Not much has been made here of long-term contracts for oil. This is because up until the early 1980s there were not very many. Production continued as long as the extracted oil could find a home in the spot market. The oil-producing countries, recognizing their market power, either implicitly or explicitly avoided long-term contracts in pursuit of volatile and largely lucrative spot prices.

We have already explained the difference between spot markets and forward markets. Both are "physical" markets, in that their main purpose is to exchange commodities between willing buyers and sellers. A spot or forward transaction typically involves the exchange of money for a physical commodity. Within the past few decades, entities with sufficiently large exposure in the physical market (i.e., the need to buy or sell lots of physical barrels of crude oil) have developed financial instruments that can help them "hedge" or control price volatility. By far the most important of these financial instruments is the "futures" contract.

Futures contracts differ from forward contracts in three important ways. First, futures contracts are highly standardized and non-customizable. The NYMEX futures contract is very tightly defined, in terms of the quantity and quality of oil that makes up a single contract, the delivery location and the prescribed date of delivery. Forward contracts are crafted between a willing buyer and seller and can include whatever terms are mutually agreeable. Second, futures contracts are traded through financial exchanges instead of in one-on-one or "bilateral" transactions. A futures contract for crude oil can be purchased on the NYMEX exchange and nowhere else. Third, futures contracts are typically "financial" in that the contract is settled in cash instead of through delivery of the commodity.

A simple example will illustrate the difference. Suppose I sign a forward contract for crude oil with my neighbor, where she agrees to deliver 100 barrels of crude oil to me in one month, for 50 dollars per barrel. A month from now arrives and my neighbor parks a big truck in my front yard, unloads the barrels, and collects 5000 dollars from me. This is a "physical" transaction. If I were to sign a futures contract with my neighbor, then in one month instead of dropping off 100 barrels of crude oil in front of my house, she pays me the value of that crude oil according to the contract (this is called "settlement" rather than "delivery"). So, I would receive 5000 dollars. I could then go and buy 100 barrels of crude oil on the spot market. If the price of crude oil on the spot market was less than $50 per barrel, then in the end I would have made money. If it was more than 50 dollars per barrel, then in the end I would have lost money, but not as much as if I had not signed the futures contract.

This simple example illustrates the primary usefulness of futures contracts, which is hedging against future fluctuations in the spot price. A hedge can be thought of as an insurance policy that partially protects against large swings in the crude oil price.

NYMEX (now called the "CME Group") provides a platform for buying and selling crude oil contracts from one month in advance up to eight and a half years forward. The time series of futures prices on a given date is called the "forward curve," and represents the best expectations of the market (on a specific date) as to where the market will go. The value of these expectations, naturally, depends on the number of market participants or "liquidity." For example, on a typical day, there are many thousands of crude oil futures contracts traded for delivery or settlement one month in advance. On the other hand, there may be only a few (if any) futures contracts traded for delivery or settlement eight years in advance.

The NYMEX crude oil futures contract involves the buying and selling of oil at a specific location in the North American oil pipeline network. This location, in Cushing Oklahoma, was chosen very specifically because of the amount of oil storage capacity located there and the interconnections to pipelines serving virtually all of the United States.

There is a wealth of data out there on crude oil markets. The following video will help orient you toward a website where you can find information on crude oil prices, demand, shipments and other data. Although this is a U.S. website, there is a good amount of data on global markets.

Video: Crude Oil Futures (4:01)

Many of the world's most active energy commodity markets are run by an organization called the CME Group. And in this video, I'm gonna show you the CME group's website and show you how to find information on energy futures markets through the CME Group. And the specific example we're gonna use in this video is how to find information about the futures market for West Texas Intermediate Crude Oil, which is the benchmark crude oil futures market. So we're gonna go to the CME Group website, CME Group.com. And then we're gonna click on markets. And then in the section here where it says "browse by," we're going to click on energy. And then once we come to the energy futures and options page, we're going to click on "Products." And this will take us further down the page to where we can find information on a number of different energy futures markets. The one we're most interested in right now is crude oil futures. What we're going to click on that. And then it may take a second for the page to load. But what is going to pop up is a whole bunch of information about the futures market for West Texas Intermediate Crude Oil. And so I'll just say a little bit about what these different columns mean. The Month column is the month of contract delivery, not the month that the contract was treated. So September 2020, for example, that indicates the contract for deliveries of West Texas Intermediate crude oil in September 2020. The last column, the column that says "Last" here, that shows the last recorded offer for West Texas Intermediate Crude Oil in that month. It takes units of dollars per barrel. So here, the September 2020 contract, the last offer that was received is $42.78 per barrel. And the "Change" column is just the change, again, in dollars per barrel, from teh previous author. The "Prior settle" column is one that we'll use a lot. And that represents the last recorded price at which a buyer and a seller were matched at which to trade happened. And so here the prior subtle column for the September 2020 contract is $42.89 per barrel. The "Open" and "High" and "Low" columns, show the price for the West Texas Intermediate Crude Oil Futures contract at the start of the trading day. And then the highest price and the lowest price where the crude oil contract traded on each day. Then the volume just shows you the number of contracts that have traded. And these orange flashes you see will happen because this data is effectively updated in real time. And so when there are additional contracts traded or when the price changes, those will show up in real time on the screen. So this video has shown you how to get to the CME group's website, where to find information on energy contracts, and specifically, how to get data on the West Texas Intermediate Crude Oil futures contract.

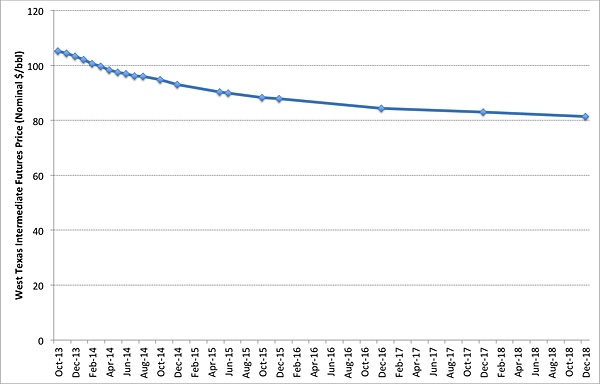

If you look at Figure 10.4, you might notice that the price of crude oil generally declines as you move farther out into the future. This is called "backwardation." The opposite, in which the price of crude oil increases as you move farther out into the future, is called "contango." In general, we expect the crude oil market to be in backwardation most of the time; that is, we expect the future price to be lower than the current (spot) price. This can be true even if we expect demand for crude oil to increase in the future. Why would this be the case? If demand is expected to rise in the future, shouldn't that bring the market into contango?

Sometimes this does happen. Most often, the crude oil market is in backwardation because storing crude oil generally involves low costs and has some inherent value. Suppose you had a barrel of crude oil. You could sell it now, or store it to sell later (maybe the price will be higher). The benefit to storing the barrel of oil is the option to sell it at some future date, or to keep on holding on to the barrel. This benefit is known as the "convenience yield." Now, suppose that hundreds of thousands of people were storing barrels of oil to sell one year from now. When one year comes, all those barrels of oil will flood the market, lowering the price (a barrel in the future is also worth less than a barrel today; a process called discounting that we will discuss in a later lesson). Thus, because inventories of crude oil are high, the market expects the price to fall in the future.

The ability to store oil implies that future events can impact spot prices. A known future supply disruption (such as the shuttering of an oil refinery for maintenance) will certainly impact the futures price for oil, but should also impact the spot price as inventories are built up or drawn down ahead of the refinery outage.