARIMA, and therefore I will not discuss them here but focus instead on how we make the selection between using a pure AR, pure MA, an ARMA/ARIMA/ and a periodic ARIMA. We use the shape of the ACF or PACF plot to suggest the first guess of model type. But again, the function will automate this process to further refine the selection. Below is a summary table discussing the shape of the ACF and what model you should select. A summary table is also available from NIST.

| Shape | Model |

|---|---|

| Exponential, Decaying to Zero | AR model: use PACF to identify the order |

| Alternating positive and negative, decaying to zero | AR model: use PACF to identify the order |

| One or more spikes, rest are at 0 | MA model: order identified by the lag at which the correlation becomes zero |

| Decay starting after a few lags | ARMA |

| All 0 or close to 0 | Data is random |

| High values at fixed intervals | Include seasonal AR term |

| No Decay to 0 | Series is not stationary (possible trend or periodicity) - include differencing term |

If your ACF shows an exponential decay to 0, we would use the AR model. If there are one or more spikes but the rest are 0, we use an MA model. If there is a decay starting after a few lags, we use ARMA, if there are high values at fixed intervals, we use a periodic ARMA, and if there is no decay to 0, we use ARIMA.

Below is a clickable flowchart to help you through the process of selecting the correct model.