Profitability and Added Value

As we will be devoting the majority of this course to understanding how we can innovate and leverage opportunities in sustainability, I would like to take this section to provide two readings examining correlations between high performing sustainability programs, increased organizational profitability over peers, and leading management processes.

Optional Reading:

The Business of Sustainability: Imperatives, Advantages and Actions

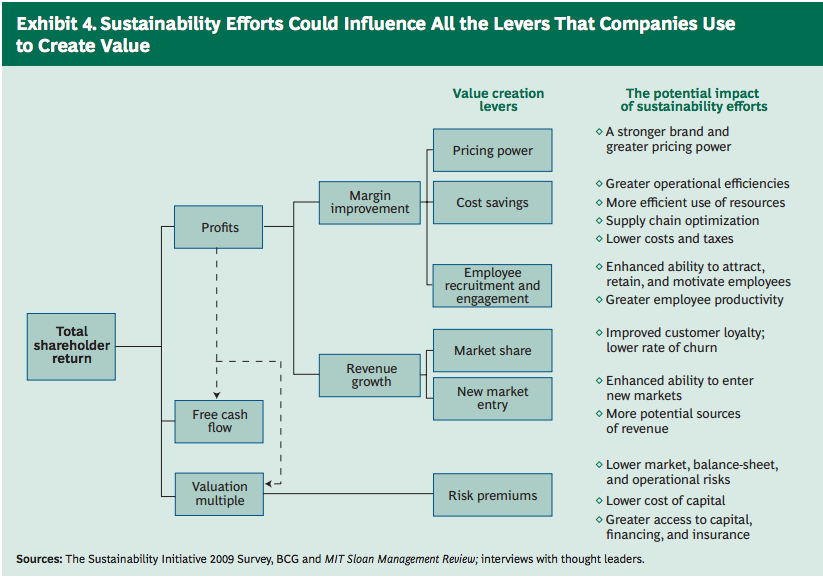

The first reading is jointly authored by The Boston Consulting Group and MIT Sloan Management Review, and reflects survey results from more than 1500 executives and high-level managers, and in-depth interviews with more than 50 thought leaders. It has quite a few interesting insights into sustainability's benefits to the business model and profitability, but below is one which nicely illustrates the ties between shareholder return and sustainability efforts.

Click to view a text version

The potential impact of sustainability efforts includes:

- A stronger brand and greater pricing power

- Greater operational efficiencies

- More efficient use of resources

- Supply chain optimization

- Lower costs and taxes

- Enhanced ability to attract, retain, and motivate employees

- Greater employee productivity

- Improved customer loyalty; lower rate of churn

- Enhanced ability to enter new markets

- More potential sources of revenue

- Lower market, balance-sheet, and operational risks

- Lower cost of capital

- Greater access to capital, financing, and insurance

Optional Reading:

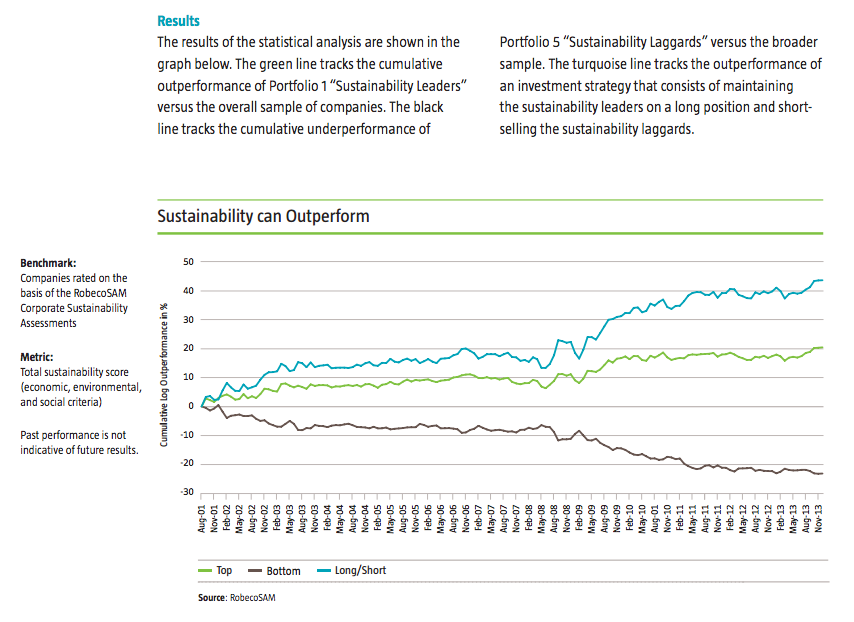

This is a shorter piece, centered on one, rather in-depth analysis of long-term performance. RobecoSAM, the auditing firm known for its international Sustainability Yearbook rankings, examined the sustainability profile of more than 500 companies a year over a 13-year dataset to create a five-level tier of their approach to sustainability. From Leader to Laggard, they then evaluated the financial performance of those companies over the same period. Below is a central finding of that research:

Click to view a text description