Inflation Reduction Act

The Inflation Reduction Act of 2022 is likely the most aggressive step taken in the US policy realm towards emissions reduction. The Act includes numerous components including lowering the price of prescription drugs, increasing tax rates for large corporations, funding for IRS tax enforcement, and lowering the budget deficit. But the key part from a climate point of view is to promote the use of clean energy, thus reduce emissions and set the US on a path towards meeting its Paris climate goals. The Act includes significant funding for installation of solar panel by households using tax incentives and increased tax rebates for purchases of electric vehicles. More broadly, the Act includes funding for states and local municipalities to install charging stations for electric vehicles and to convert to renewable energy production. The Act also includes tax incentives for corporations to produce renewable energy. Finally, there is funding for cutting-edge technologies such as carbon capture and storage and clean hydrogen. The EPA has estimated that the Inflation Reduction Act will reduce US CO2 production from 2005 levels by 35 to 43 percent by 2030. This is a start, but more policies will be required in the near future if we are to limit warming to 1.5 oC. As of early 2025, the fate of the funding is up in the air in the new administration.

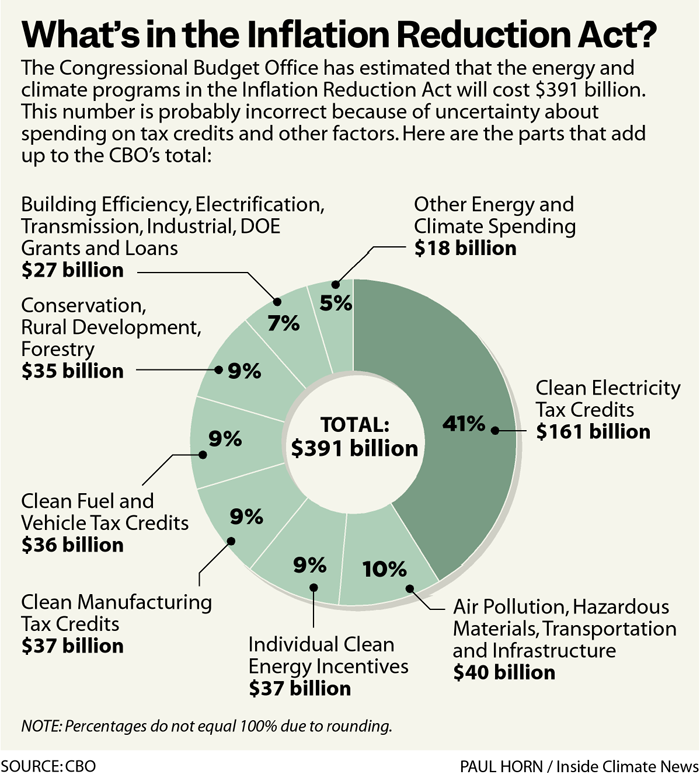

This pie chart details the estimated $391 billion cost of energy and climate programs as calculated by the Congressional Budget Office (CBO), with notes on potential inaccuracies due to uncertainties in tax credits and other factors. The chart is divided into segments representing different spending categories: Clean Electricity Tax Credits ($161 billion, 41%), Air Pollution, Hazardous Materials, Transportation, and Infrastructure ($40 billion, 10%), Individual Clean Energy Incentives ($37 billion, 9%), Clean Manufacturing Tax Credits ($37 billion, 9%), Clean Fuel and Vehicle Tax Credits ($36 billion, 9%), Conservation, Rural Development, Forestry ($35 billion, 9%), Building Efficiency, Electrification, Transmission, Industrial, DOE Grants and Loans ($27 billion, 7%), and Other Energy and Climate Spending ($18 billion, 5%). A note indicates percentages do not total 100% due to rounding.

- Chart Overview

- Title: What's in the Inflation Reduction Act?

- Source: CBO, Paul Horn / Inside Climate News

- Type: Pie chart

- Total Cost: $391 billion

- Spending Categories

- Clean Electricity Tax Credits: $161 billion (41%)

- Air Pollution, Hazardous Materials, Transportation, and Infrastructure: $40 billion (10%)

- Individual Clean Energy Incentives: $37 billion (9%)

- Clean Manufacturing Tax Credits: $37 billion (9%)

- Clean Fuel and Vehicle Tax Credits: $36 billion (9%)

- Conservation, Rural Development, Forestry: $35 billion (9%)

- Building Efficiency, Electrification, Transmission, Industrial, DOE Grants and Loans: $27 billion (7%)

- Other Energy and Climate Spending: $18 billion (5%)

- Notes

- Percentages do not equal 100% due to rounding

- Uncertainty in cost estimates due to tax credits and other factors