The National Flood Insurance Program (NFIP)

If you purchase property in a flood zone, and you have a mortgage, you are required to purchase a flood insurance policy in addition to a homeowner’s policy. The National Flood Insurance Program, (NFIP) was created by legislation in 1968 and has maintained the affordability of insurance for homeowners in flood-prone (both inland and coastal) areas since then. This sounds like a great idea on the surface, but there are some problems with this policy that need to be addressed by Congress.

The NFIP was created to protect property owners in flood-prone areas from disastrous losses in the event of flooding. NFIP, which is managed by the Federal Emergency Management Administration (FEMA) is federally subsidized and kept affordable by borrowing money from the U.S. Treasury in order to keep the program solvent. It is currently in “deep water” so to speak, in fact, it is in debt to the tune of $40 billion. Climate change is complicating the picture. Because of the increase in the frequency of catastrophic flooding in the past 20 years, NFIP has become deeper in debt and in danger of lapsing coverage for property owners. For example, in 2017, many Houston residents whose property flooded in Harvey were not required to have insurance based on their flood zones. This raises further questions about how to manage flood loss in the coming years. The NFIP is no longer a sustainable way to protect property, and it is clear that changes are needed.

Also, although it was not originally intended to do so, the affordability of flood insurance through the NFIP has encouraged development in flood-prone areas, creating an even bigger problem. Homeowners have become accustomed to the availability of affordable flood insurance for their primary residences as well as their second homes on the coast, the number of which has ballooned since the NFIP first came into existence. According to a 2013 study, about one-third of all properties insured under NFIP are second homes (Gaul, 2019).

Without government subsidies insurance rates are likely to increase dramatically, so attempts to change the NFIP have so far been unsuccessful. However, FEMA is in the process of updating the NFIP with the Risk Rating 2.0 Program, which went into effect in 2021.

The overhaul is designed to help address some of the inequity issues with the NFIP and to update the process using current data and technology. New maps are replacing the older FIRM maps and properties are assessed based on their proximity to a water body as well as other features of the property. Raising your property’s height to an additional elevation above the standard base flood elevation* no longer reduces flood insurance premiums, however. You can read about these changes at FEMA: RiskRating 2.0: Equity in Action.

The 21st-century rating system, Risk Rating 2.0—Equity in Action, provides actuarially sound rates that are equitable and easy to understand. It transforms a pricing methodology that has not been updated in 50 years by leveraging improved technology and FEMA’s enhanced understanding of flood risk. (fema.gov)

Video: Defining a Property’s Unique Flood Risk (1:15)

[Music] Flooding. It's the most common and most expensive natural disaster in the United States. And, flood risk varies no matter where you live. FEMA has spent decades investing in high-quality mapping data to help inform flood risk and set flood insurance rates. Today we're leveraging that data, along with cutting-edge technology, to get a better understanding of your property's unique flood risk and how that risk can be reflected in the cost of your insurance. FEMA will consider your home's distance to a flooding source, the type and frequency of flooding, and property characteristics, such as the cost to rebuild. With more data going into assessing your flood risk, you'll have a more complete picture of what goes into the cost of your flood insurance. We're making flood insurance fairer and easier to understand to help you protect the life you've built. Learn more about this effort and the benefits of flood insurance by visiting fema.gov forward slash NFIP transformation.

However, there is still work to be done, as in some cases flood insurance has become unaffordable. Lower-income families are having to forego insurance, placing them further at risk. The changes have the potential to change where people choose to build or buy, and the changes are also affecting the livelihood of people who live and work in communities that are flood-prone.

According to the Natural Resource Defense Council (NRDC) in It’s Time to Fix Our Water-Logged National Flood Insurance Program (nrdc.org):

Congress must act to create a means-tested flood insurance option that helps lower-income families purchase flood insurance, and that prioritizes those same families for flood adaptation assistance. (nrdc.org)

More on Flood Insurance Rate Maps and Base Flood Elevation

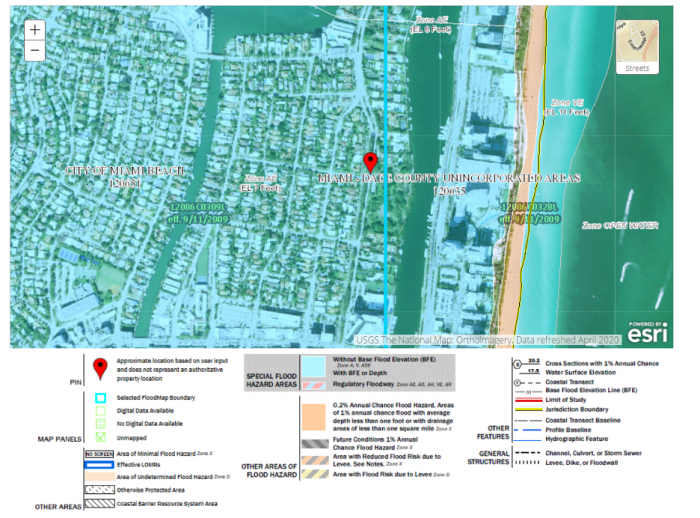

Flood Insurance Rate Maps | FEMA Flood Maps Explained are used to determine a property’s flood insurance. A potential homeowner can access these maps before deciding to purchase property in a flood zone. The maps are also designed to help residents of coastal communities plan for and mitigate the flood risk to their properties by delineating flood zones and identifying Base Flood Elevations (BFE). The BFE is the height to which a location has a 1% annual chance of being flooded. A house must be built at or above the BFE to be eligible for flood insurance.

The FIRM zones are based on elevation and proximity to water, as well as several other factors that determine a property’s risk of flooding. Visit this site to read about the flood zones shown on a Flood Insurance Rate Map (FIRM).