Beginnings of a Market to 1970

Through much of the first half of the 20th Century, the United States was the dominant world oil producer and was, in fact, a net exporter. By the early 1900s, a bilateral "world" market for oil had developed, but the world price was simply the U.S. price plus the cost of freight. Russia's production did not lag far behind U.S. production during this time, but their relatively closed economy precluded much trade with the rest of the world. Table 10.1 shows the leading crude oil producers up to 1970.

| Year | U.S. | Mexico | Venezuela | Russia | Indonesia | Middle East |

|---|---|---|---|---|---|---|

| 1910 | 575 | 10 | 0 | 170 | 30 | 0 |

| 1920 | 1,214 | 430 | 1 | 70 | 48 | 31 |

| 1930 | 2,460 | 408 | 374 | 344 | 114 | 126 |

| 1940 | 3,707 | 12 | 508 | 599 | 170 | 280 |

| 1950 | 5,407 | 198 | 1,498 | 729 | 133 | 1,755 |

| 1960 | 7,055 | 271 | 2,854 | 2,957 | 419 | 5,255 |

| 1970 | 9,637 | 487 | 3,708 | 6,985 | 854 | 13,957 |

Unlike OPEC, the market for crude oil in the U.S. was generally competitive since mineral rights did not belong to the state but to the landholder. If it was under your property, you owned it. Since oil (and gas) reservoirs often crossed property boundaries, "rights" were hard to specify and enforce. If an oil reservoir was split between my property and yours, the money would flow to whoever could suck all the oil out first. Overdrilling was the result, as was the birth of "wildcatters," individuals who would dig oil wells on unproven land, hoping to strike it rich.

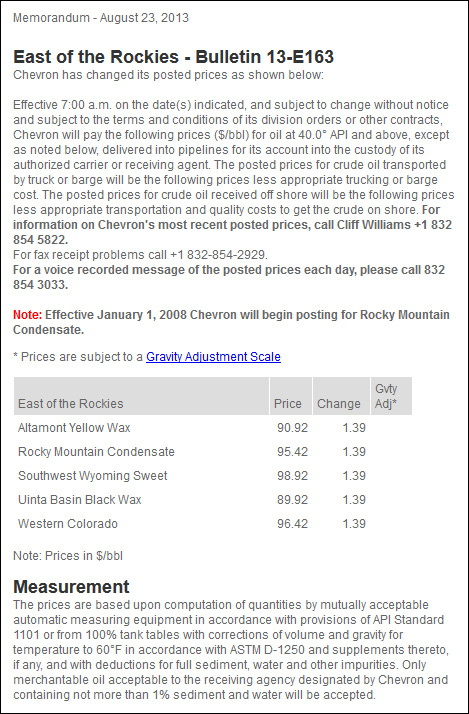

During the period up to 1970 (and even beyond), the "market" for crude oil was characterized largely by within-company exchanges. Most oil companies were "vertically integrated," meaning that the company operated all the way down the value chain - crude oil would go from the field to the refiner to the marketer (and then to the retailer, like a gas station) while staying within company borders. There was a small number of market transactions at what were referred to as "posted prices." Posted prices are essentially fixed offer prices posted by companies in advance of transactions. Posted prices were originally painted on wooden signs and hung on posts (hence the name), each remaining in effect until it was replaced by a new one. Now, posted prices take the form of electronic bulletins issued by major oil producers. (The spot market for crude oil is still not very large, so posted prices are not always representative of market conditions.) An example of a posted price bulletin is shown in Figure 10.1.

Memorandum - August 23, 2013

East of the Rockies - Bulletin 13-E163

Chevron has changed its posted prices as shown below:

Effective 7:00 a.m. on the date(s) indicated, and subject to change without notice and subject to the terms and conditions of its division orders or other contracts, Chevron will pay the following prices ($/bbl) for oil at 40.0° API and above, except as noted below, delivered into pipelines for its account into the custody of its authorized carrier or receiving agent. The posted prices for crude oil transported by truck or barge will be the following prices less appropriate trucking or barge cost. The posted prices for crude oil received offshore will be the following prices, less appropriate transportation and quality costs to get the crude on shore. For information on Chevron's most recent prices, call Cliff Williams +1 832 544 5822.

For fax receipt problems, call +1 832-854-2929.

For a voice-recorded message of the posted prices each day, please call 832 854 3033.

Note: Effective January 1, 2008, Chevron will begin posting for Rocky Mountain Condensate.

1 Prices are subject to a Gravity Adjustment Scale.

| East of the Rockies | Price | Change | Gvty Adj1 |

|---|---|---|---|

| Altamont Yellow Wax | 90.92 | 1.39 | --- |

| Rocky Mountain Condensate | 95.42 | 1.39 | --- |

| Southwest Wyoming Sweet | 98.92 | 1.39 | --- |

| Uinta Basin Black Wax | 98.92 | 1.39 | --- |

| Western Colorado | 96.42 | 1.39 | --- |

Note: Prices in $/bbl

Measurement

The prices are based upon the computation of quantities by mutually acceptable automatic measuring equipment in accordance with provisions of API Standard 1101 or from 100% tank tables with corrections of volume and gravity for temperature to 60°F in accordance with ASTM D-1250 and supplements thereto, if any, and with deductions for full sediment, water and other impurities. Only merchantable oil acceptable to the receiving agency designated by Chevron and containing not more than 1% sediment and water will be accepted.